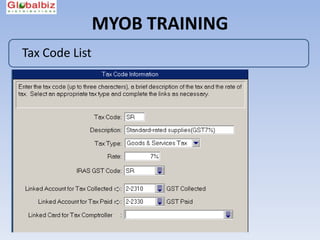

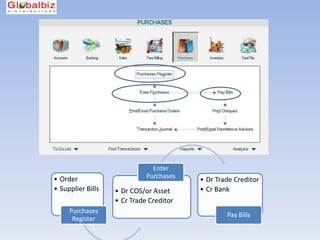

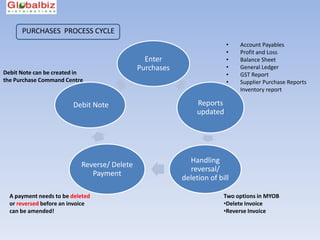

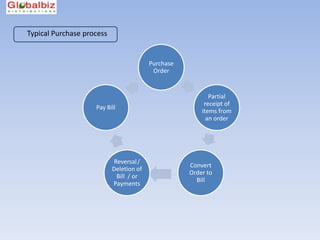

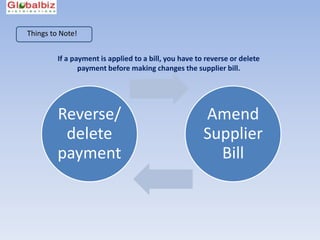

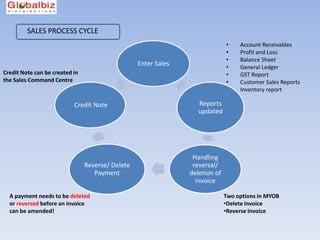

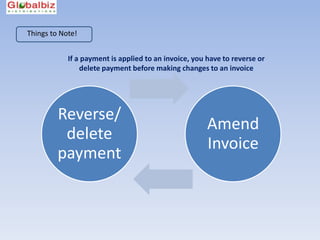

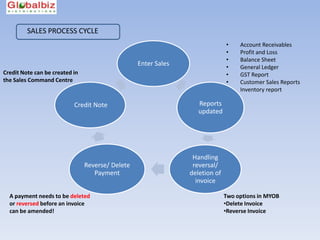

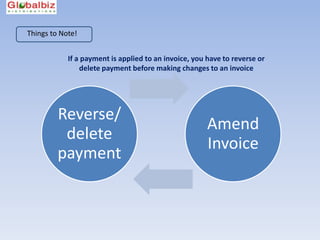

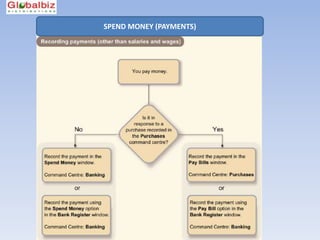

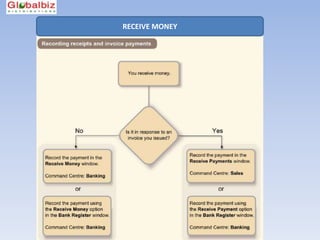

The document provides an overview of the topics covered in a MYOB training session. The training covers how to set up and manage key aspects of MYOB including the chart of accounts, budgets, taxes, banking, payments, receipts, inventory, sales, purchases, reports, passwords and more. It includes explanations of common processes like entering transactions, reconciling payments and handling reversals or amendments to transactions.