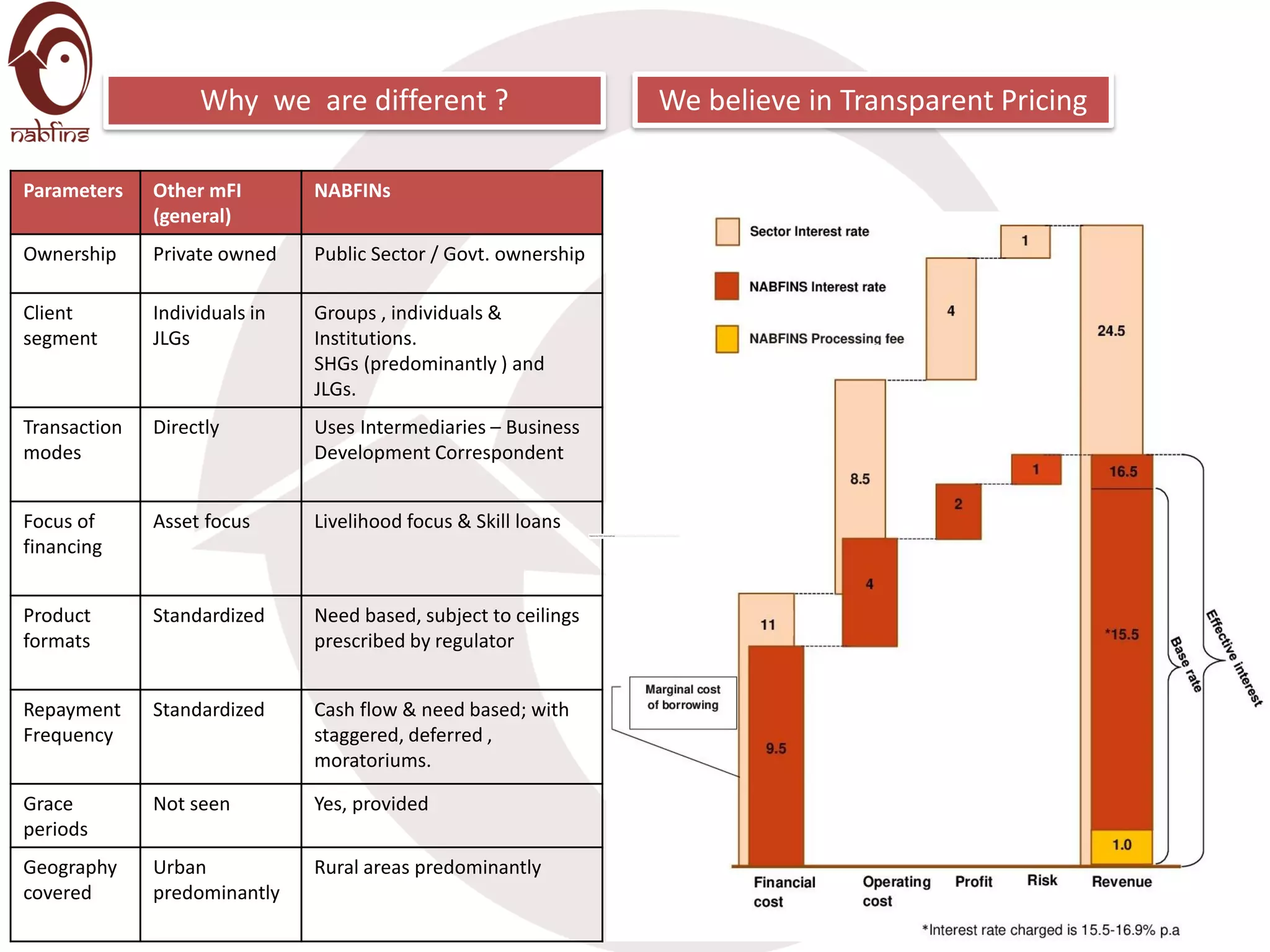

1) NABARD Financial Services Limited aims to improve access to affordable and timely financial services for low-income groups through true financial inclusion.

2) It provides various credit services tailored to clients' needs and cash flows, including loans to self-help groups, joint liability groups, individuals, youth for skills training, and solar/HLS traders.

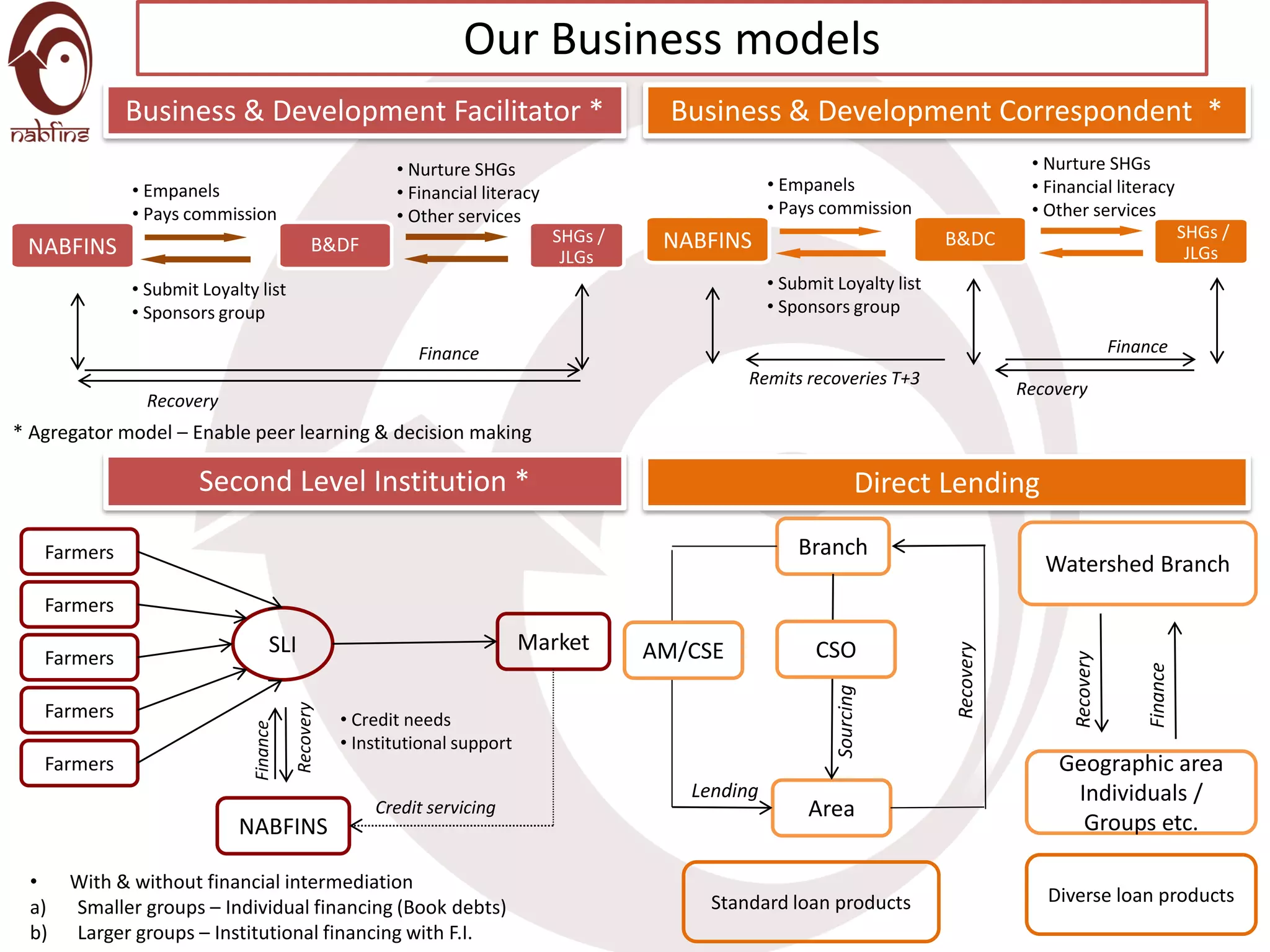

3) The company uses different business models like business and development facilitators, correspondents, and second-level institutions to deliver these services predominantly in rural areas.