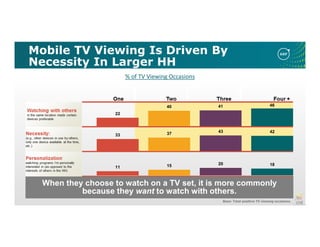

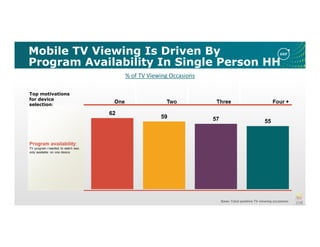

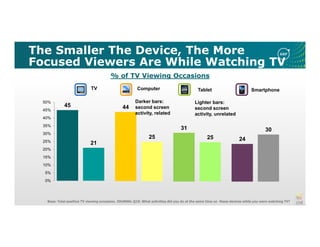

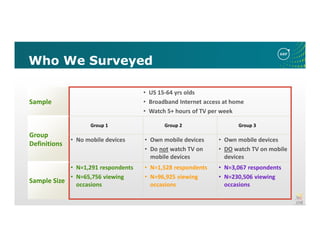

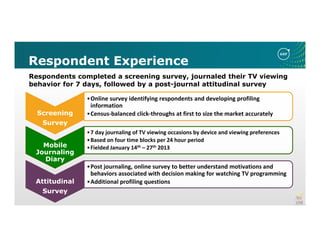

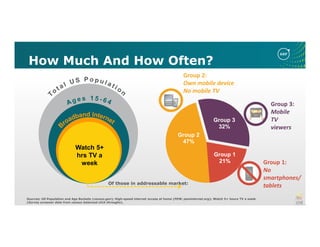

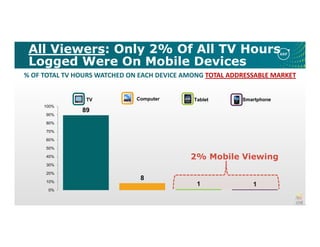

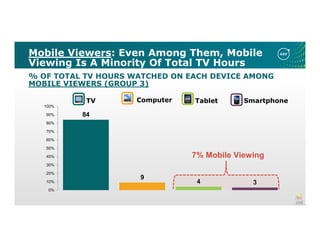

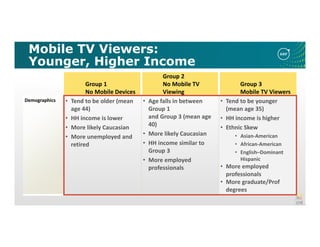

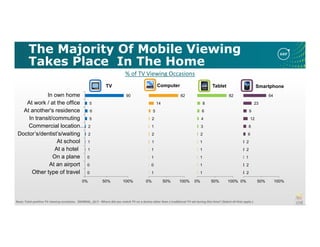

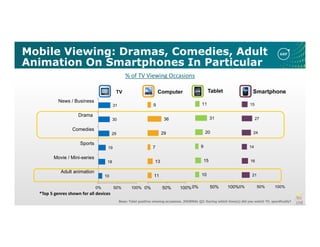

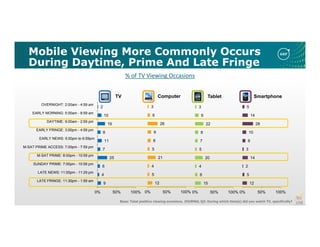

The Council for Research Excellence consists of over 35 senior-level research professionals from across the media industry seeking to advance research methodology. Its Media Consumption and Engagement Committee studied mobile video usage, surveying over 3,000 respondents who tracked over 230,000 mobile viewing occasions. The study found that while mobile viewing is increasing, the majority of TV watching still occurs on traditional TV sets, and that convenience is the primary driver of mobile viewing.

![Most Mobile Viewing Is

Through Online Services

Base: Total positive viewing occasions. JOURNAL Q6/Q8/Q10/Q12/Q14: What was the source of TV shows or movies that you watched on a [DEVICE] during this time? All data is within Group 3.

% of TV Viewing Occasions

8

4

3

2

16

10

26

64

0% 50% 100%

Smartphone

17

3

17

6

24

49

0% 50% 100%

Computer

3

3

4

4

10

11

26

54

0% 50% 100%

Tablet

3

12

4

27

80

0% 50% 100%

DVD of TV series

TV program: online source

Unofficial app or website

On demand (TV/website/app)

DVR

iTunes or similar service

TV aggregator site - free

TV service provider site/app

Broadcast/cable net site, free

Online subscription service

Live

TV](https://image.slidesharecdn.com/tvuntethered-measuringtheshiftingscreen-130605135858-phpapp02/85/TV-Untethered-Measuring-the-Shifting-Screen-16-320.jpg)

![Convenience And Multi-Episode

Availability Drive Mobile Viewing

Base: Those who watched on device other than TV set (Group 3 Mobile Viewers). QADQ10: Why did you choose to watch television programming on a [DEVICE] instead of on a TV set?

.

Ad avoidance is not a primary motivator](https://image.slidesharecdn.com/tvuntethered-measuringtheshiftingscreen-130605135858-phpapp02/85/TV-Untethered-Measuring-the-Shifting-Screen-19-320.jpg)