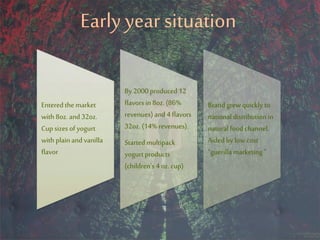

Natureview Farm is a small yogurt manufacturer founded in 1989 in Vermont. It has grown revenues from less than $100,000 to $13 million in 10 years by emphasizing natural ingredients, quality, and taste. The company is considering options to grow further to $20 million by 2001.

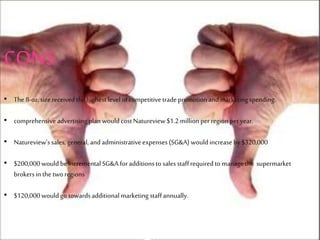

The three options presented are: 1) Expand 8oz yogurt SKUs into supermarket regions, 2) Expand 32oz SKU sizes nationally, or 3) Introduce multi-pack children's yogurt into natural food channels. Expanding 8oz SKUs into supermarkets could generate significant revenue but would require high marketing costs. Expanding 32oz SKUs would have lower costs but reducing the 8oz presence could hurt brand entry.