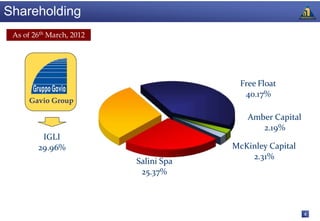

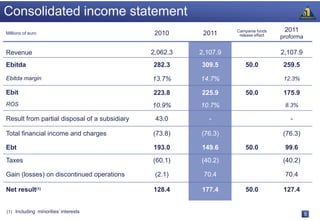

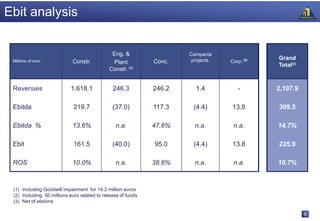

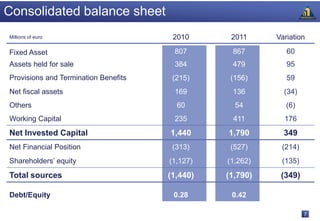

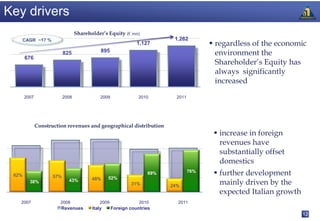

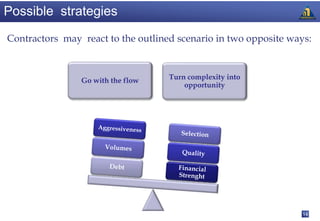

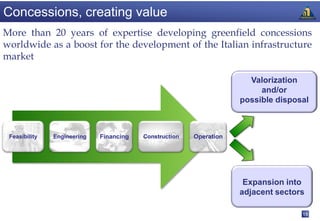

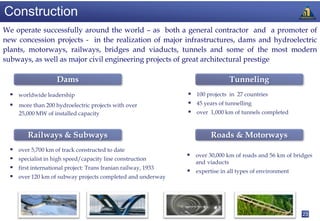

This document discusses Salini Impregilo's 2011 results and 2012 targets. It summarizes the company's growth in concessions, highlights from its financial statements, shareholding structure and key markets. It also analyzes the current economic environment and outlines strategies for selective growth, including focusing on technically complex projects and Italian greenfield concessions. Strengthening its position in Italian infrastructure is seen as important for driving growth and economic recovery in the country.