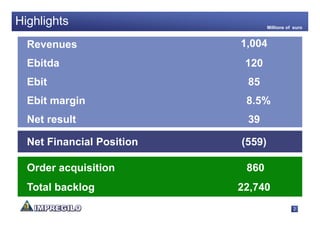

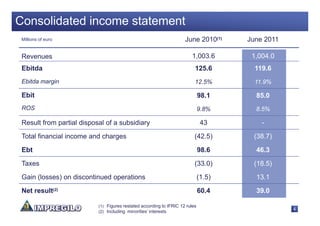

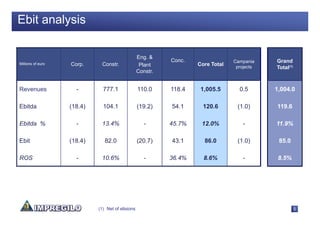

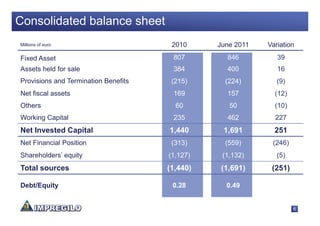

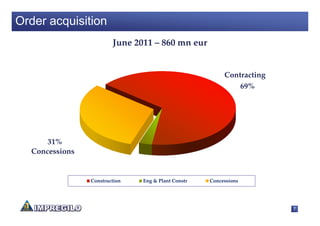

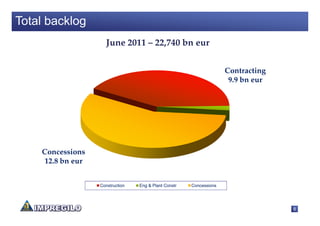

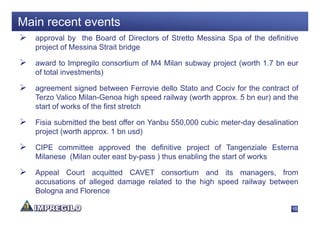

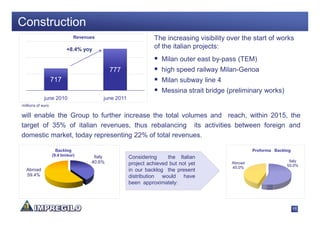

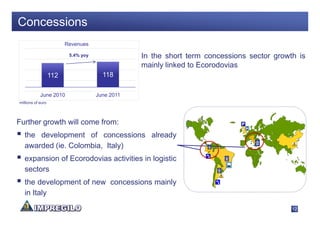

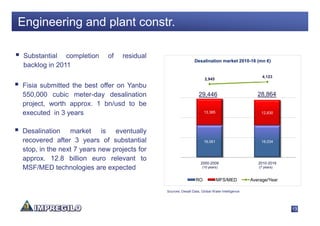

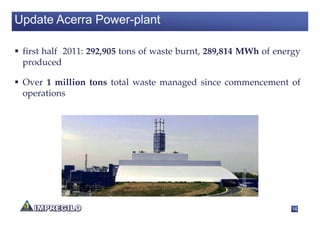

The document provides financial and operational highlights for Impregilo for the first half of 2011. It summarizes that revenues were €1,004 million, EBITDA was €120 million, and net result was €39 million. It also notes that order acquisition was €860 million and total backlog was €22,740 million. The document outlines Impregilo's operations and projects in various sectors including construction, concessions, and engineering.