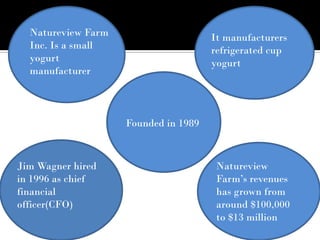

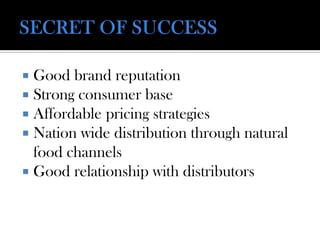

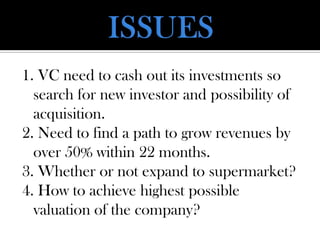

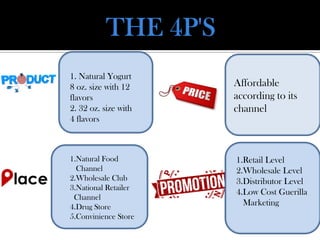

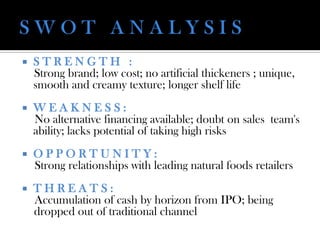

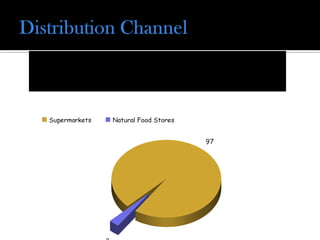

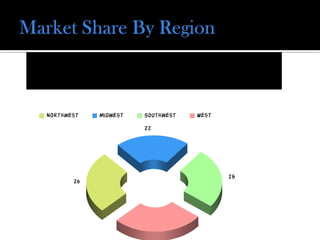

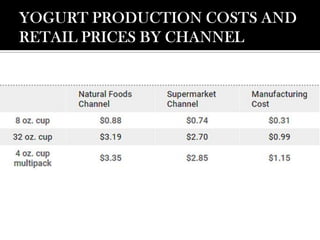

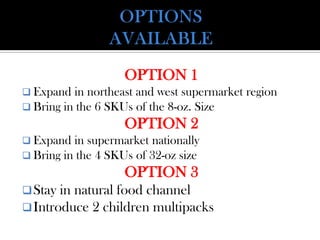

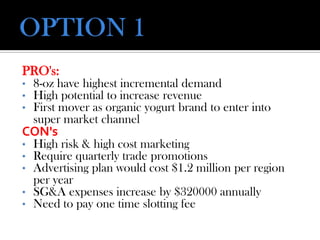

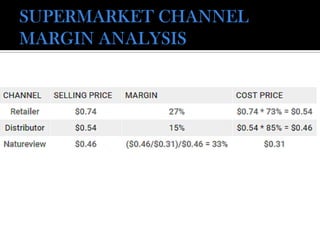

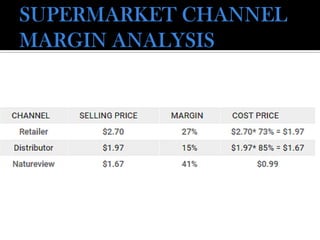

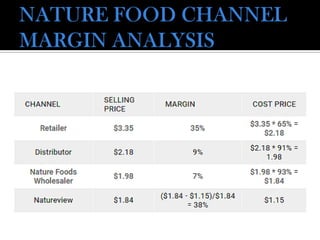

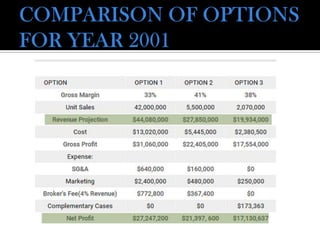

Natureview Farm is a small yogurt manufacturer founded in 1989 that produces refrigerated cup yogurt. It has experienced significant growth in revenues from $100,000 to $13 million from 1989 to 1996. The company is considering options to further grow revenues by over 50% in 22 months to satisfy venture capital investors. The options under consideration are to expand product offerings and distribution channels to supermarkets, increase the size of existing products, or stay within the natural foods channel by introducing new multipacks. Expanding the 8-ounce size yogurt line to new supermarket regions in the Northeast and West is identified as the highest potential option to meet revenue goals and provide first mover advantage for the company in the supermarket channel.