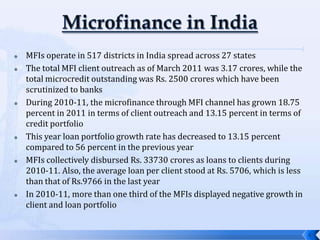

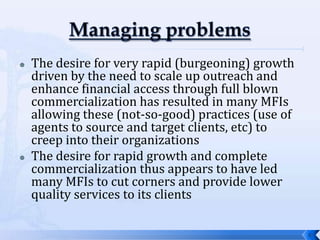

The document is a presentation on microfinance in India. It discusses the definition of microfinance and provides statistics on microfinance initiatives in India, including the number of districts and clients served. It also notes trends in loan amounts and growth rates. The presentation outlines some of the key issues and challenges faced by microfinance institutions, such as rapid growth and commercialization leading to lower quality services. It concludes by recommending strategies for microfinance institutions to manage risks and maintain proper systems.