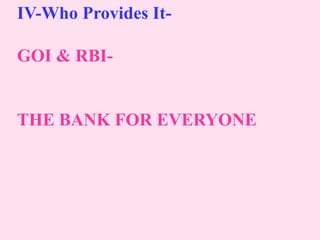

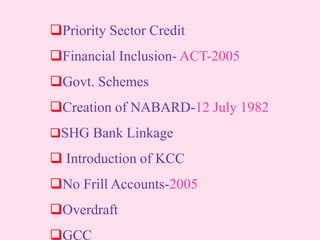

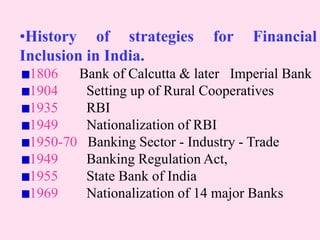

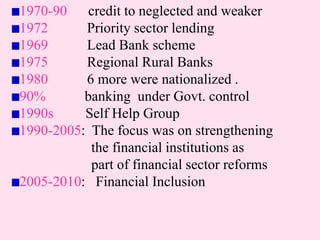

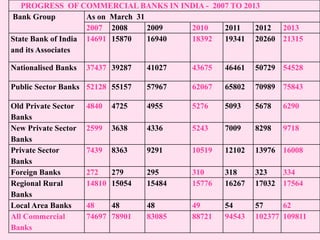

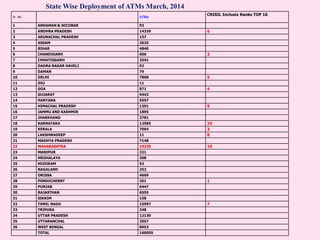

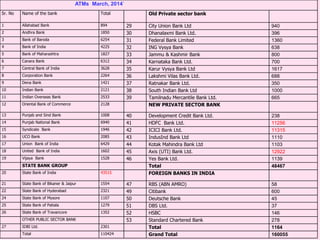

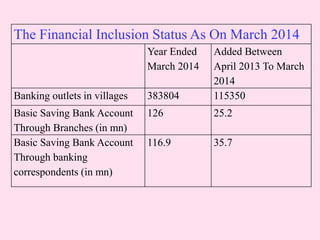

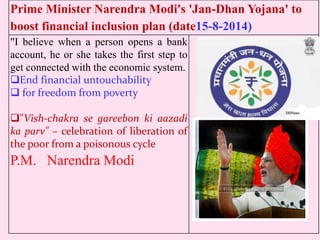

This document provides an overview of promoting financial inclusion in India. It discusses the need for financial inclusion, approaches taken by the Reserve Bank of India and other organizations to expand access to financial services, key dimensions of financial inclusion related to what services are provided, how they are delivered, who receives them, and who provides them. The document outlines India's history with financial inclusion strategies dating back to the early 1900s and highlights some of the major policies and programs implemented over time to promote inclusion, including the recent Jan Dhan Yojana program launched in 2014 with a goal of providing bank accounts to all Indians.

![The Financial Inclusion -Four Core

Dimensions-

[i] What is provided-

[ii] How it is provided-

[iii] Who receives it-

[iv] Who provides it-](https://image.slidesharecdn.com/financialinclusion-170411065347/85/Financial-inclusion-20-320.jpg)

![[i] What Is Provided:-

1.The first step:- :Awareness

2.Opening of Account :Empowerment

3.Smart Card :Providing Identity](https://image.slidesharecdn.com/financialinclusion-170411065347/85/Financial-inclusion-21-320.jpg)

![[II] How It Is Provided:-

With Quality

Convenience

Affordability,

Safety and Dignity of Treatment

Client Protection.

Adequacy,

Availability.

Accessibility](https://image.slidesharecdn.com/financialinclusion-170411065347/85/Financial-inclusion-23-320.jpg)

![[iii] Who Receives It:-Who are excluded ?

Poor

Women

Farmers

Disabled

Uneducated

Un-employed

Ethnic Minorities

Physically challenged people

Old people as well as children

Agricultural and Industrial Labourers

People engaged in un-organised sectors

Socially under-privileged in rural and urban areas](https://image.slidesharecdn.com/financialinclusion-170411065347/85/Financial-inclusion-24-320.jpg)