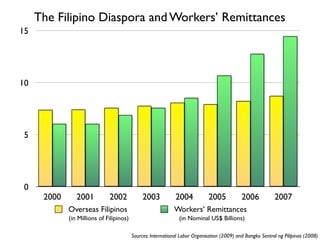

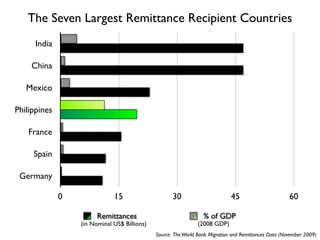

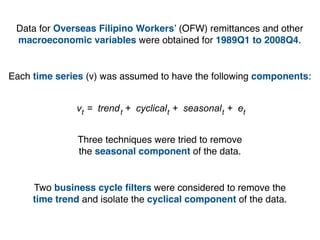

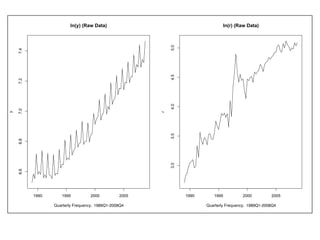

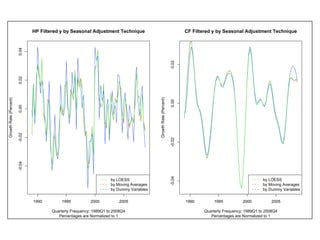

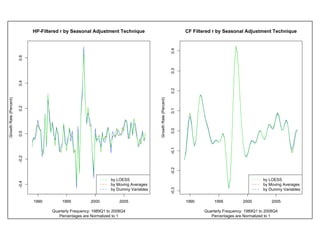

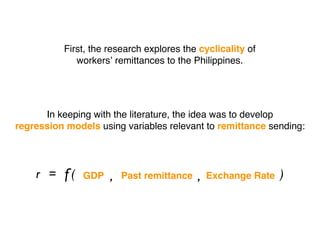

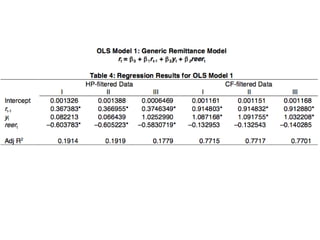

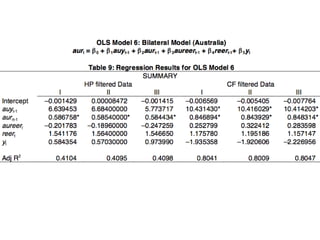

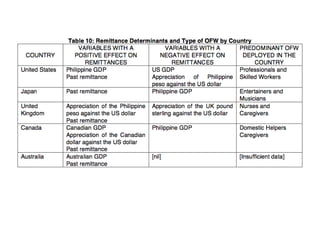

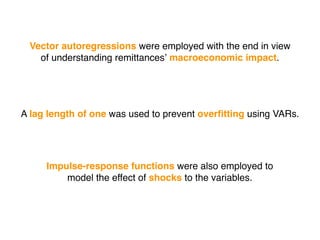

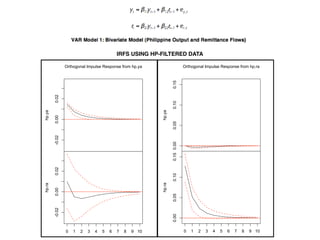

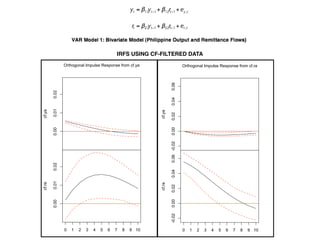

This dissertation proposal explores the properties of Philippine remittances, particularly their cyclical nature and macroeconomic impacts. It involves detailed data treatment and analysis techniques to understand the dynamics of remittances from overseas Filipino workers. The research aims to apply new methodologies to remittance data, addressing issues like exchange rate effects and structural breaks in the data.