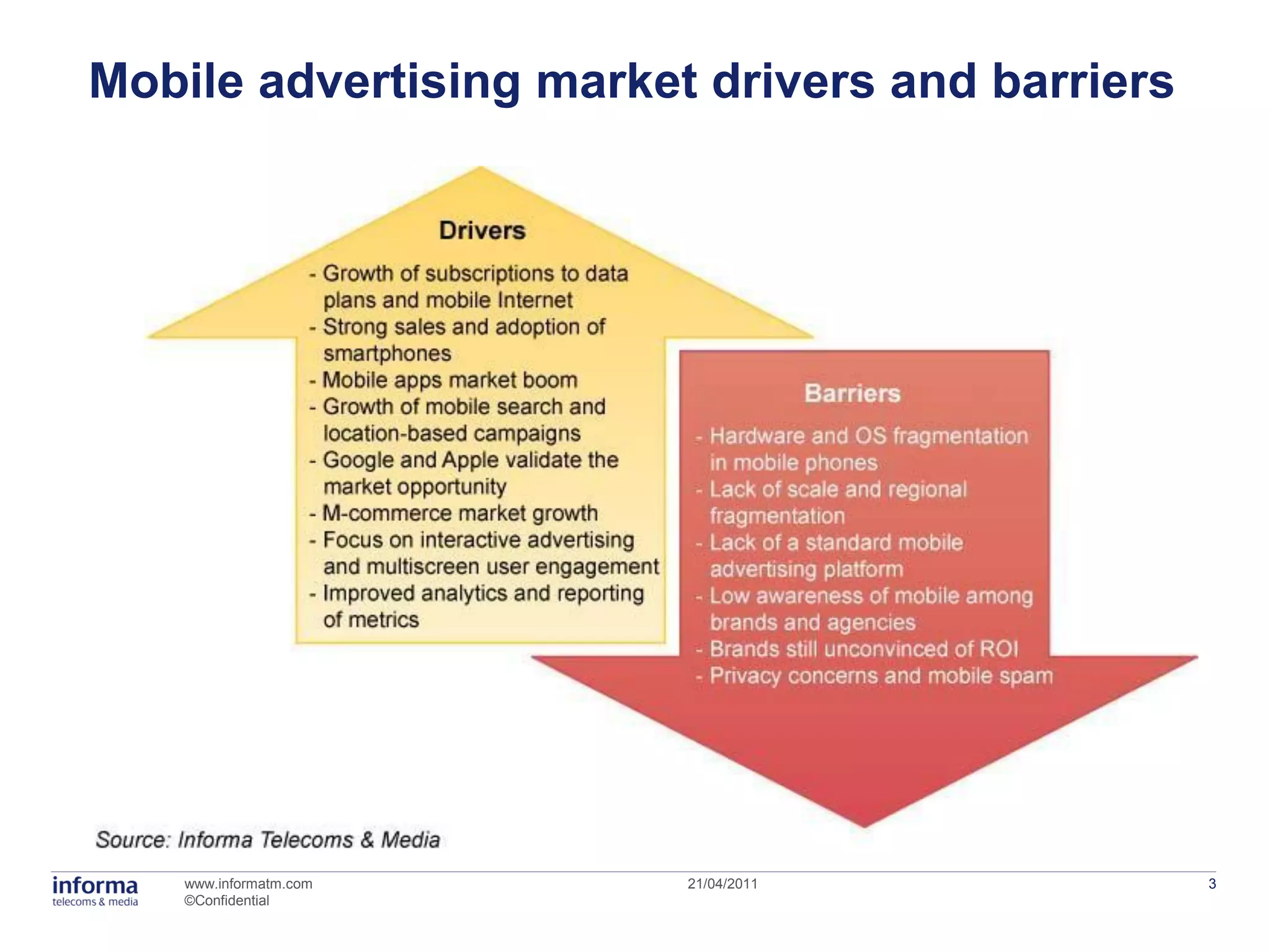

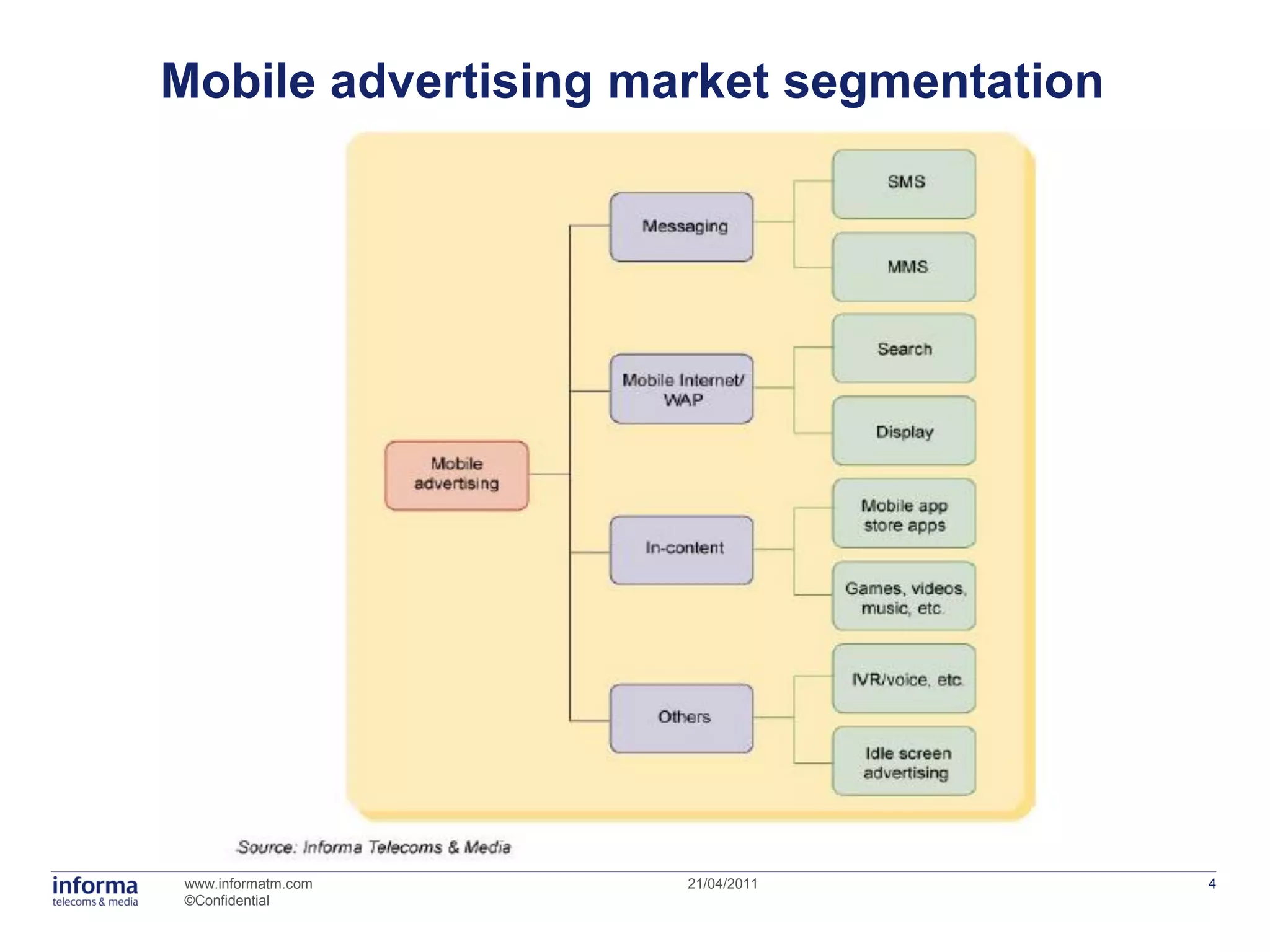

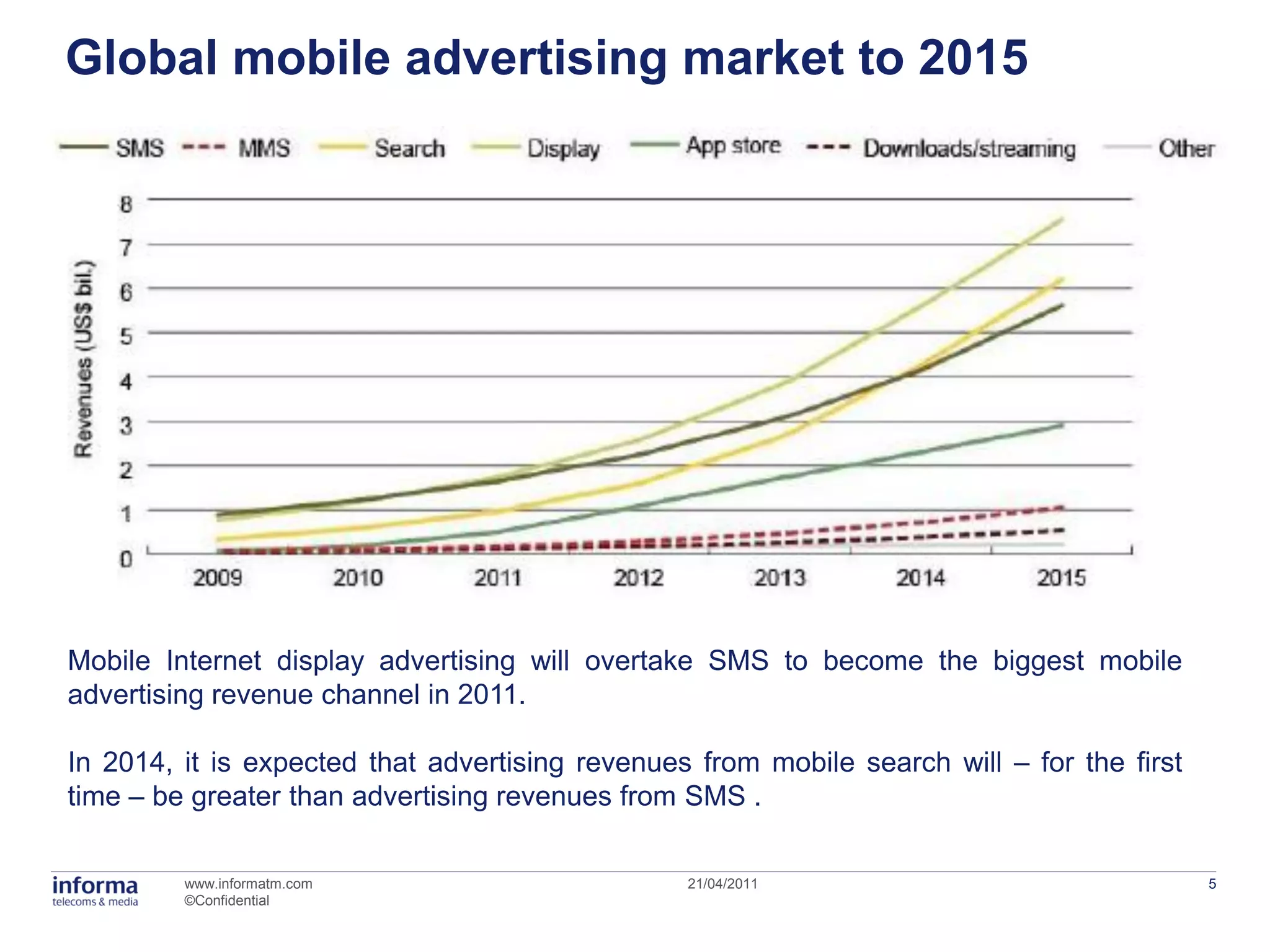

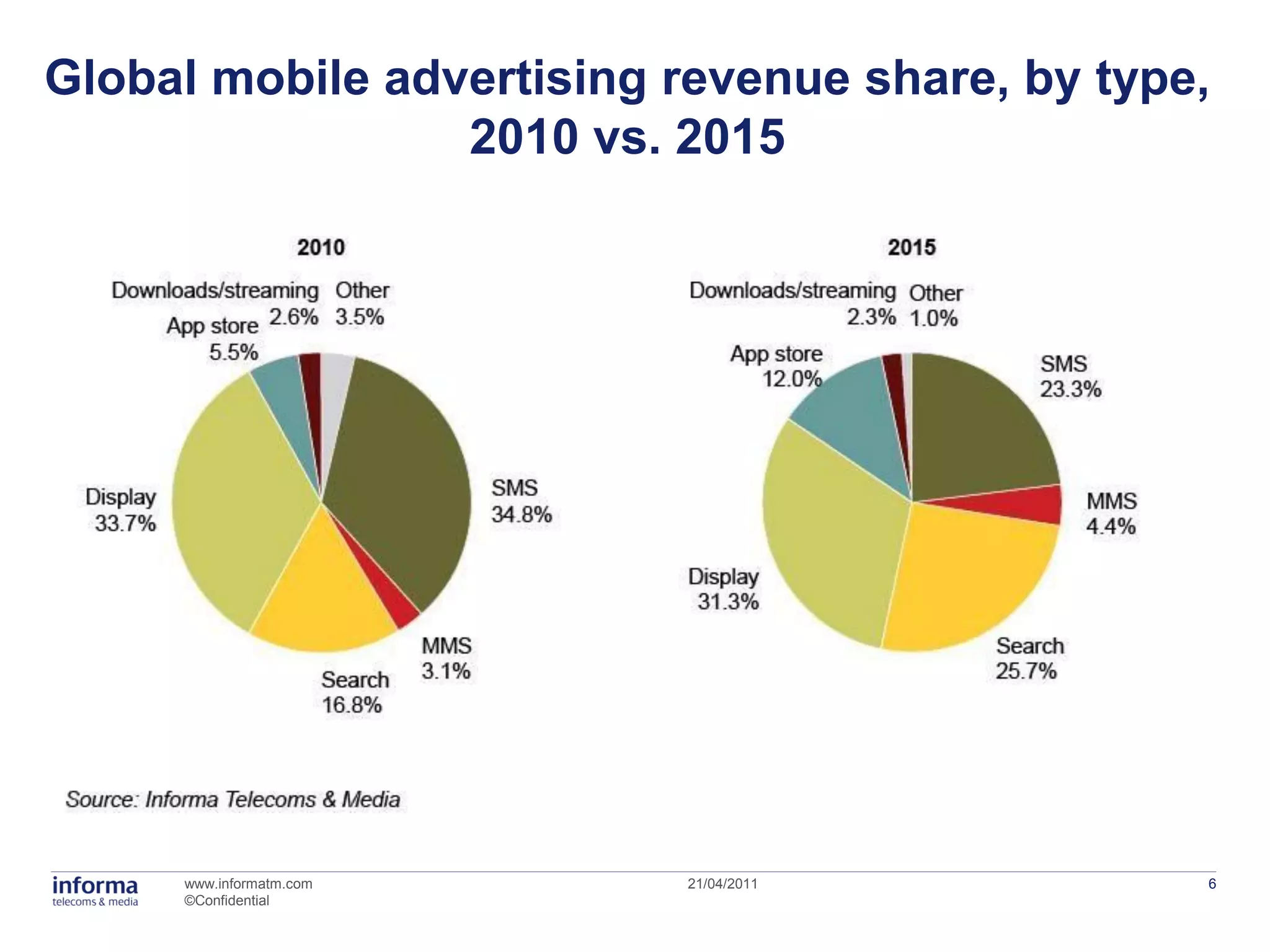

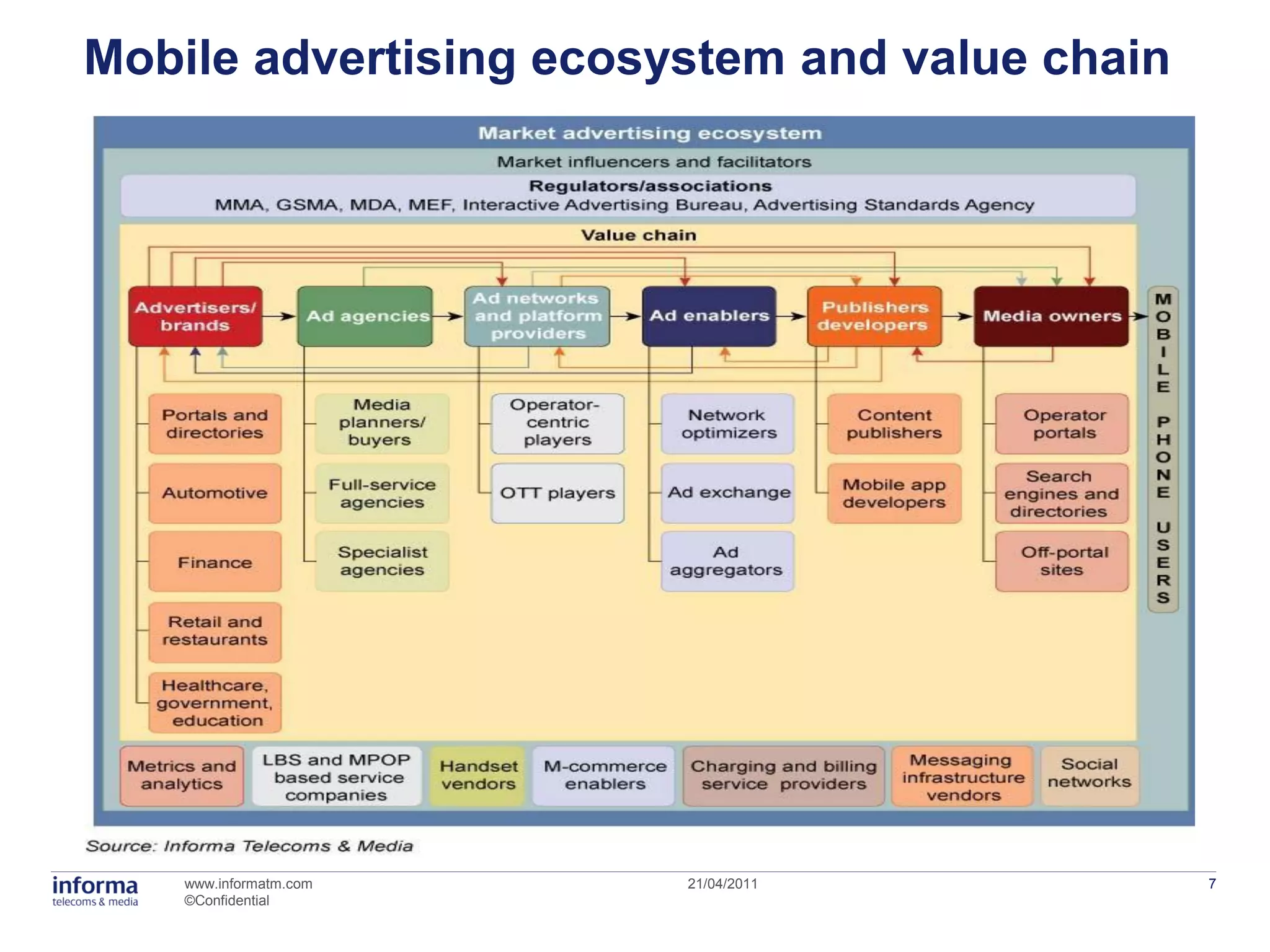

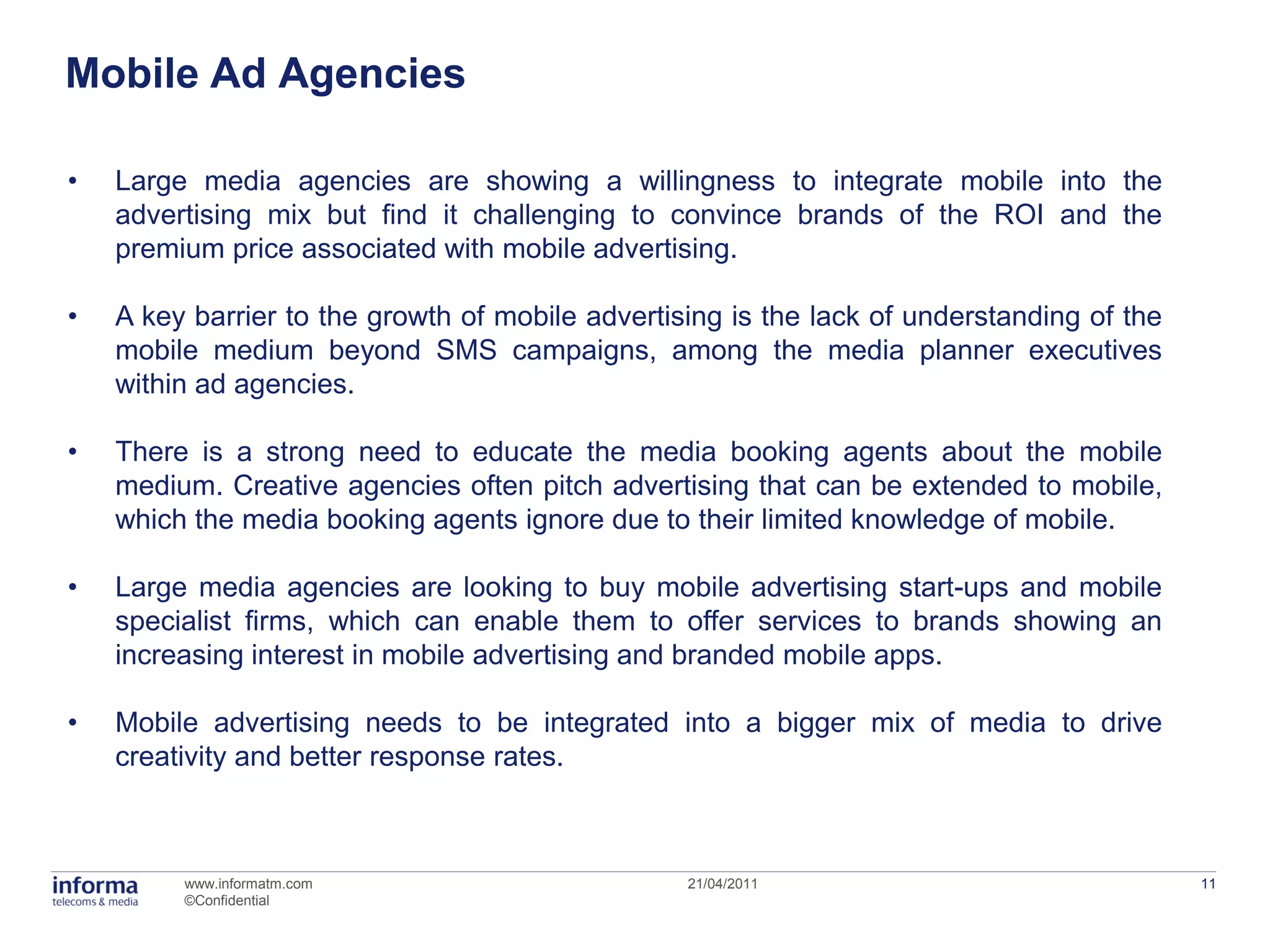

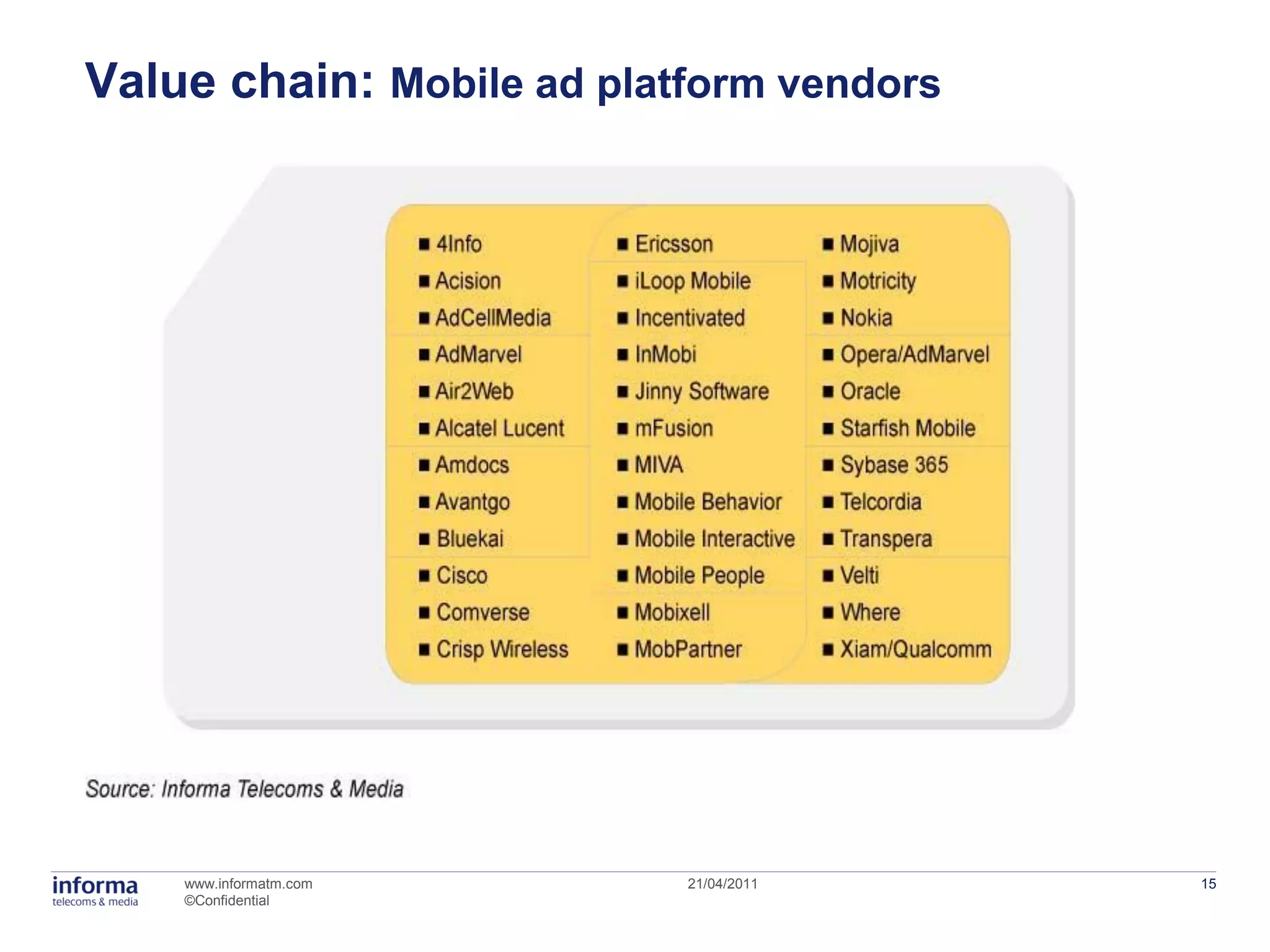

The document discusses the mobile advertising market. It notes that the market has moved past trials to significant spending by brands on regular campaigns. While fragmentation and lack of standards remain challenges, growth in mobile search and commerce are driving the market. The document provides an overview of market segments and key players in the mobile advertising ecosystem and value chain. It recommends that messaging will see continued strong growth due to its suitability for mass campaigns, but that display advertising will overtake SMS spending in many markets by 2011-2012.