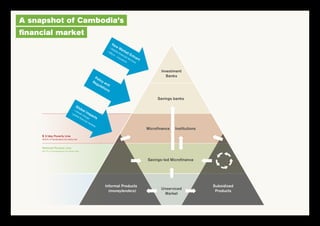

This document summarizes a prospectus for investing in Savings-Led Microfinance in Cambodia. Savings-Led Microfinance forms community savings groups that allow members to save money and take small loans. The program aims to reach 1 million Cambodians and transform the financial market. It argues that this approach empowers the poor, builds social capital, and generates economic growth through financial inclusion and capital accumulation by the poor. The document invites impact investors by highlighting both financial and social returns on investment in Savings-Led Microfinance.