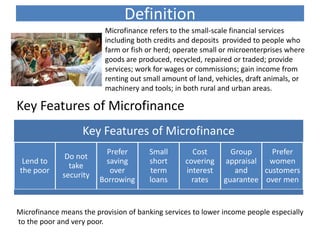

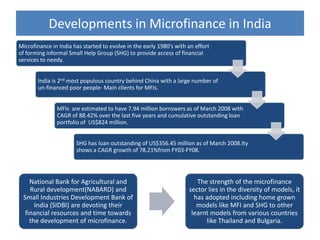

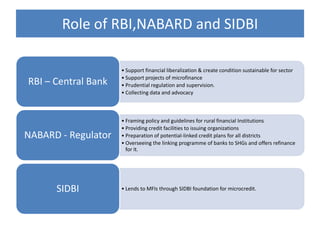

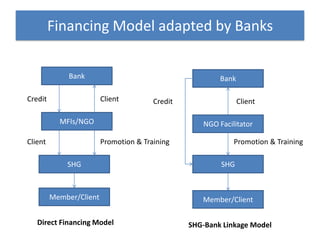

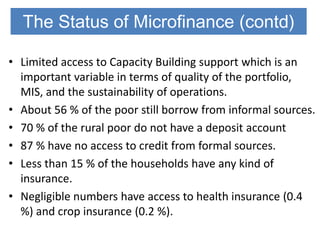

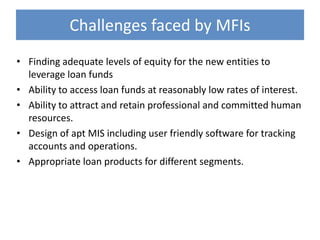

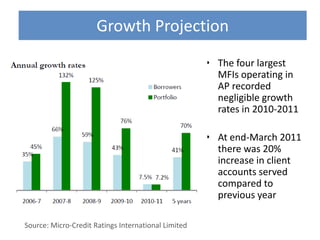

The document provides an overview of the microfinance sector in India. It defines microfinance and discusses the key features and models used, including self-help groups (SHGs) and SHG-bank linkage models. It outlines the case for microfinance in India given high poverty levels. It also discusses the various actors involved like MFIs, banks, NABARD, SIDBI and regulations like the Microfinance Institutions Bill. It notes that while microfinance has grown, there is still a large unmet demand and challenges remain around access to funding, human resources and over-indebtedness.