Karnataka Agri Development's 25 Year Journey

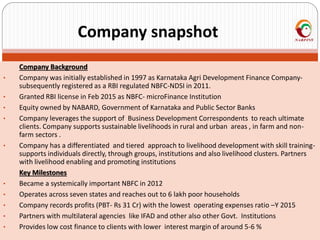

- 1. Company Background • Company was initially established in 1997 as Karnataka Agri Development Finance Company- subsequently registered as a RBI regulated NBFC-NDSI in 2011. • Granted RBI license in Feb 2015 as NBFC- microFinance Institution • Equity owned by NABARD, Government of Karnataka and Public Sector Banks • Company leverages the support of Business Development Correspondents to reach ultimate clients. Company supports sustainable livelihoods in rural and urban areas , in farm and non- farm sectors . • Company has a differentiated and tiered approach to livelihood development with skill training- supports individuals directly, through groups, institutions and also livelihood clusters. Partners with livelihood enabling and promoting institutions Key Milestones • Became a systemically important NBFC in 2012 • Operates across seven states and reaches out to 6 lakh poor households • Company records profits (PBT- Rs 31 Cr) with the lowest operating expenses ratio –Y 2015 • Partners with multilateral agencies like IFAD and other also other Govt. Institutions • Provides low cost finance to clients with lower interest margin of around 5-6 % Company snapshot

- 2. Company Performance 0% 20% 40% 60% 80% 100% 120% 2011-12 2012-13 2013-14 2014-15 0 100 200 300 400 500 600 700 800 900 1000 TotalAssets Total Assets Growth rate Total Assets 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2011-12 2012-13 2013-14 2014-15 0 100 200 300 400 500 600 700 800 900 DisbursementDisbursement Growth rate Loan Disbursement PARTICULARS 2011-12 2012-13 2013-14 2014-15 Clients covered (lakhs) 1.19 2.41 3.93 5.35 Profit after tax (lakhs) 8.64 210.09 1,08.95 1,741.37 ROA 1.21% 2.07% 2.25% 2.11% ROE 6.20% 10.11% 10.87% 10.29% Book Value per share (in `) 11.39 11.32 12.50 12.97 (Amount in crore)

- 3. Some key differences Parameters mFIs ( general) NABFINs 1.Ownership Privately owned Public Sector / govt ownership 2.Client segment Individuals in JLGs Groups , individuals & Institutions. SHGs (predominantly ) and JLGs. 3.Transaction modes Directly Uses Intermediaries – Business Development Correspondent 4.Focus of financing Asset focus Livelihood focus & Skill loans 5.Product formats Standardized Need based, subject to ceilings prescribed by regulator 6. Margins ( loan pricing – ULR) 10-12 %; (22-27 % p.a.) 5-6 % (14-16.75 % p.a). 7.Repayment Frequency Standardized Cash flow & need based; with staggered, deferred , moratoriums. 8.Grace periods / gestation Not seen Yes, provided 9.Geography covered Urban predominantly Rural areas predominantly

- 4. Developments • Has dedicated, talented and committed team of about 300 staff across 75 districts • Have succeeded substantially to prove low cost finance can be done by mFIs with lower interest margin of around 5-6 % • The Company is well on the course of replicating the same in resource poor regions as also unreached segments and institutions. • To maintain a sectoral lead and serve as a profit earning mFI which is client friendly , with diverse range of products coupled with high standards of governance and transparency. Future Plans • Reaches out to about 1/5 th the districts of the country, including the NE Regions serving the unreached segments of the country. • Financing second level institutions, livelihood clusters, activity groups that supports livelihoods development for the poor and unreached / unserved. • Funding unemployed youth in conflict stricken areas and other geographies with vocational training with skill loans & post training placements • Further diversification to geographies and also other unreached client segments , with diverse products and with localized and client friendly delivery modes . Future Plans