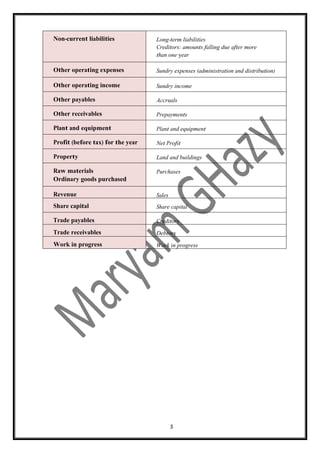

This document provides terminology and templates for preparing financial statements according to international standards. It includes templates for income statements, statements of financial position, and manufacturing accounts for sole proprietorships, partnerships, and limited companies. Key sections and accounts are defined, such as appropriation accounts, receipts and payments accounts, and trading versus non-trading organizations. Template line items and account headings are explained.