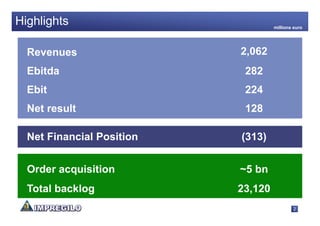

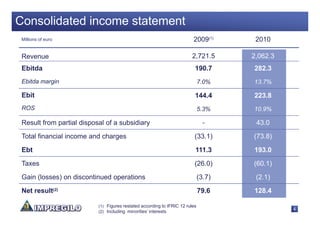

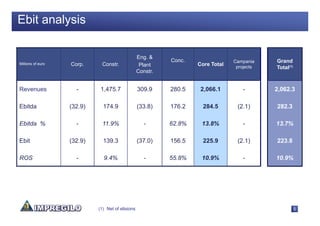

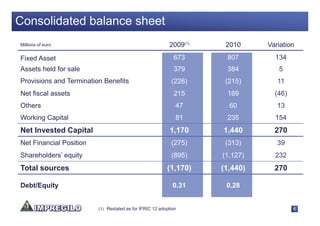

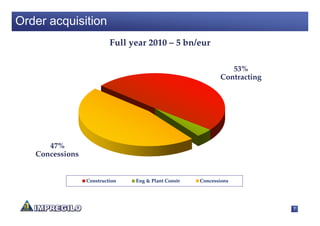

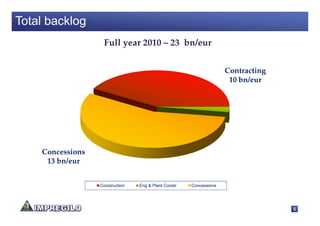

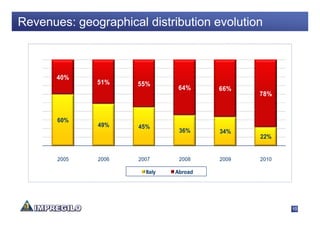

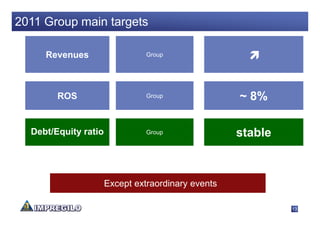

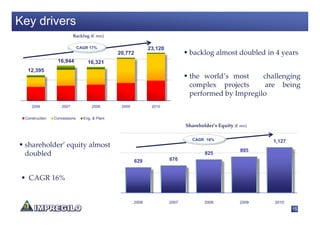

The document summarizes Impregilo's 2010 financial results and future targets. Key highlights include revenues of €2.06 billion, EBITDA of €282 million, and a net result of €128 million. The order backlog grew to €23.12 billion. Targets for 2011 include maintaining a stable debt to equity ratio and achieving an ROS of around 8% for the group. Long-term targets to 2015 include operating in 35 countries, with Italy accounting for around 35% of revenues, and expanding concessions backlog to €16 billion.