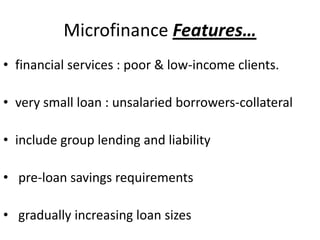

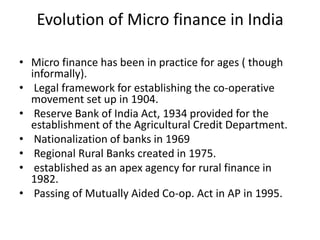

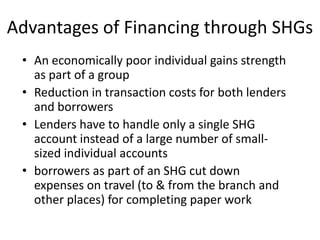

The document discusses microfinance features such as providing small loans and financial services to low-income individuals without collateral. It describes microfinance objectives like providing access to financial services to help poor households finance business activities and stabilize consumption. Majority of microfinance clients are self-employed, low-income individuals, including many women near the poverty line. The status and evolution of microfinance in India is examined, along with the roles of institutions like NABARD in promoting rural development through microfinance initiatives.