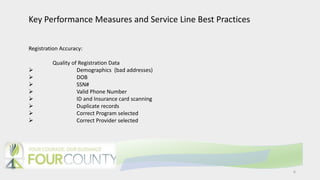

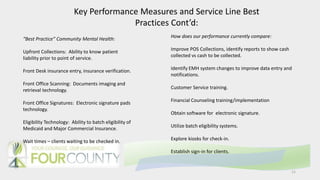

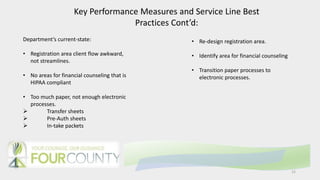

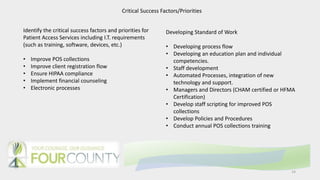

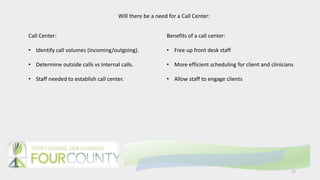

This document provides a draft model for developing a Patient Access department at Four County Centers. It includes mission and vision statements, a description of services, and proposed key performance measures. Some of the priorities and goals outlined are improving the patient registration flow, ensuring HIPAA compliance, implementing financial counseling, transitioning paper processes to electronic formats, and achieving customer satisfaction, collection, and accuracy standards above 80%. Establishing a call center is also discussed to help schedule clients and free up front desk staff.