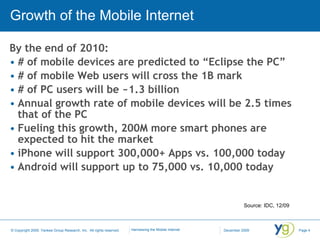

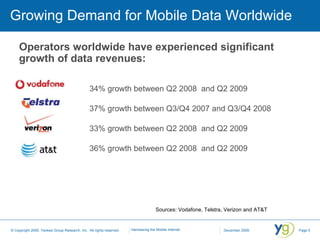

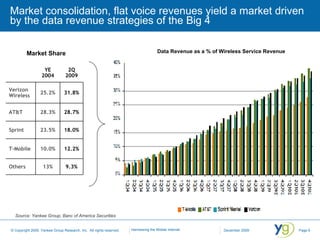

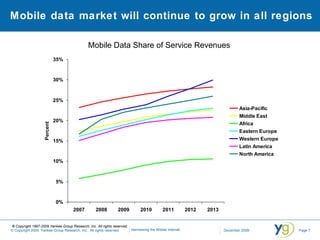

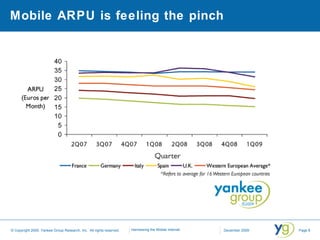

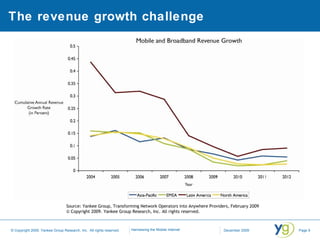

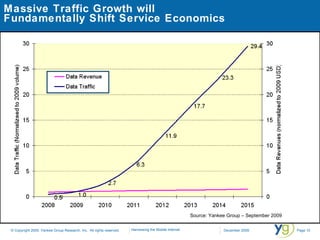

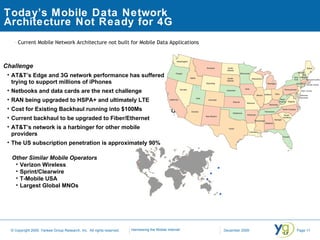

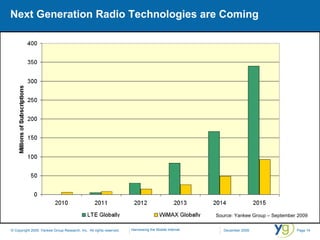

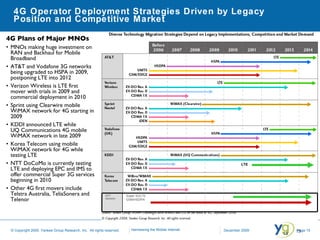

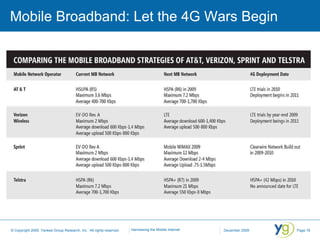

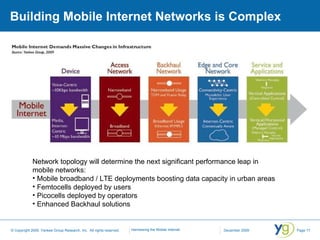

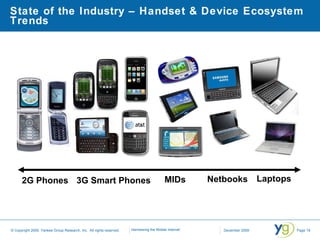

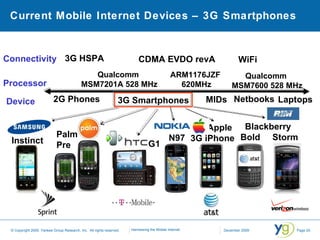

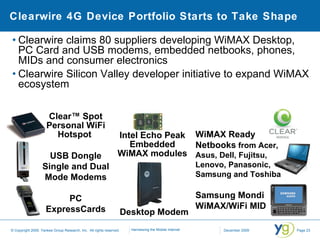

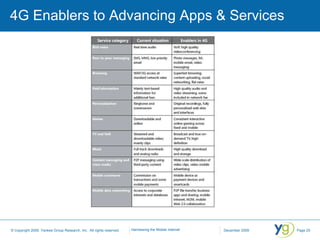

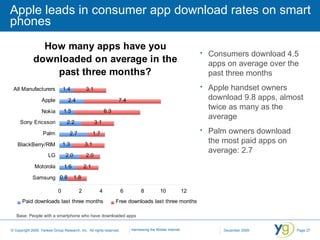

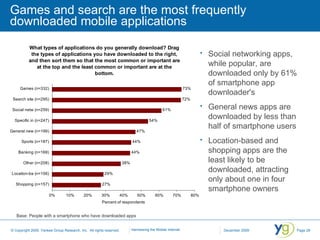

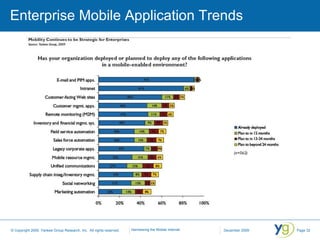

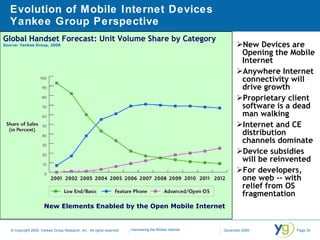

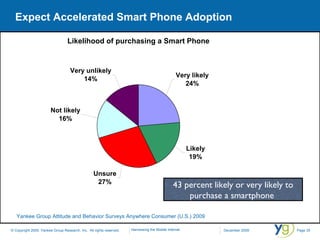

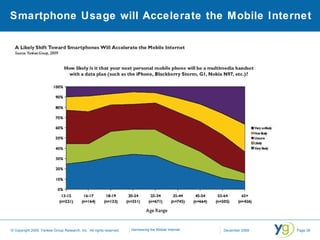

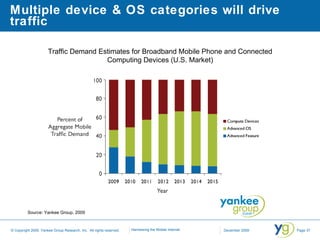

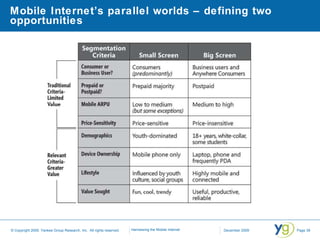

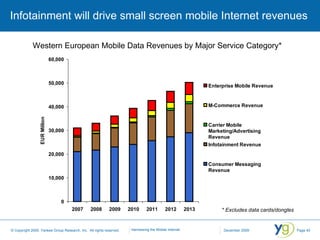

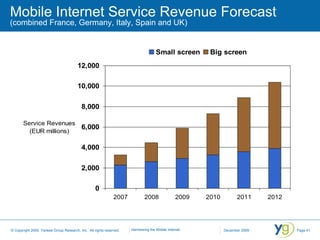

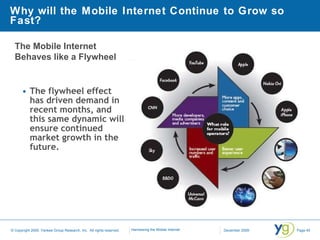

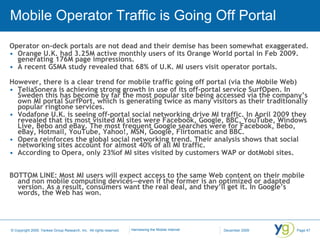

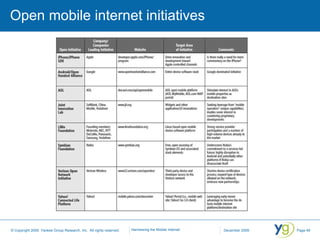

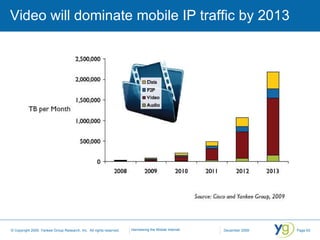

The document discusses the significant growth and demand for mobile broadband, predicting that mobile devices will soon outnumber PCs and mobile web users will exceed one billion by the end of 2010. It outlines challenges faced by mobile operators in transitioning to 4G networks, including the need for upgraded infrastructure to manage increasing data traffic and diminishing revenue per bit. Furthermore, it emphasizes the importance of mobile applications and device innovation in driving the mobile internet's evolution and market dynamics.