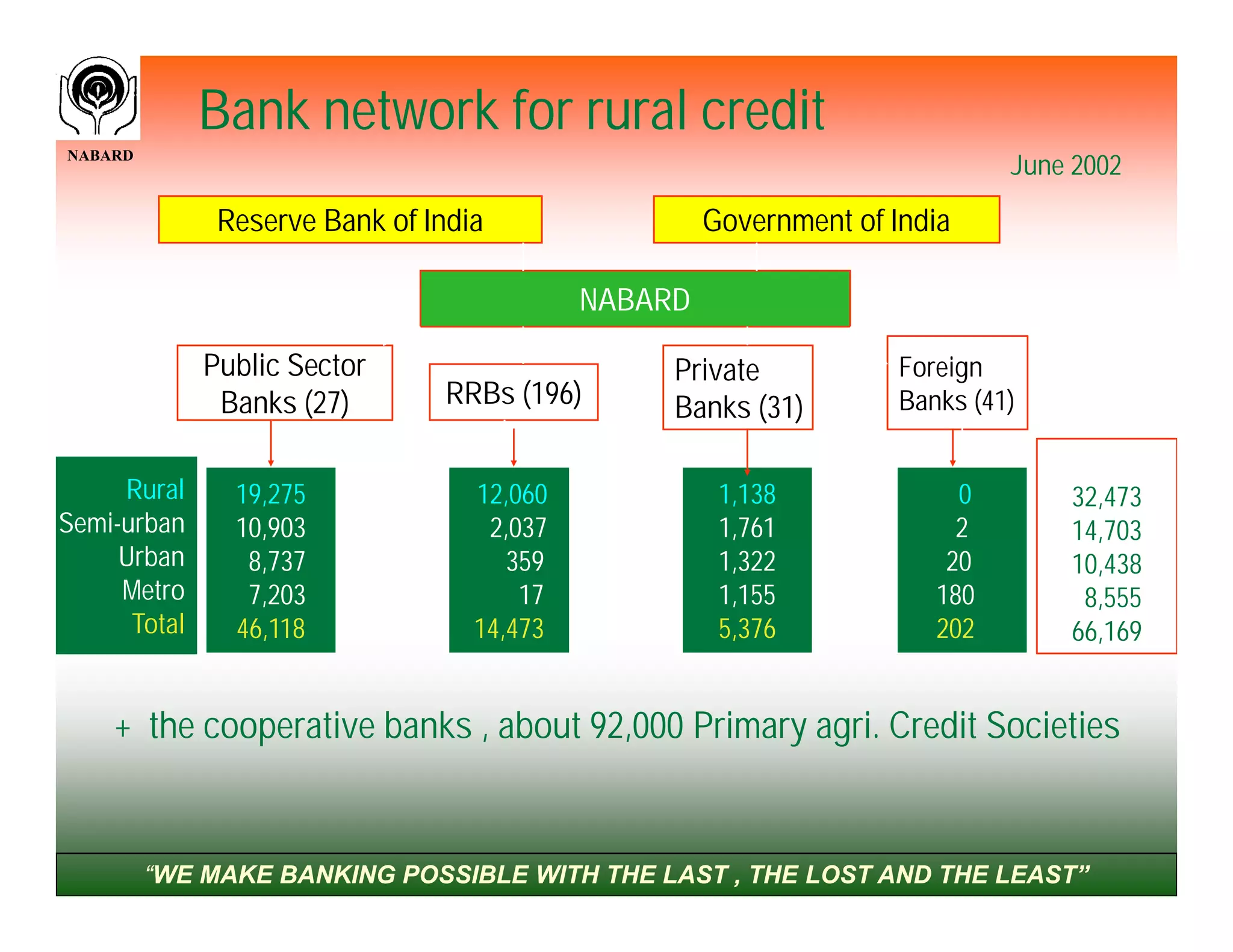

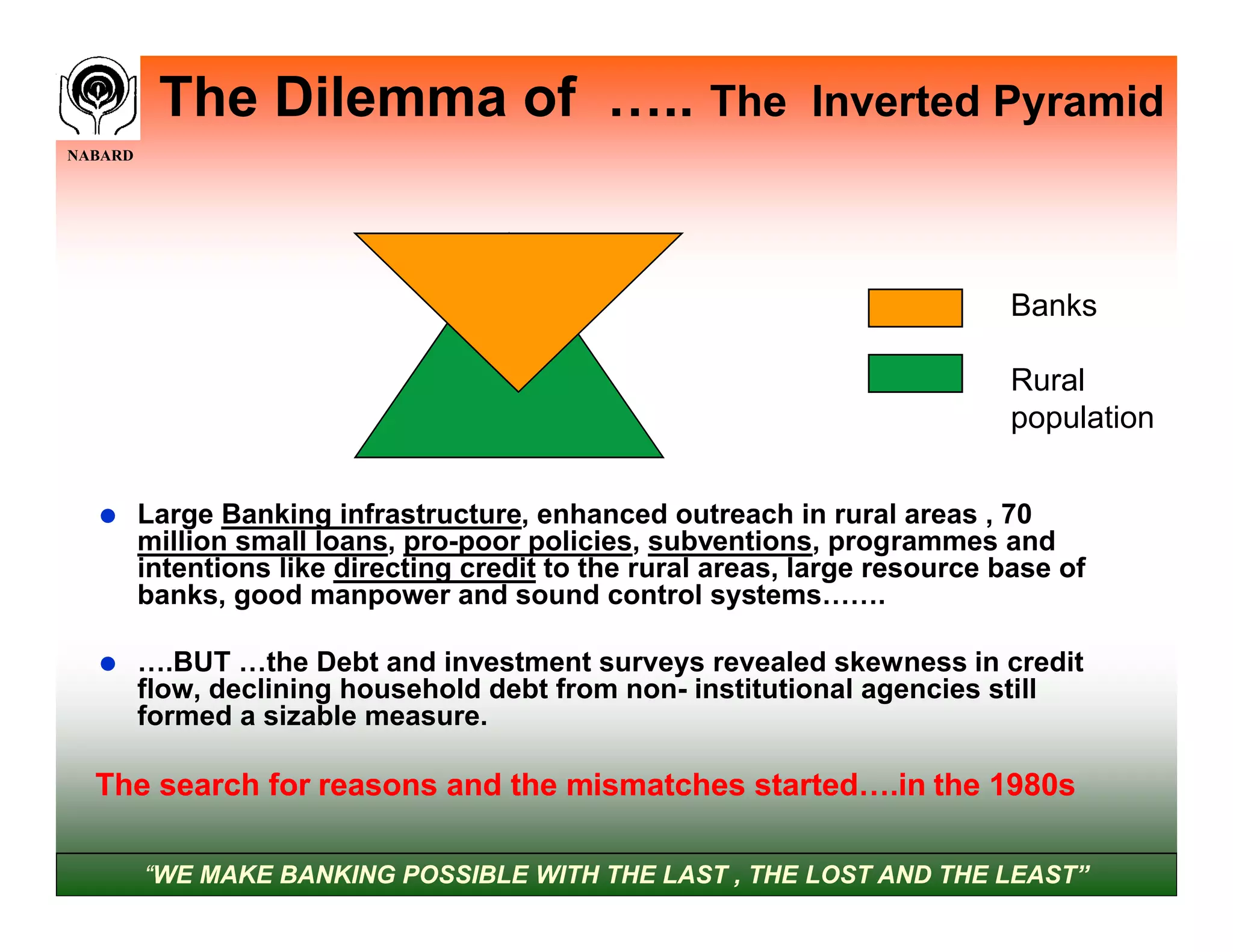

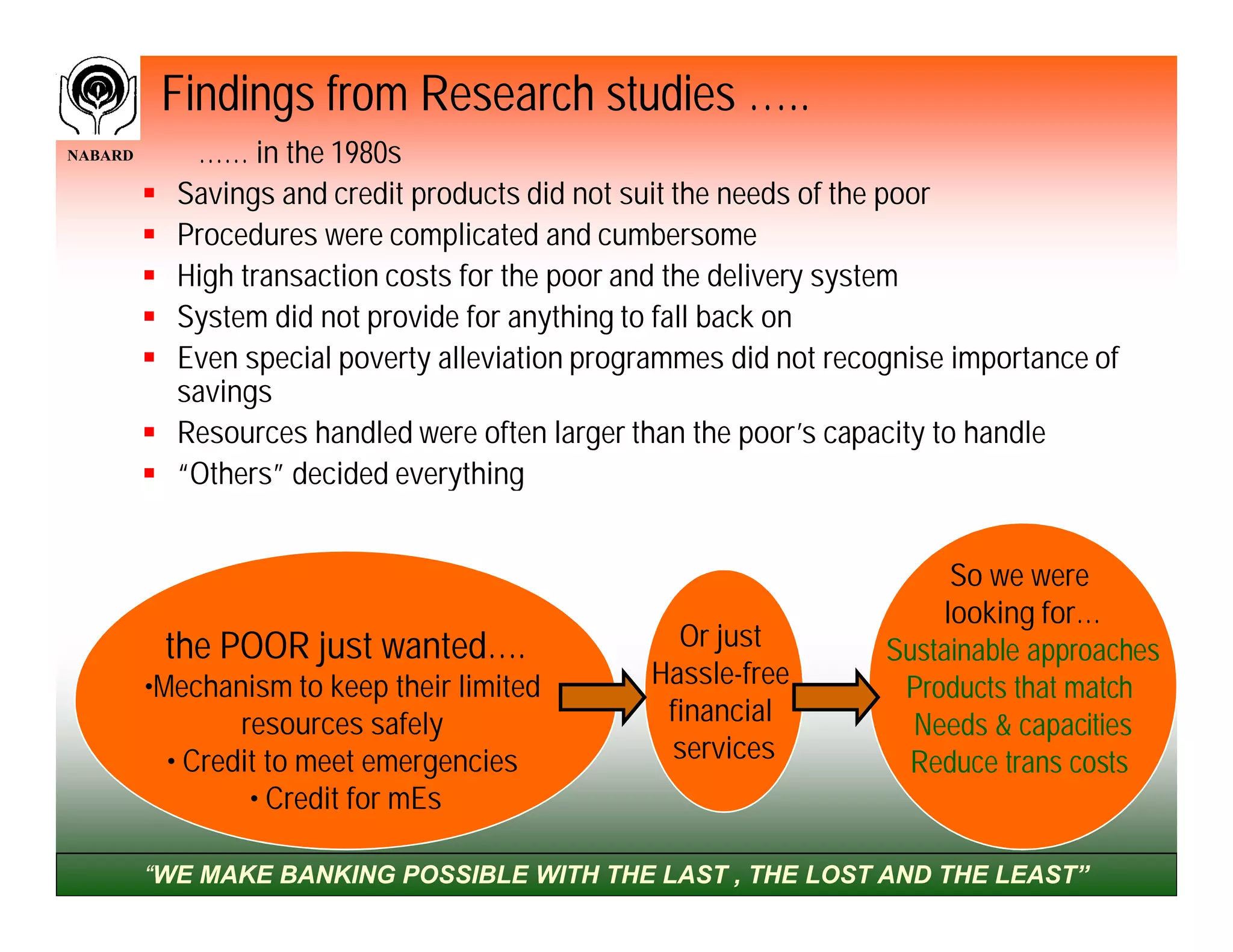

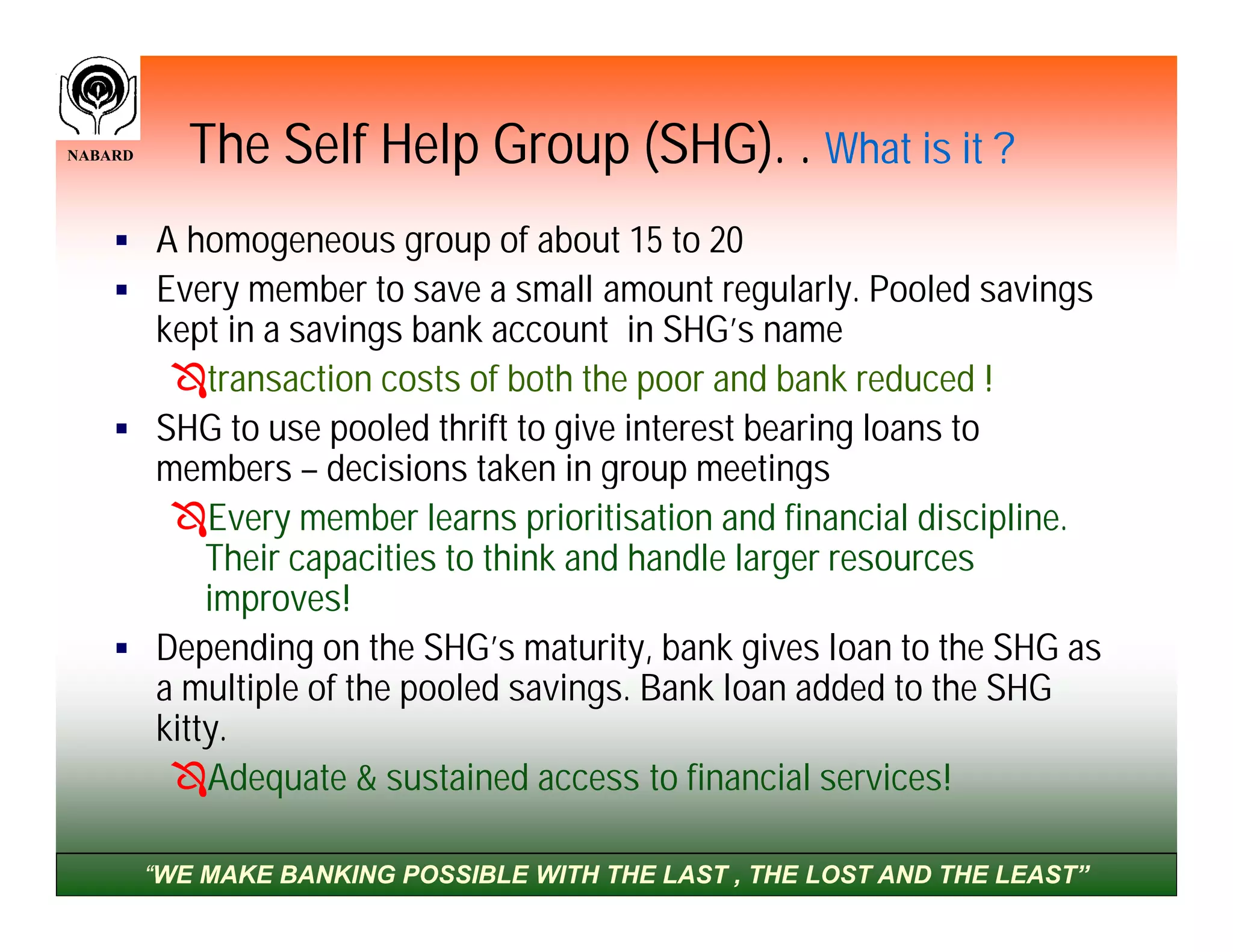

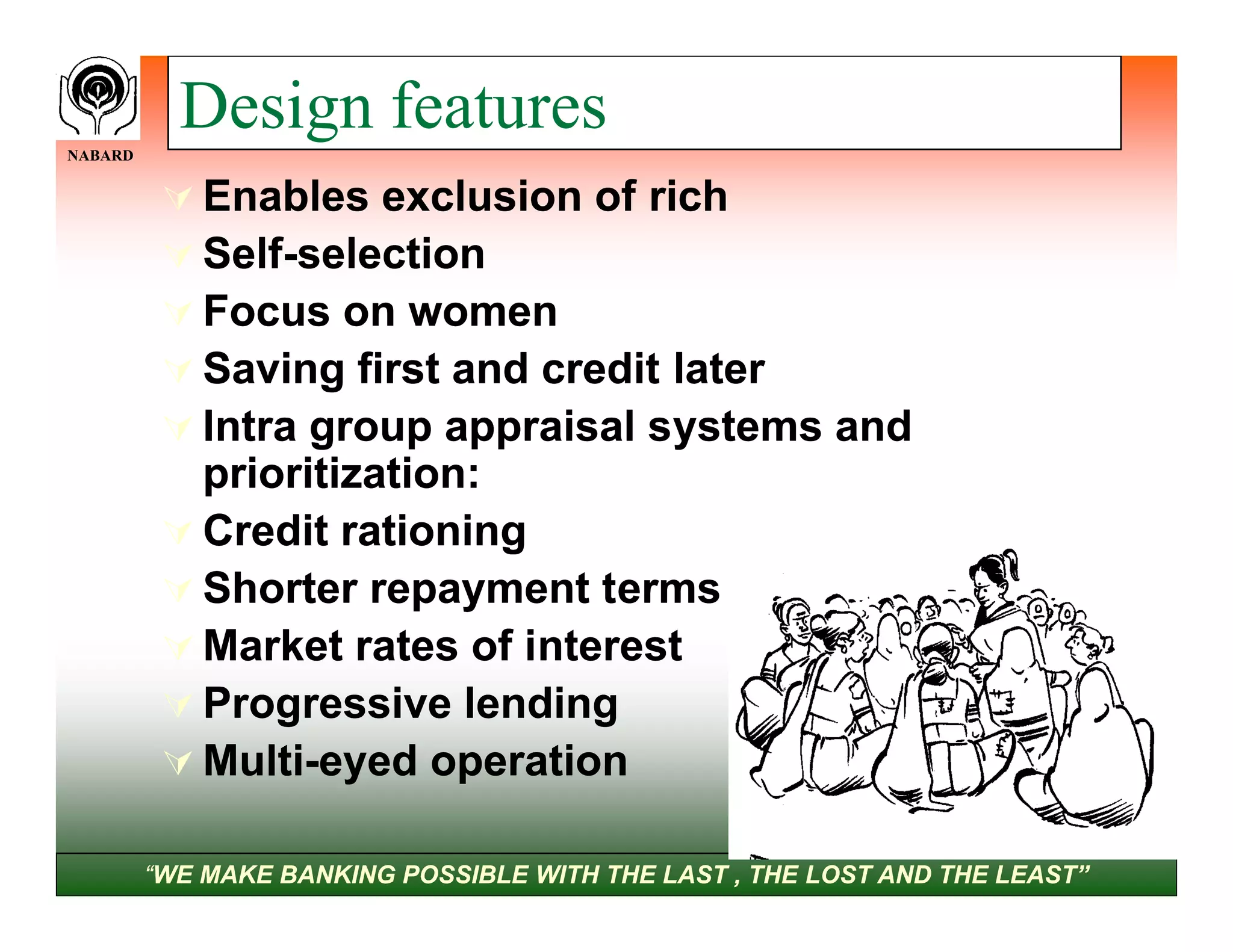

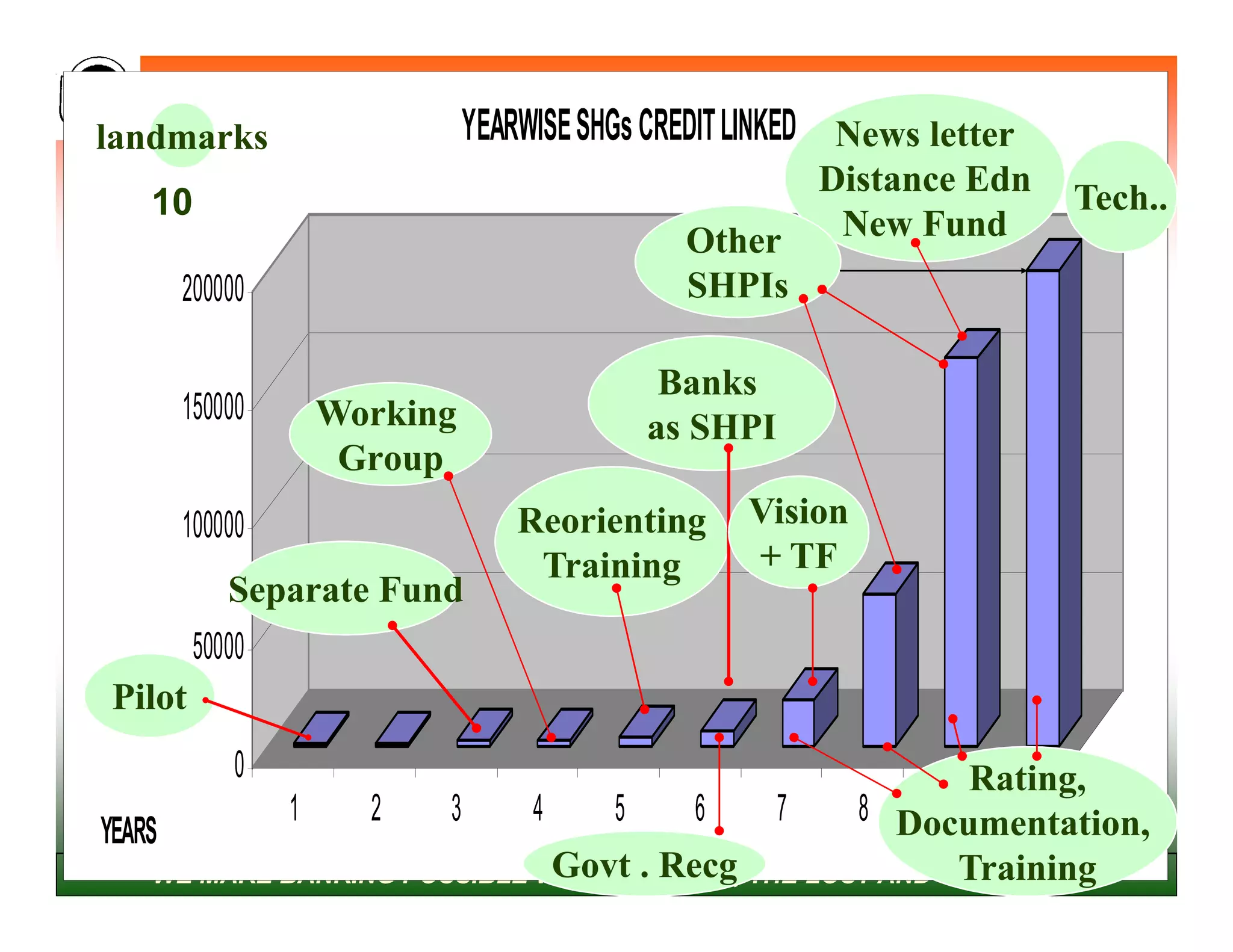

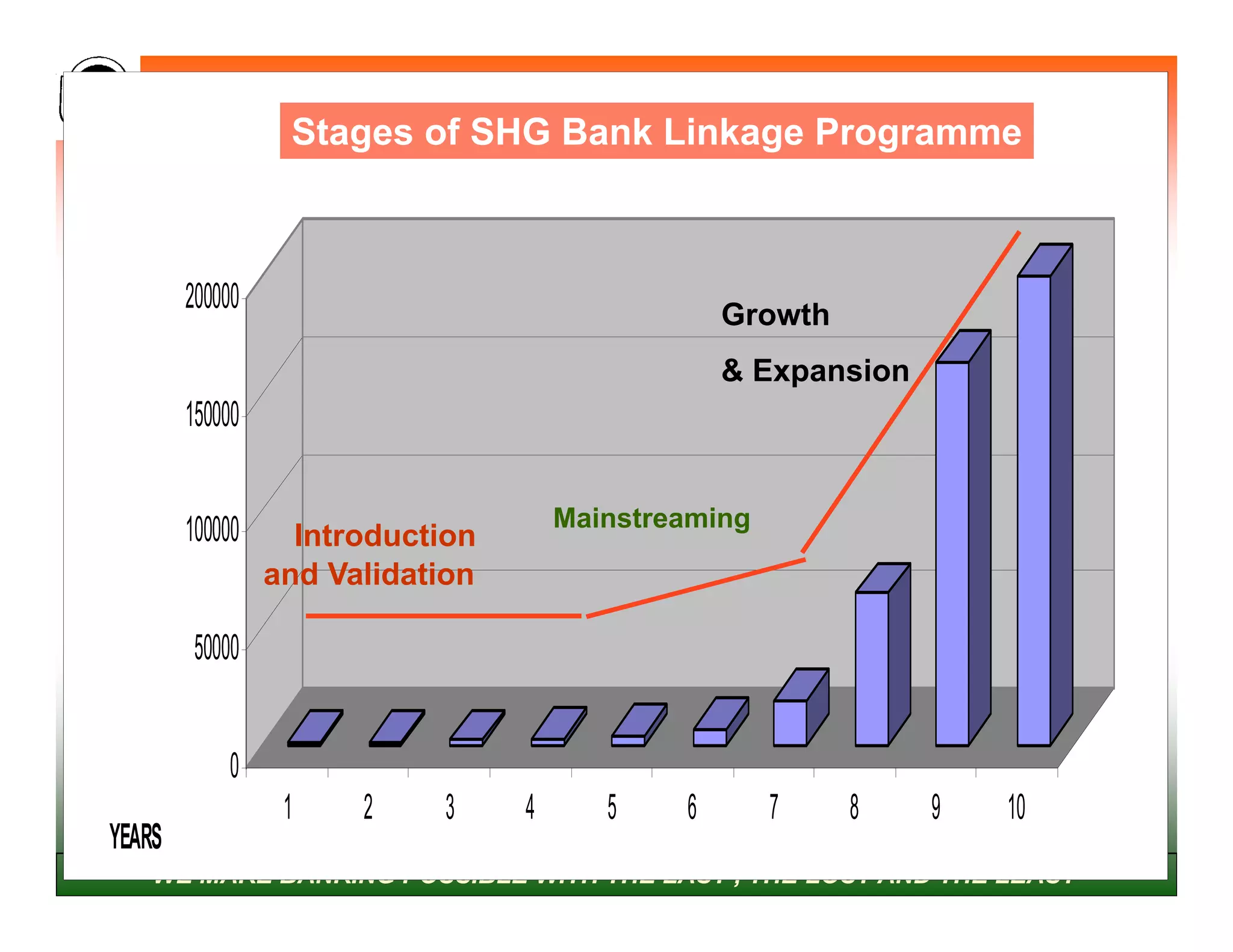

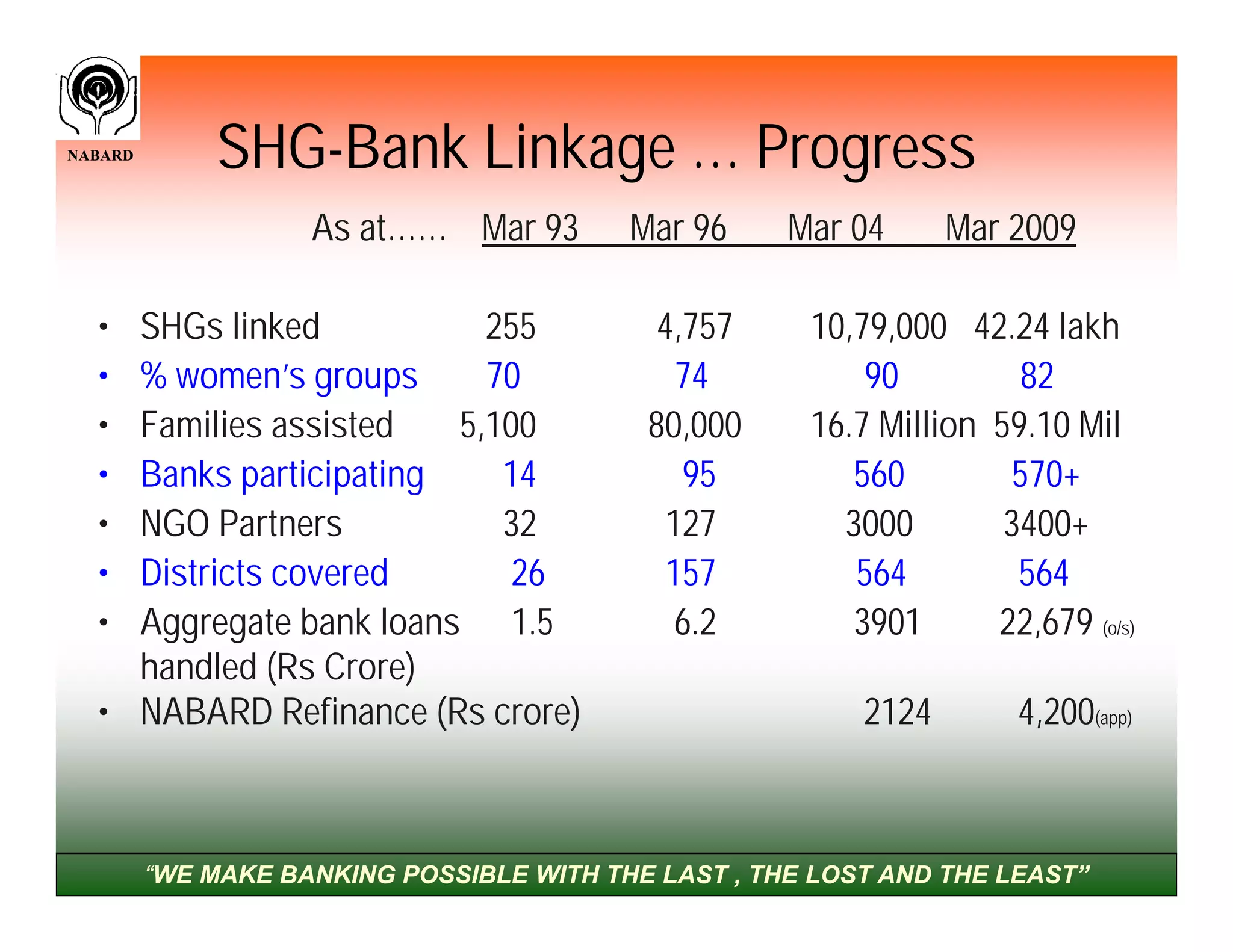

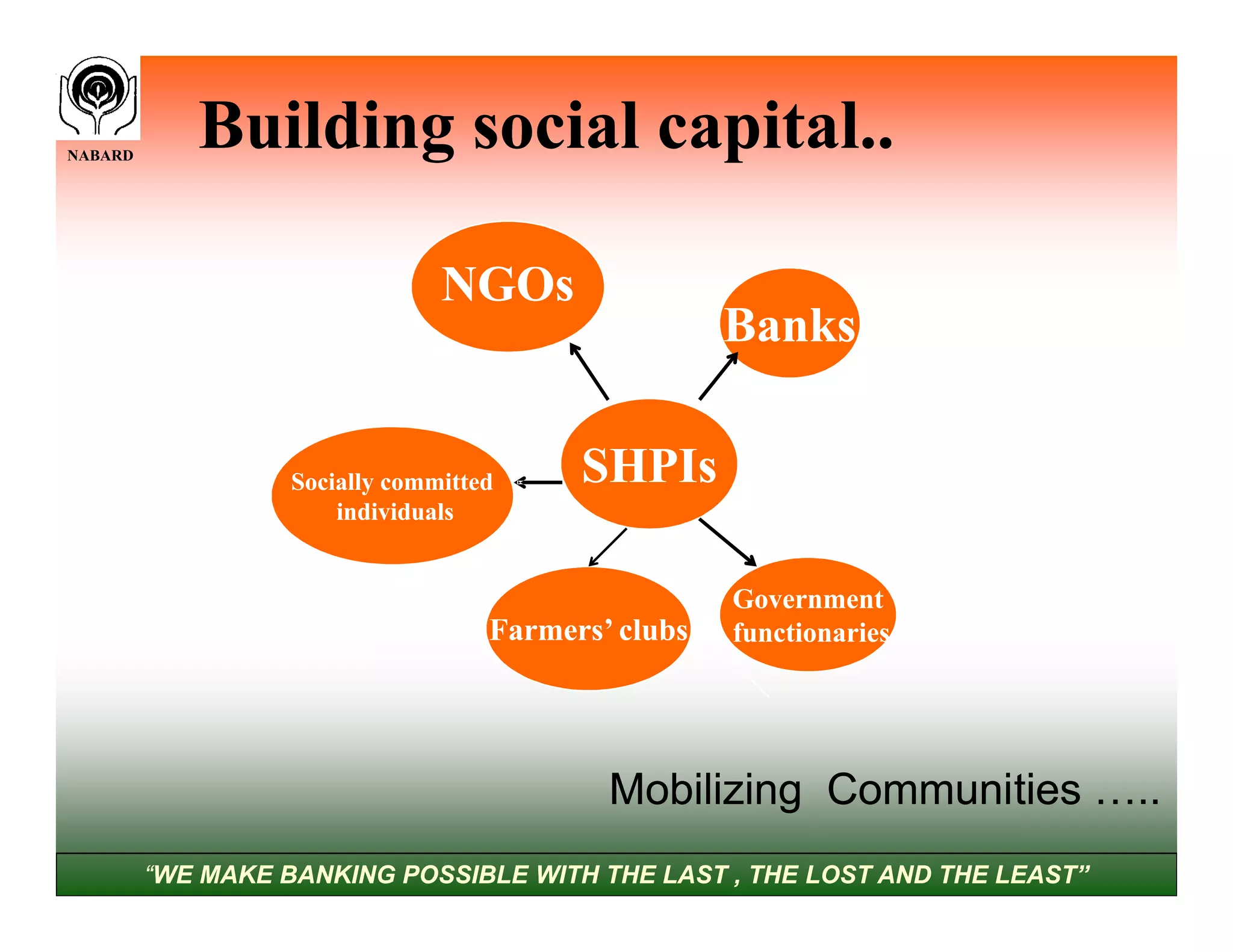

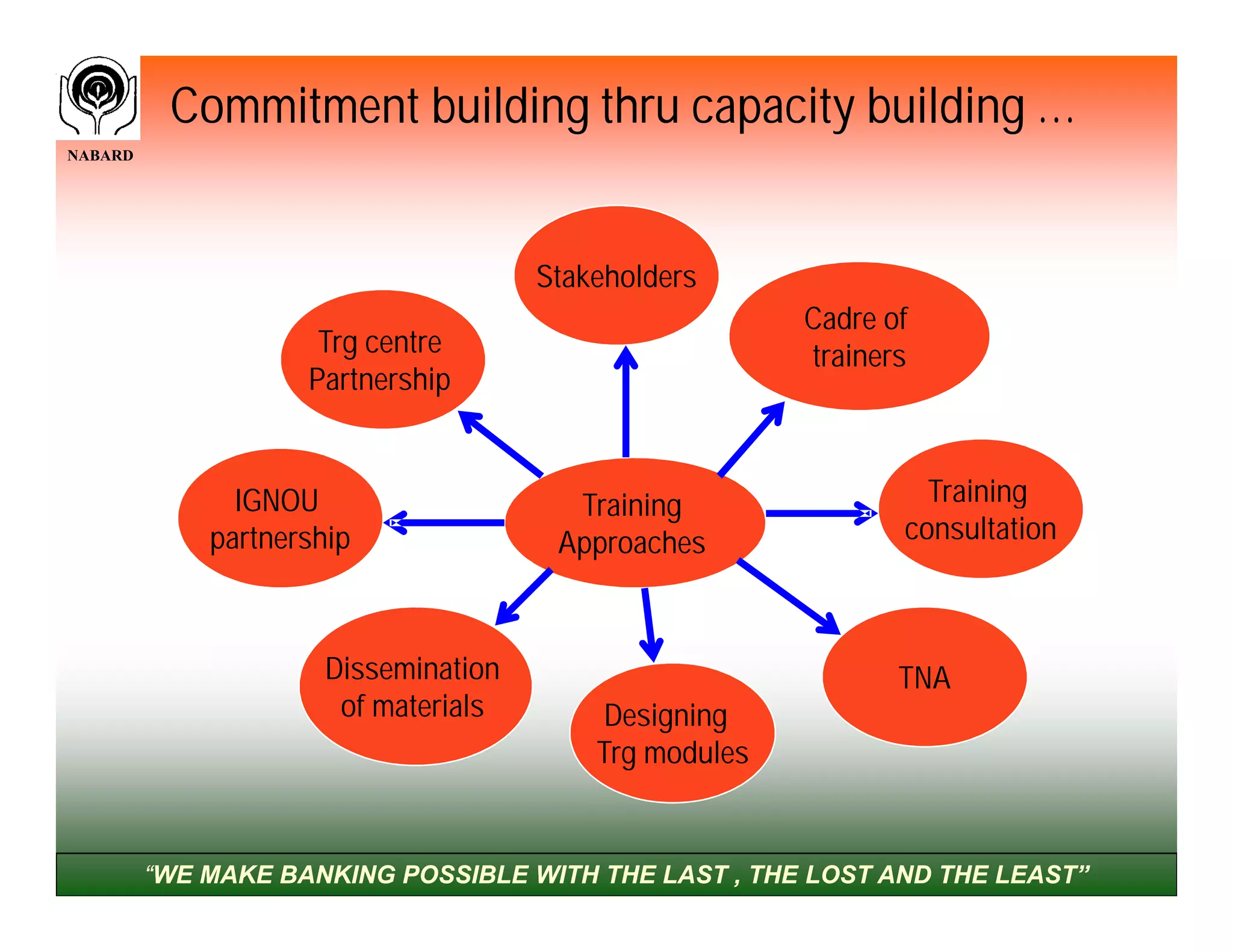

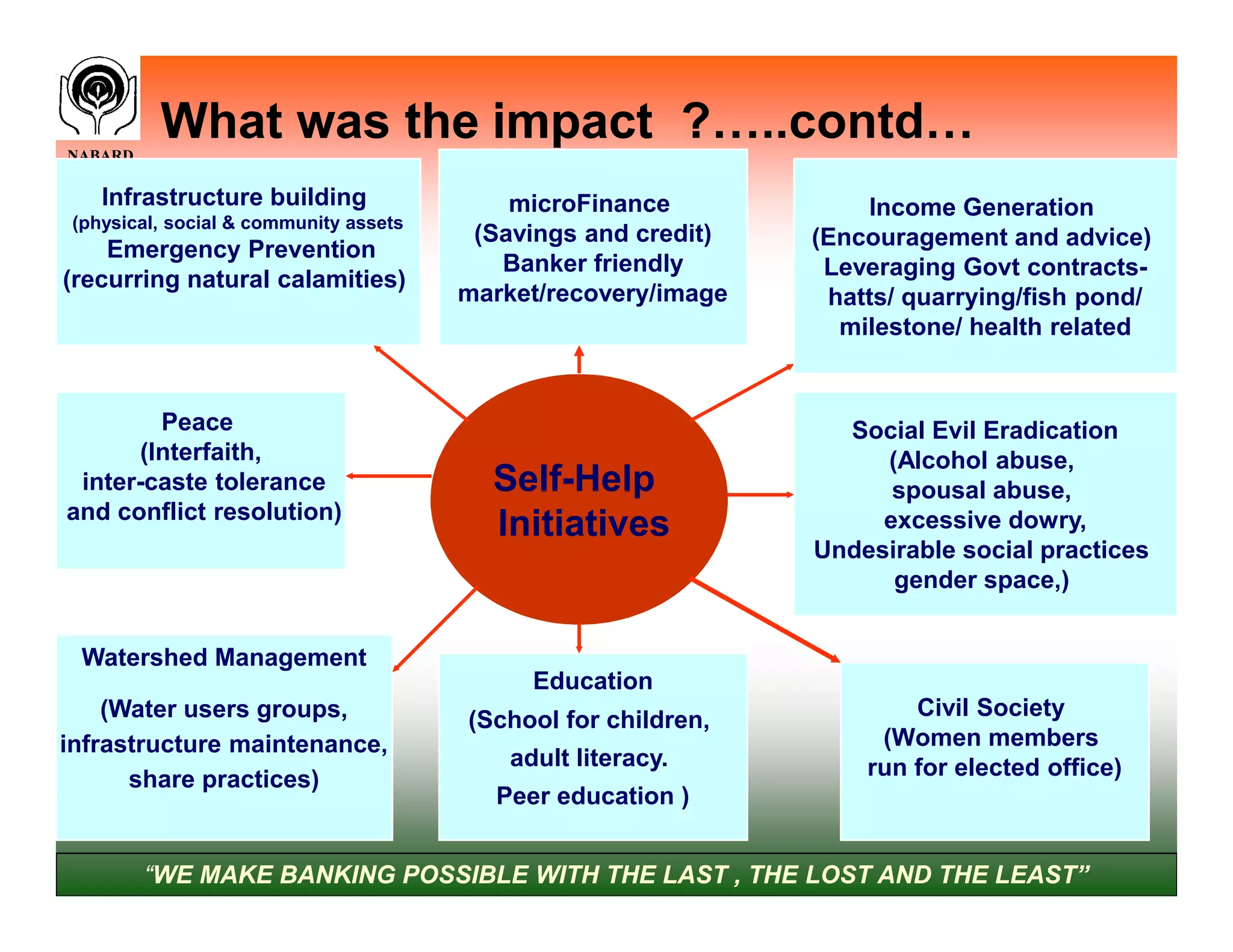

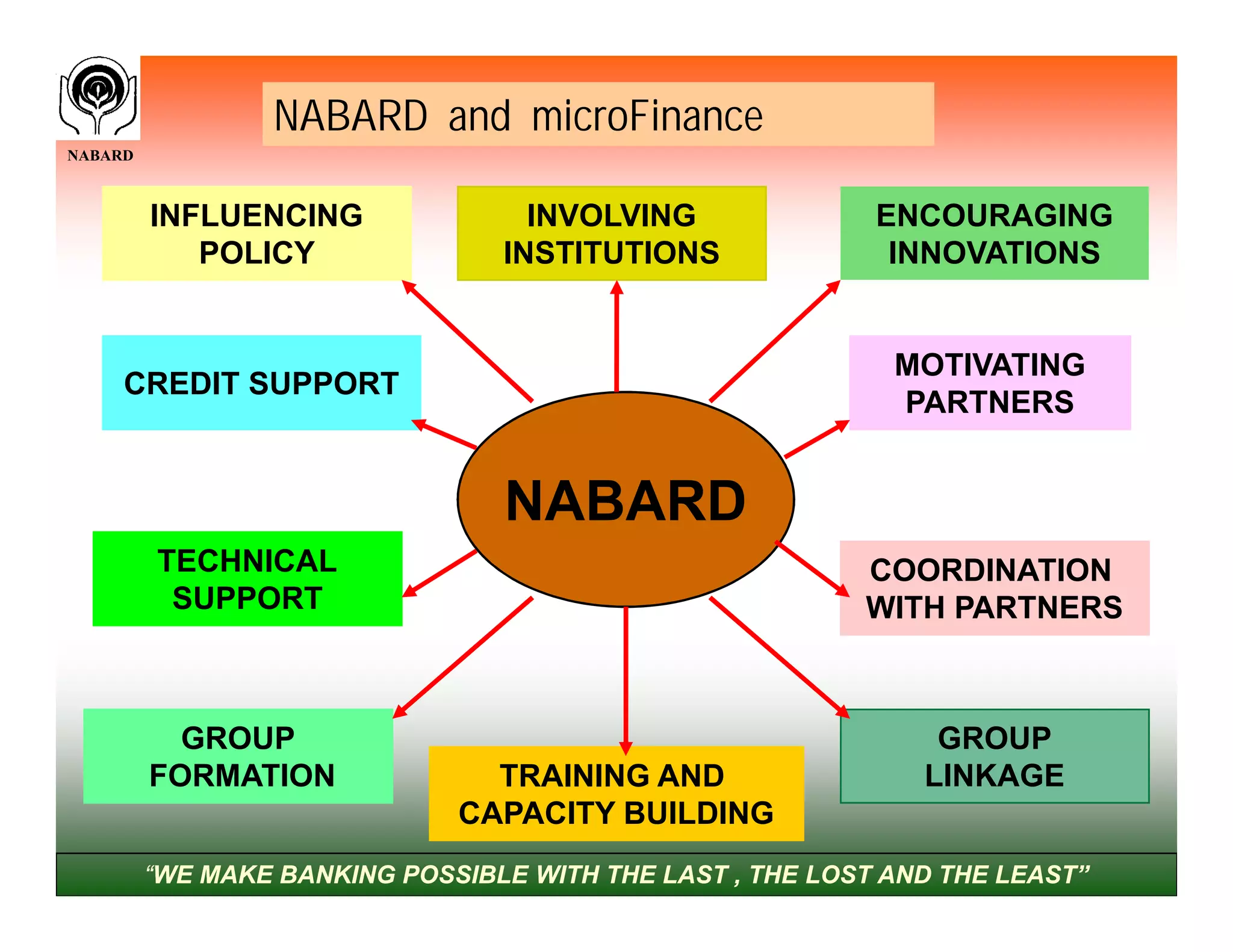

The document outlines NABARD's commitment to enhancing rural prosperity through financial inclusion and support for self-help groups (SHGs). It highlights the growth and challenges in rural banking, the importance of tailoring financial products to meet the needs of the poor, and the development of SHGs to facilitate savings and credit access. Additionally, it details NABARD's strategies for training and capacity building to strengthen rural financial systems and support sustainable community development.