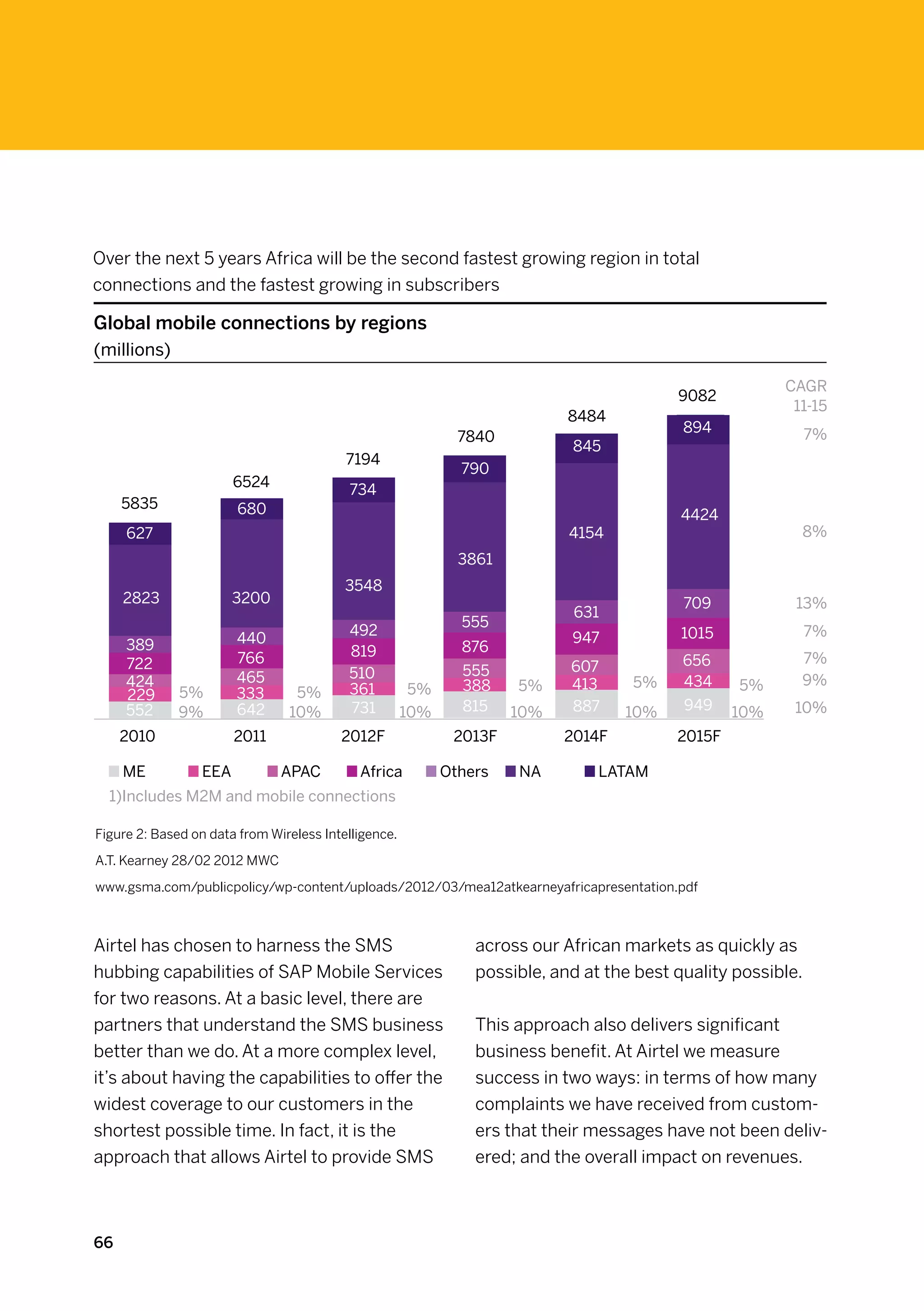

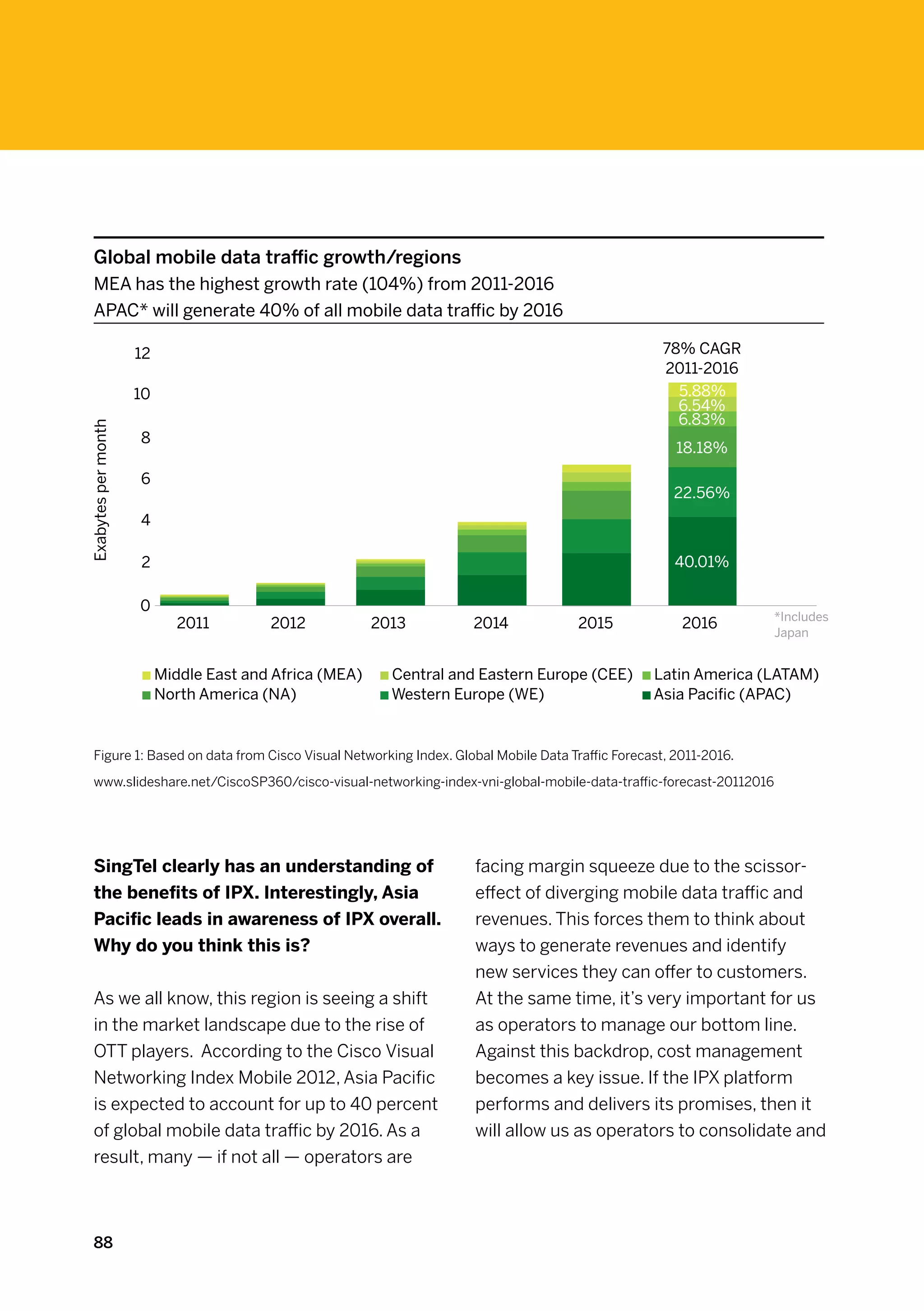

This document provides an overview and analysis of challenges, strategies and opportunities for mobile operators in evolving mobile services. It contains sections on driving revenue through SMS services and mobile number portability, leveraging IPX interconnectivity to bundle services, enabling 4G LTE networks, and facilitating LTE roaming. The document features case studies and perspectives from mobile operators and industry experts on these topics.

![PART TWO: STRATEGIES FOR DRIVING REVENUE

Cybersafety: Everyone’s

Responsibility

By Steve Largent, President CEO, CTIA-The Wireless Association

Imagine identifying a cyberthreat well as many other significant problems. How

such as a virus, worm or malicious can this possibly be considered efficient, effec-

tive or “good business”? It’s not.

code on your company’s commun-

ications network. You know how to If you’re like the CTIA-The Wireless

remove it, but you also believe that Association, and many of its members, then

your company isn’t the only one you already know that private sector net-

works are targeted every day by hackers,

under attack. You tell your boss

criminals and nation-state actors for cyber

that others, including your comp- exploitation and theft. The scenario I des-

etitors and military commun- cribed above, as well as the attacks that

ication networks, might likewise confront the private sector daily, are pivotal

reasons why we support the Cyber Informa-

be affected (but their IT experts

tion Sharing and Protection Act [(CISPA)

might not have noticed the threat (H.R. 3523)].

yet, or simply haven’t figured out

how to stop it). This legislation would pave the way for

efficient and effective business practice,

As a courtesy, you’d like to alert these other allowing our members to communicate

parties and offer your assistance to help with all the stakeholders — competitors,

them protect their networks in anticipation of federal government agencies, IT directors,

the virus, or help them remove it altogether. academia and experts — to identify

Unfortunately, if you did that, you would put potential issues and create solutions

your company and yourself in danger of before, during and after the problem.

lawsuits and in violation of antitrust laws, as

CTIA and its members have already taken

an active role in addressing cybersecurity,

but time isn’t on our side because the hacker

community is moving fast.

Mobile Operator Guide 2013 The Evolution of Mobile Services: Challenges, Strategies, Opportunities 43](https://image.slidesharecdn.com/sapmobileoperatorguide2013-130315232742-phpapp01/75/Mobile-Operator-Guide-2013-The-Evolution-of-Mobile-Services-Challenges-Strategies-Opportunities-45-2048.jpg)

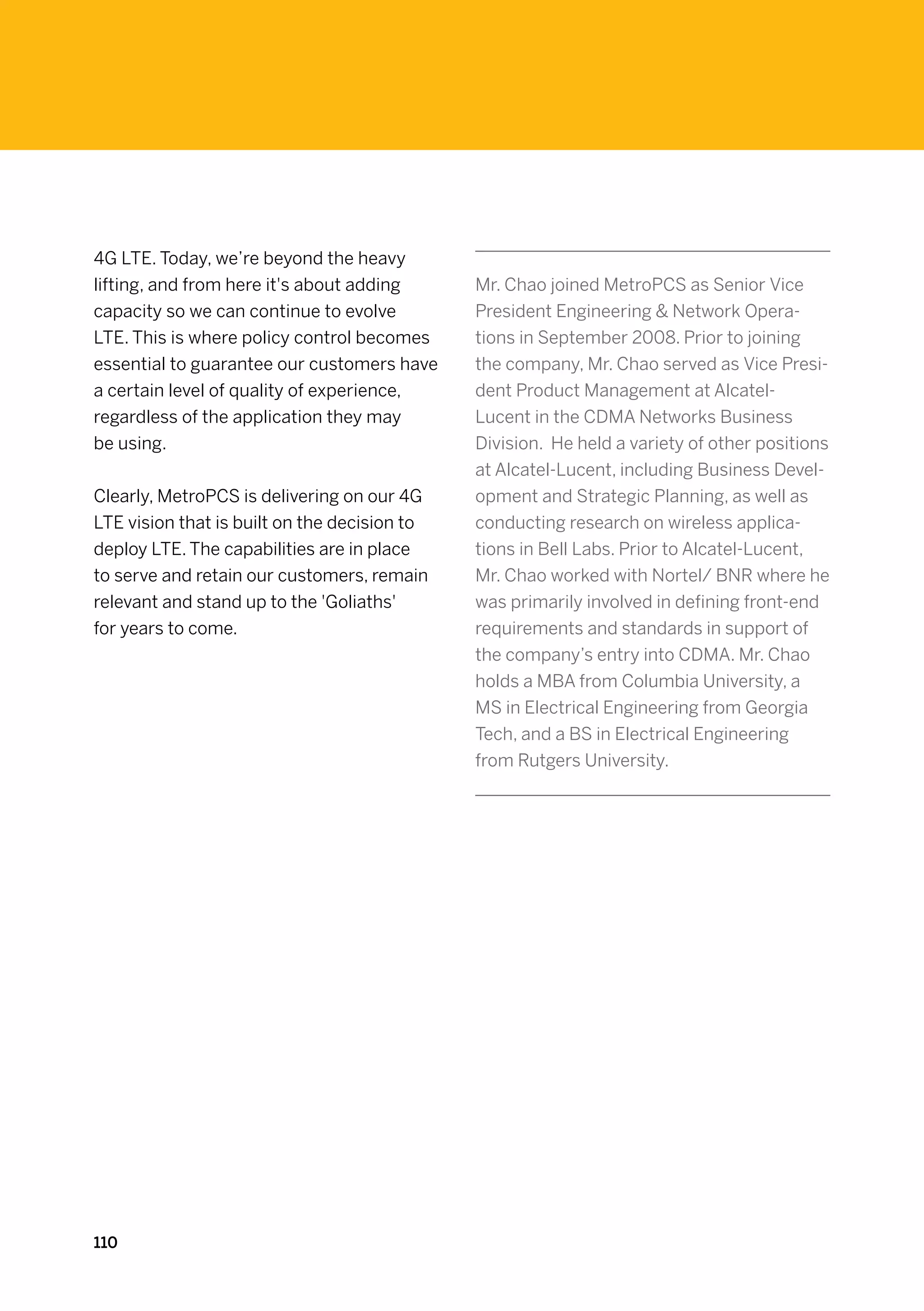

![PART FOUR: LTE: UNLEASHING INNVOVATION TO DELIVER RESULTS

Fighting Smart To Win Big

By Madan Jagernauth, Vice President, Marketing Strategy,

Mavenir Systems

In the mobile industry nothing The Apple iPhone, the smartphones from

excites analysts and investors as other manufacturers that followed, and the

app store model that swept in behind are all

much as disruptive technology that

developments that can certainly be classi-

can potentially change all the rules. fied as disruptive. Granted these innovations

They are in awe of technology that were quickly absorbed into the overall

can be labeled as a “game-changer,” mobile ecosystem, laying the groundwork

for a new phase of growth and innovation

or can be seen to “re-write the

around smartphones, mobile apps and an

rules” that came before. Disruptive ever-growing array of connected devices.

technology spells opportunity and

paves the way for new players. But the impact of these disruptive technolo-

gies on the operator business models was

But not all players welcome the

profound. The space was shaken to its core

tremendous change it brings. before anyone in the industry could react.

Network operators, for example, In fact, the advance of smartphones paved

would rather see disruptive tech- the way for the most potentially disruptive

development of all: a whole raft of new,

nology integrate smoothly, and

so-called Over the Top (OTT) competitors

offer up business opportunities, and services that could marginalise

not problems. operators in the revenue chain.

It [RCS] capitalises on the operators’ core

proposition of ubiquity, reliability and reach,

providing a common approach to a set of new

value-added services that operators can offer

on existing 3G infrastructure, as well as future

LTE networks.

Mobile Operator Guide 2013 The Evolution of Mobile Services: Challenges, Strategies, Opportunities 111](https://image.slidesharecdn.com/sapmobileoperatorguide2013-130315232742-phpapp01/75/Mobile-Operator-Guide-2013-The-Evolution-of-Mobile-Services-Challenges-Strategies-Opportunities-113-2048.jpg)

![APPENDIX

Glossary Of Terms

A2P (Application to Person) - This is CISPA - Cyber Information Sharing and

typically a human communicating with Protection Act [(CISPA) (H.R. 3523)] -

an application via messaging. CISPA addresses how information would

be shared between private companies and

ARPU (Average Revenue Per User) - This the government to catch malicious actors

is usually abbreviated to ARPU is a measure breaching networks to steal information or

used primarily by consumer communica- sabotaging systems.

tions and networking companies, defined

as the total revenue divided by the number CoS - Classes of Service

of subscribers.

CSP - Communications Service Providers

ASR (Answer Seizure Ratio) - In Voice

telecommunications, this is a measure of

DRA - Diameter Relay Agent

network quality defined as the number of

successfully answered calls divided by the

DSC - Diameter Signalling Controller

total number of calls. Defined by ITU E.411

specifications.

Diameter - An Authentication, Authoriza-

BARG (GSMA's Billing and Accounting tion, and Accounting (AAA) protocol

Roaming Group) - This is a working group for computer and telecommunications

that manages the various standards and networks. It is the successor to the Radius

procedures for GMS billing and roaming. Protocol. In LTE networks, used to

Various regional and international BARG authenticate subscribers on networks

groups meet at various times through (home or visited).

the year.

Dongle - This is a small piece of hardware

BYOD - Bring Your Own Device that plugs into an electrical connector on a

computer and serves as an electronic key

BYON - Bring Your Own Number for a piece of software; the program will run

only when the dongle is plugged in. The term

CAPEX (Capital Expenditure) - A capital dongle was originally used to refer only

expenditure is incurred when a business to software-protection dongles; however,

spends money either to buy fixed assets or currently dongle is often used to refer to

to add to the value of an existing fixed asset any small piece of hardware that plugs into

with a useful life extending beyond the a computer.

taxable year.

228](https://image.slidesharecdn.com/sapmobileoperatorguide2013-130315232742-phpapp01/75/Mobile-Operator-Guide-2013-The-Evolution-of-Mobile-Services-Challenges-Strategies-Opportunities-230-2048.jpg)

![E.164 - The ITU standard for defining tele- GSMA (GSM Association) - An association

phone numbers. Consists of a country code of mobile operators and related companies

+ local dialing digits. All Telephone Numbers to manage standardization, deployment and

should comply with E.164. promotion of the GSM-based mobile tele-

phone system.

E-UTRAN - Evolved Universal Terrestrial

Radio Access Network - the LTE radio/air GSMA AA.19 - A GSMA document used to

interface. exchange SMS parameters and termination

fees for bi-lateral interworking.

Fallback [Capacity] - The ability for an LTE

subscriber to connect to the 3G (non-LTE) GMSA IR.21 - A GSMA document that is

infrastructure while roaming. used to define the protocols and informa-

tion regarding roaming procedures as well

Five 9s service availability - Also written as messaging parameters between mobile

as 99.999%. This is used in Service Level operators.

Agreements (SLAs) that indicate that a

service should be available 99.999% of GSMA IR.35 -A GSMA document describing

the time (or greater). End-to-End Functional Capability Test Speci-

fication for Inter-PLMN GPRS Roaming.

GNU - GNU is not Unix. A Unix-like

computer operating system developed by HPLMN (Home Public Land Mobile

the GNU Project, ultimately aiming to be Network) - A subscriber's home network

a complete Unix-compatible software in a roaming scenario.

system comp-osed wholly of free software.

HSS (Home Subscriber Servicer) - Think

GPRS (General packet radio service) - of this as a net-gen HLR (Home Location

A packet oriented mobile data service on the Register). The HSS is used in LTE networks.

2G and 3G cellular communication system's

global system for mobile communications. HSPA (High Speed Packet Access) -

A combination of two mobile packet proto-

GRX (GPRS Roaming Exchange) - A hub cols: High Speed Downlink Packet Access

for GPRS connections from roaming users, (HSDPA) and High Speed Uplink Packet

removing the need for a dedicated link Access (HSUPA) to extend and improve 3G

between each GPRS service provider. networks using the WCDMA protocols.

Some call this 3.5G (a marketing term only).

Mobile Operator Guide 2013 The Evolution of Mobile Services: Challenges, Strategies, Opportunities 229](https://image.slidesharecdn.com/sapmobileoperatorguide2013-130315232742-phpapp01/75/Mobile-Operator-Guide-2013-The-Evolution-of-Mobile-Services-Challenges-Strategies-Opportunities-231-2048.jpg)