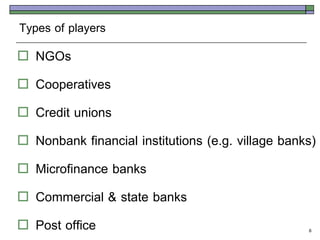

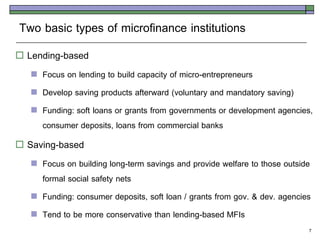

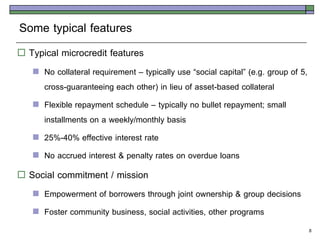

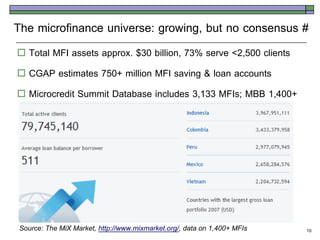

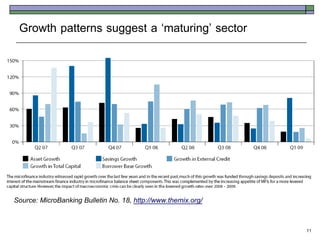

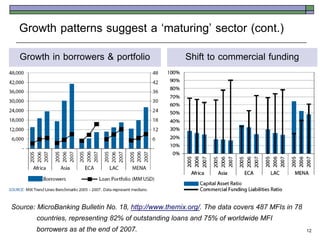

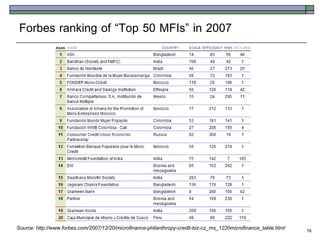

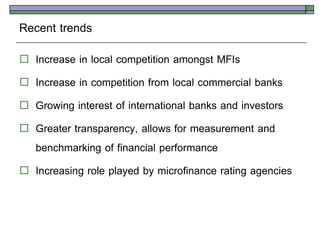

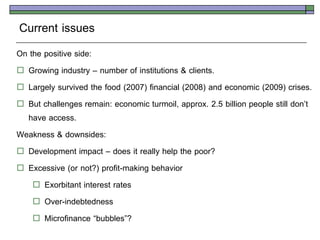

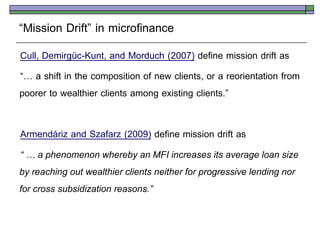

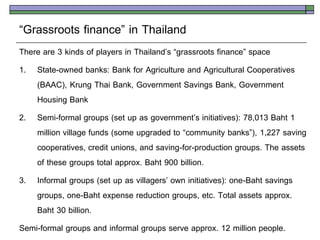

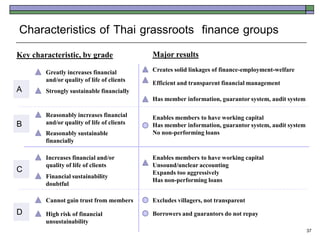

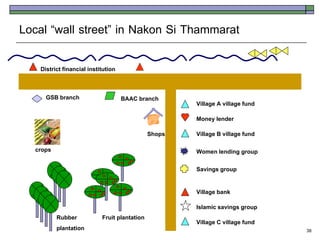

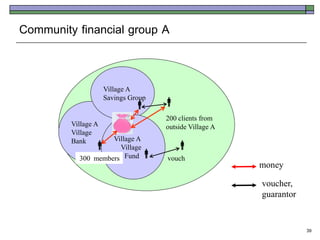

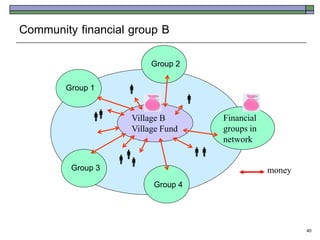

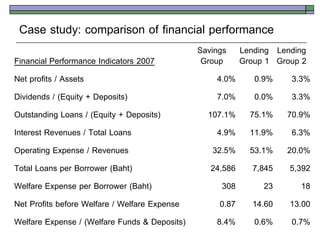

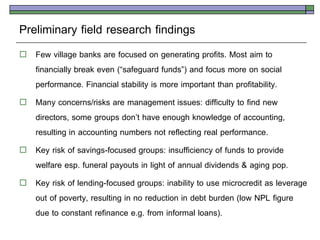

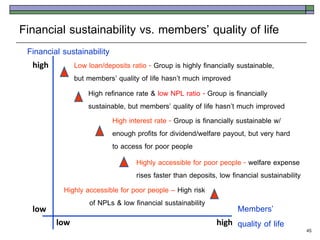

The document discusses the concept of microfinance, its models, and its effectiveness in supporting the poor, particularly in Thailand, emphasizing the diversity of institutions and the ongoing debate about their impact. It highlights key aspects such as the roles of different types of microfinance institutions, the importance of financial sustainability, and the challenges faced including governance, profit motives, and the actual benefits to clients. Preliminary findings indicate that many grassroots finance groups prioritize social missions over profitability, but face risks related to financial management and the efficacy of microcredit in improving clients' living standards.