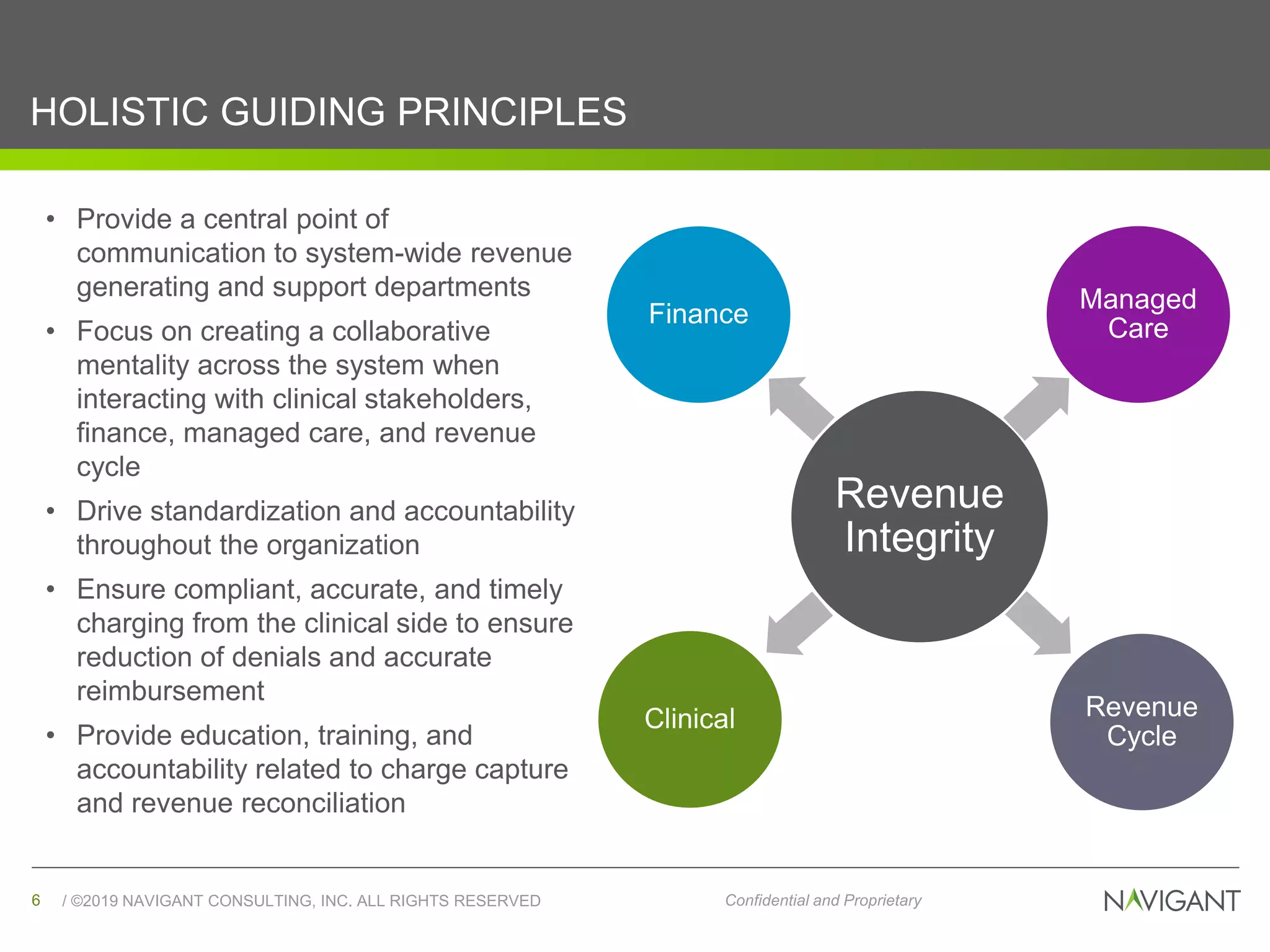

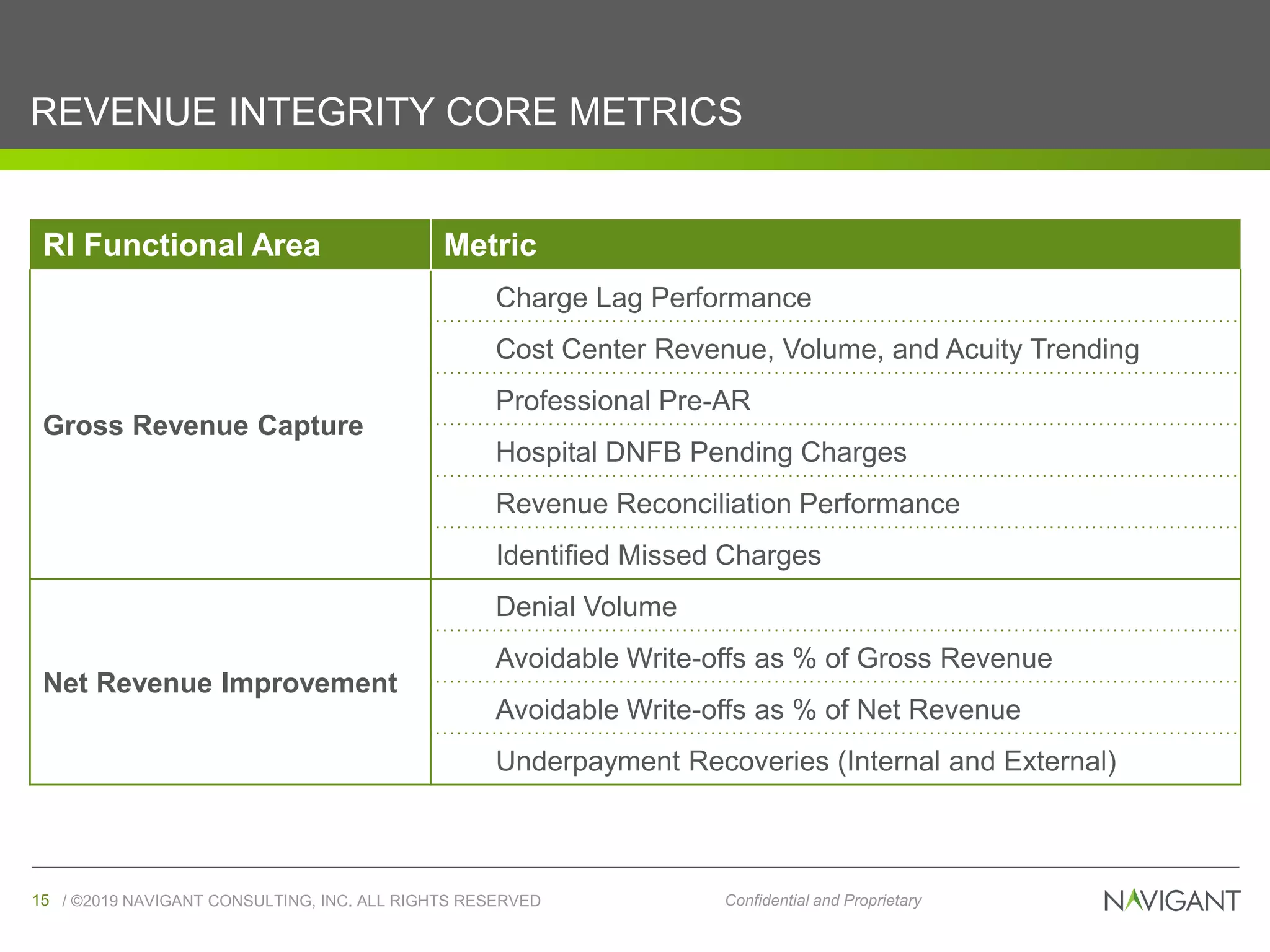

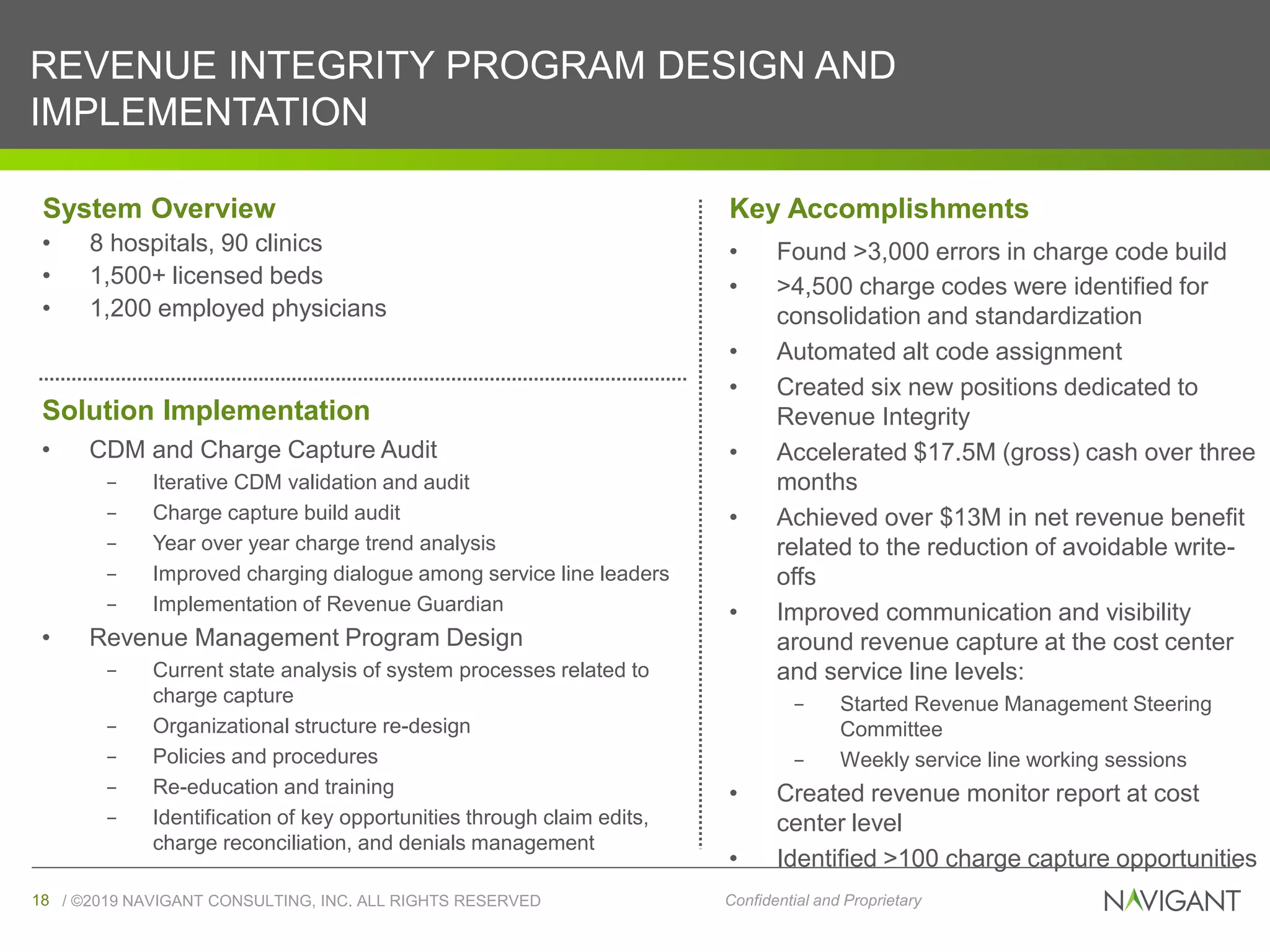

The document outlines the essential components and best practices for developing a successful revenue integrity program within healthcare organizations. It emphasizes the importance of aligning clinical and billing operations, proactive charge management, and establishing accountability structures that include communication among stakeholders. Additionally, the document presents key performance indicators and case studies demonstrating successful implementations of revenue integrity strategies.