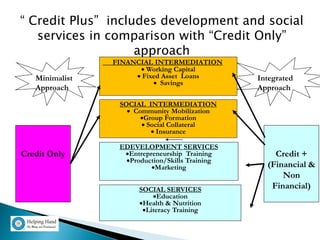

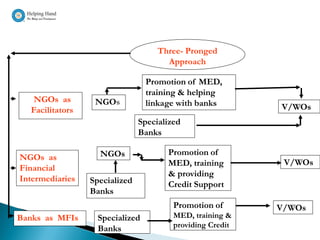

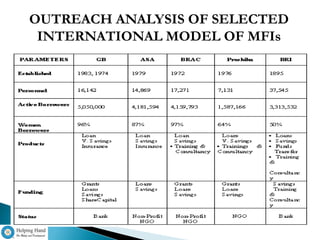

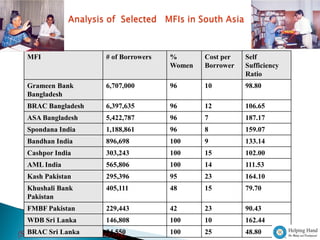

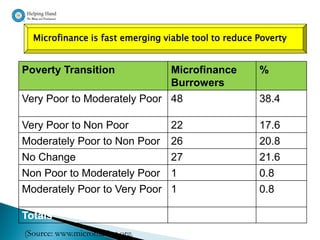

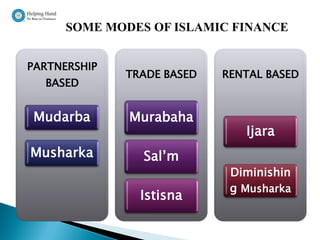

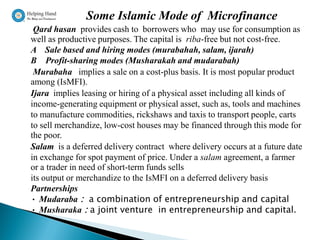

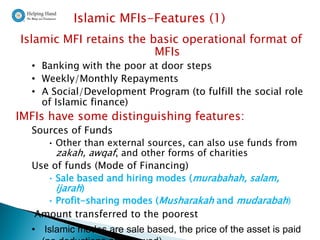

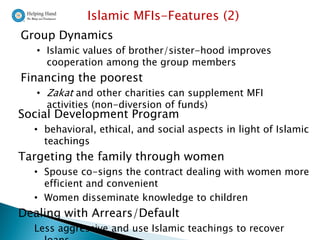

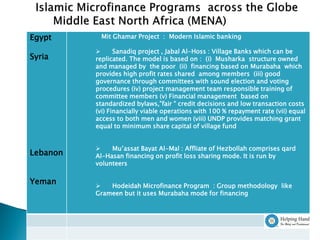

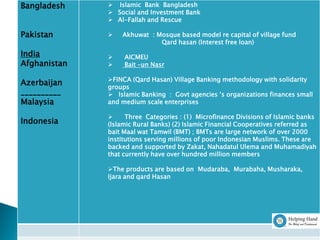

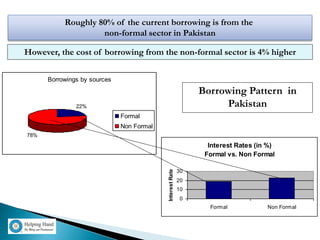

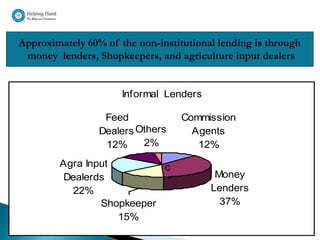

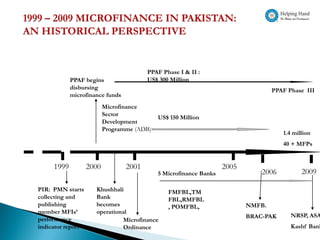

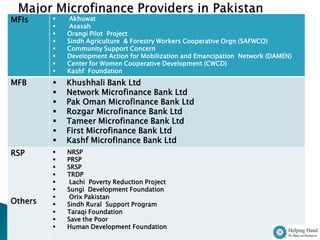

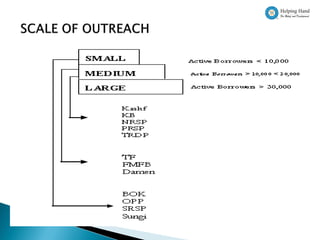

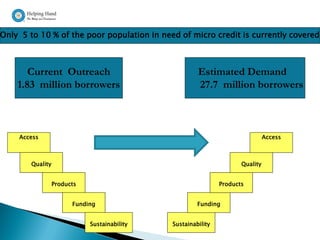

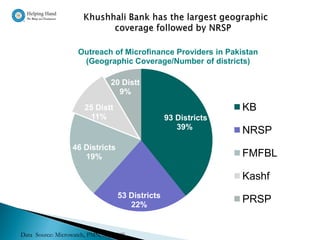

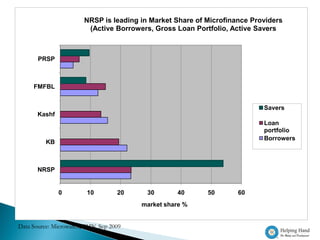

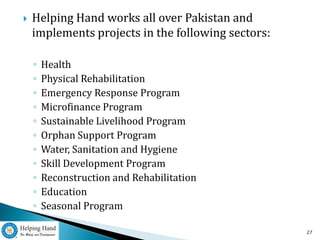

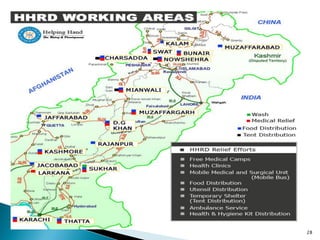

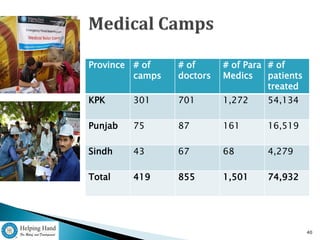

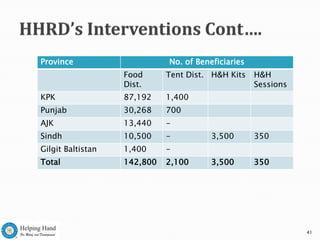

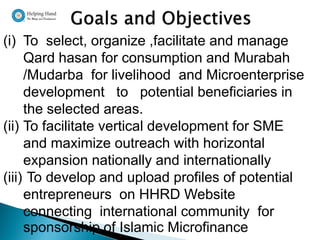

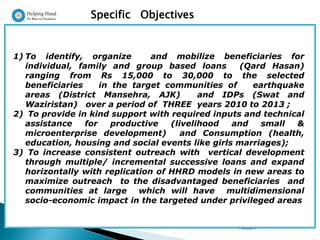

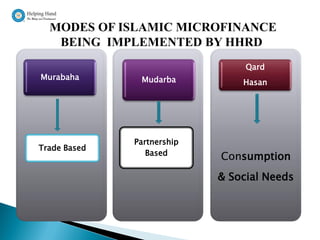

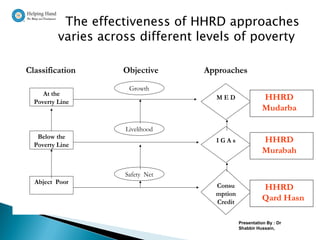

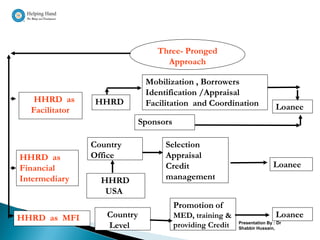

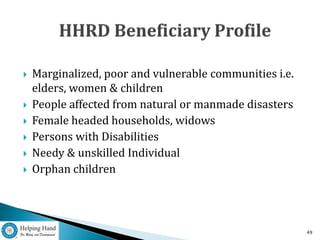

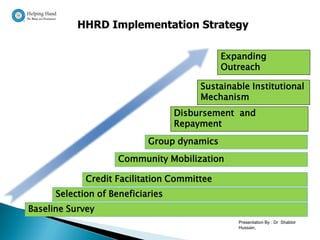

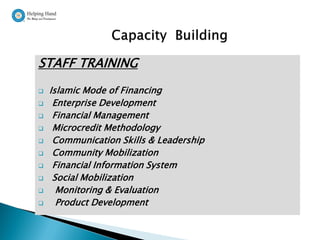

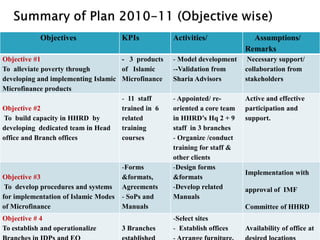

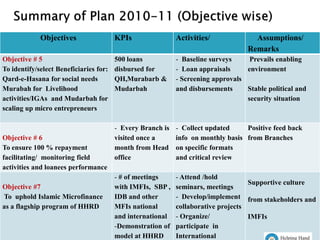

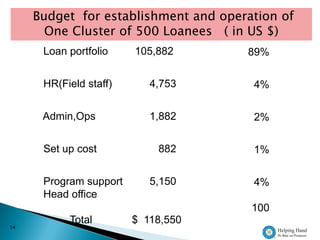

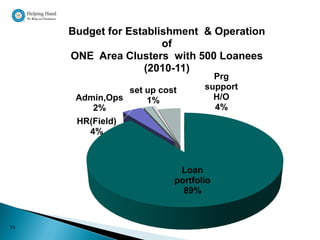

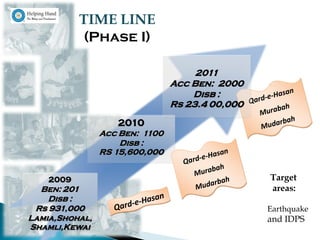

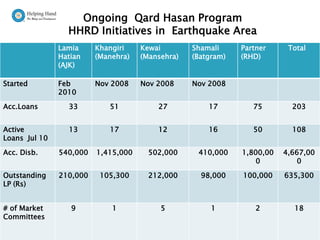

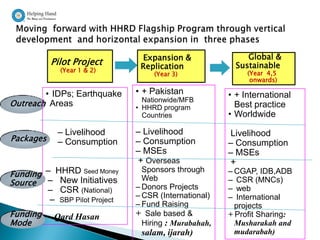

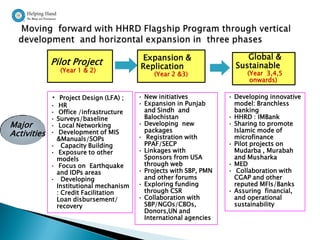

The document provides a comprehensive analysis of microfinance models, highlighting the distinction between 'credit plus' and 'credit only' approaches, along with an overview of Islamic microfinance methods. It examines outreach analysis details from various microfinance institutions (MFIs) in countries like Bangladesh and Pakistan, showcasing the percentage of women borrowers and cost-effectiveness of different models. Furthermore, it outlines the operational strategies of Helping Hand Relief and Development (HHRD) in implementing Islamic microfinance programs aimed at poverty alleviation and community support.