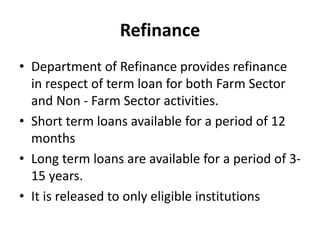

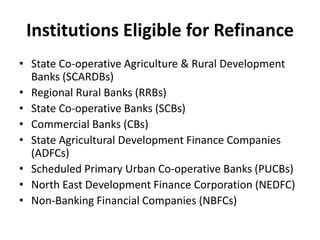

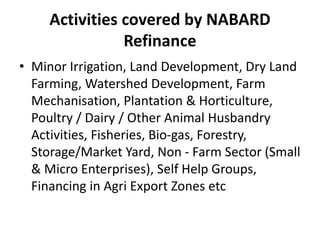

The document summarizes the origins and functions of the National Bank for Agriculture and Rural Development (NABARD) in India. It was established in 1982 to provide credit and other support services to promote rural and agricultural development. Key points include that NABARD provides refinancing to rural banks, coordinates rural development programs, and promotes initiatives like microfinance and support for farmers through training centers.