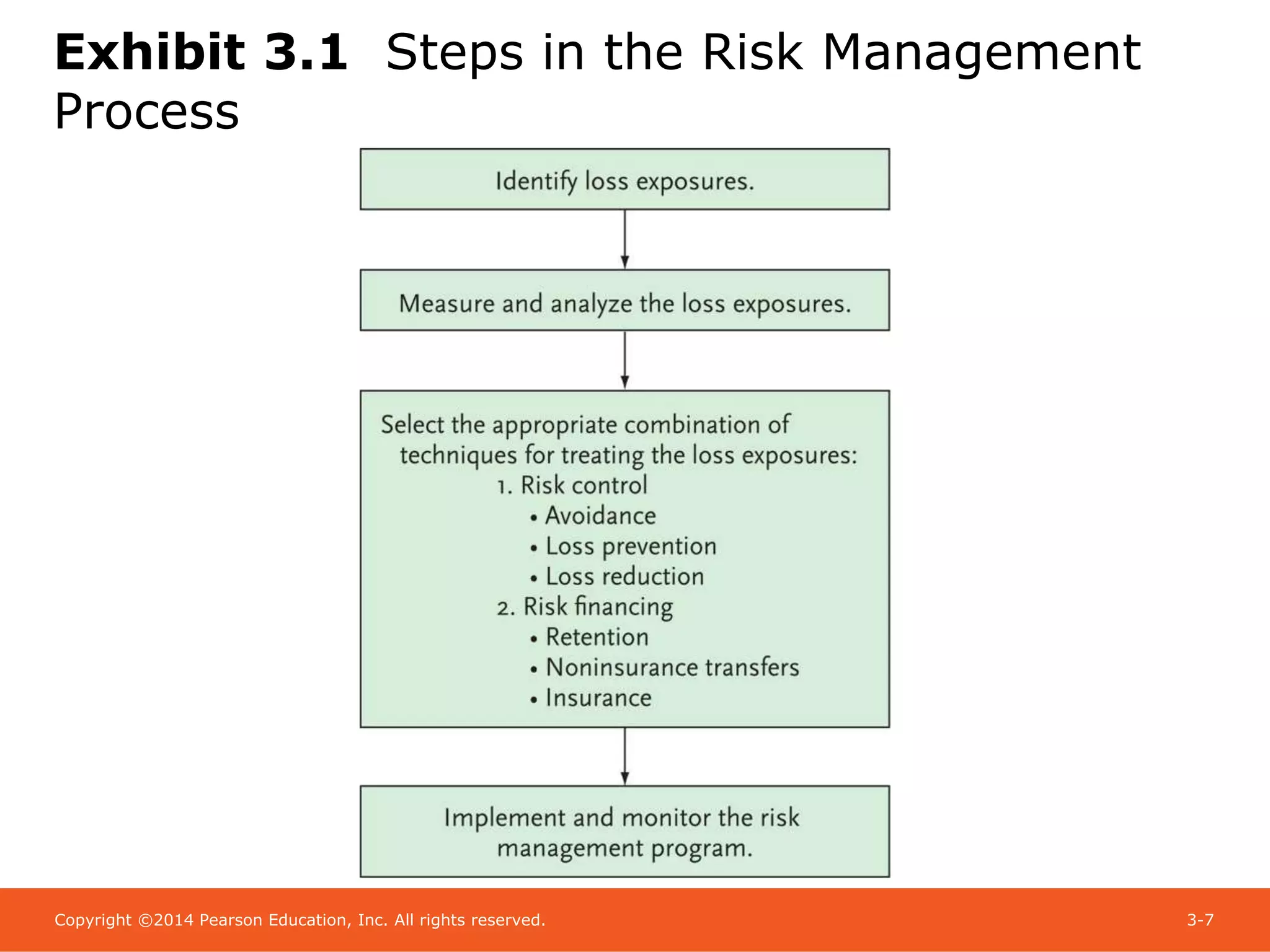

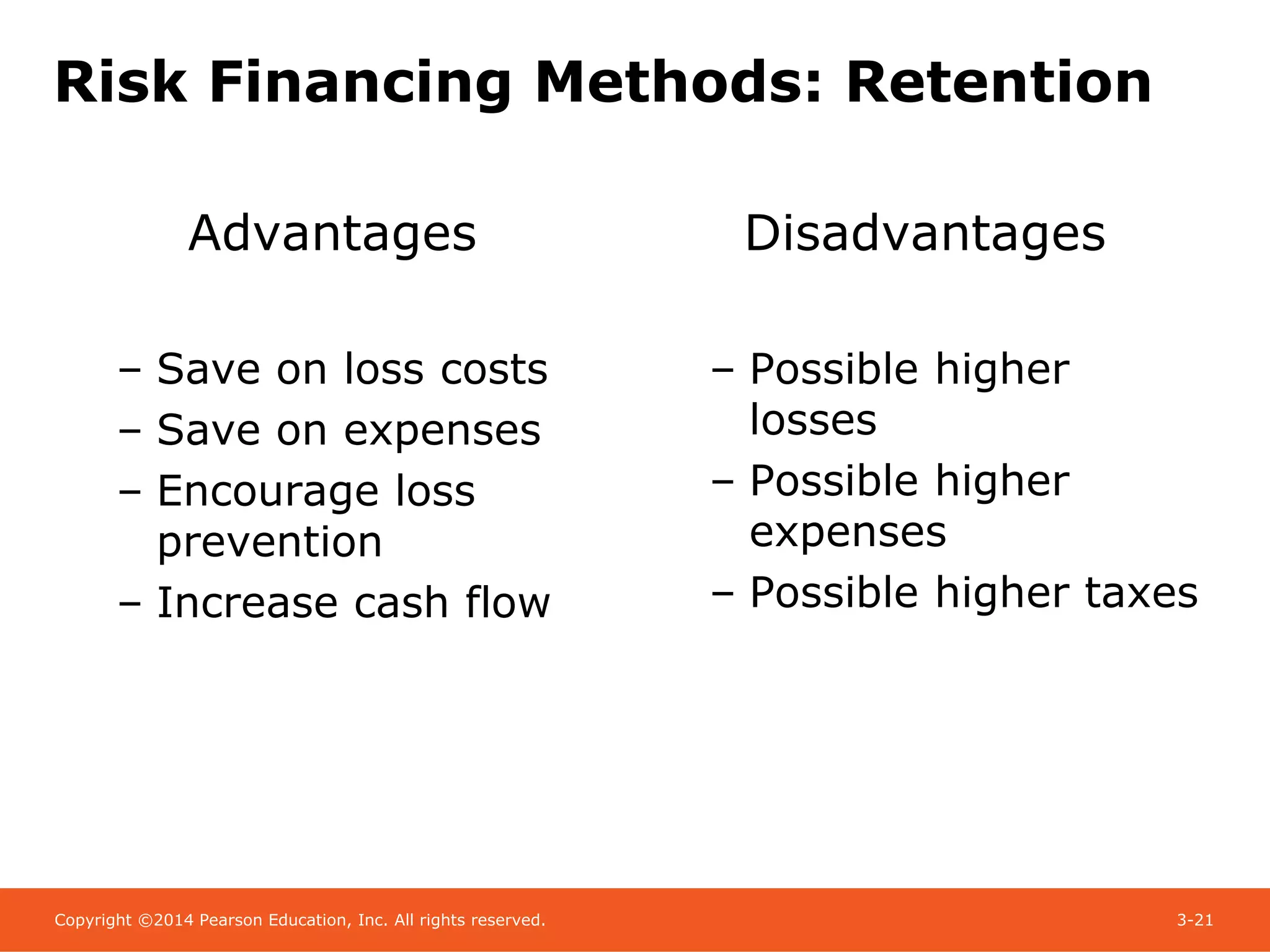

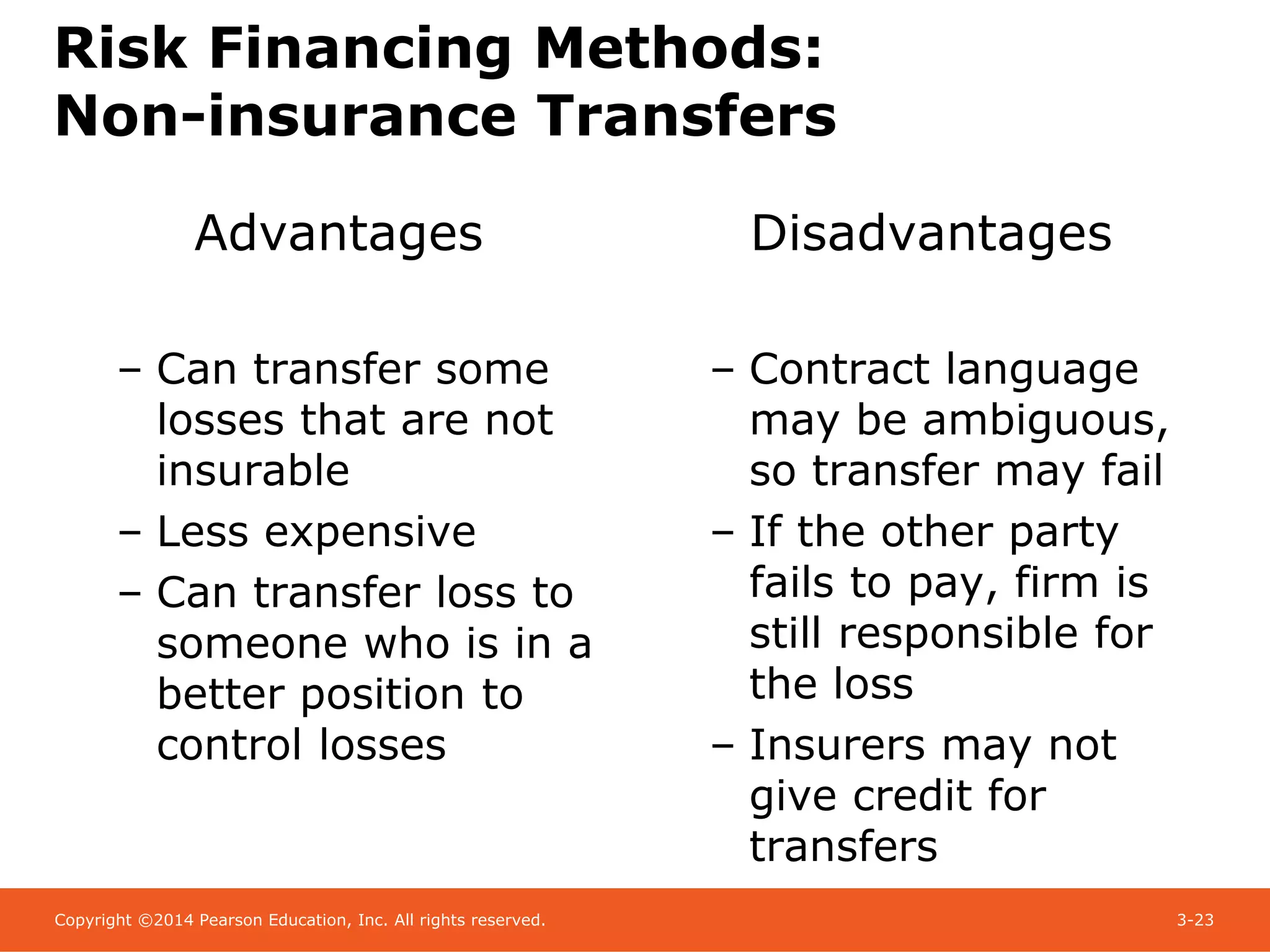

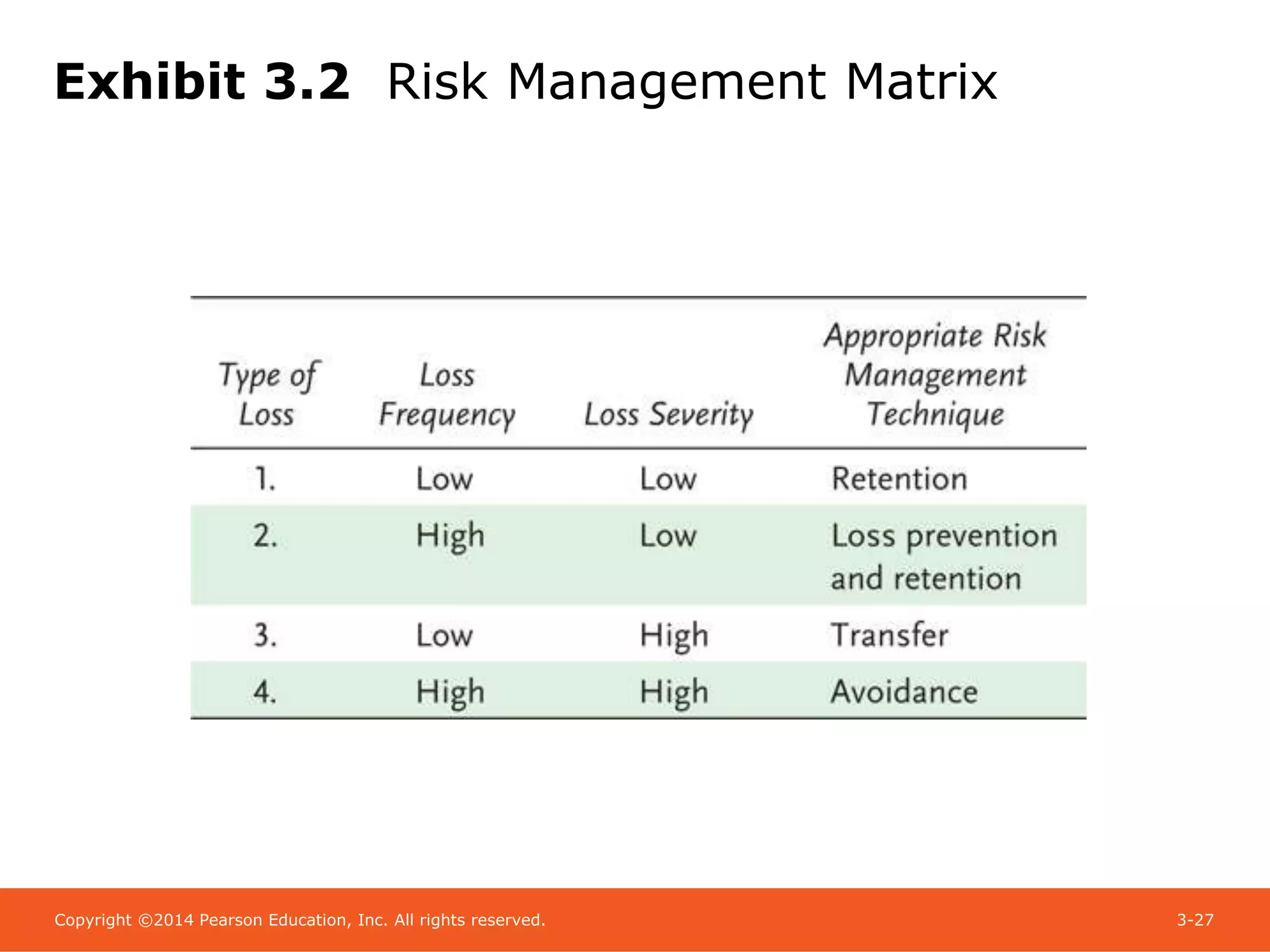

This document provides an overview of risk management. It defines risk management and outlines its key objectives as identifying potential losses and selecting techniques to treat exposures. The main steps in the risk management process are identified as identifying exposures, measuring and analyzing exposures, selecting treatment techniques, and implementing a risk management program. Treatment techniques include risk control methods like avoidance, prevention and reduction, as well as risk financing methods like retention, non-insurance transfers and commercial insurance.