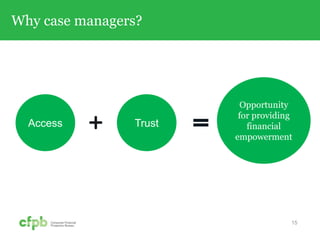

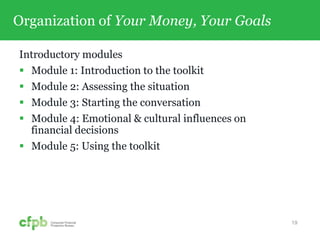

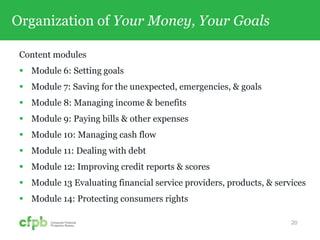

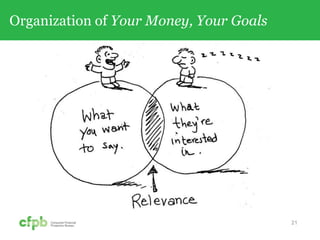

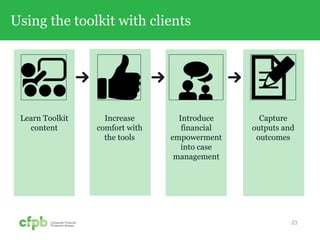

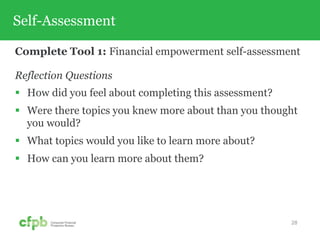

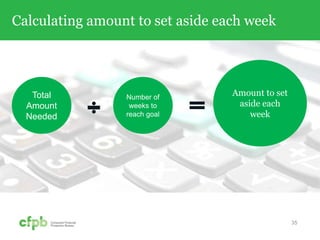

The 'Your Money, Your Goals' toolkit is designed to empower social service program staff to help clients improve their financial situations through various training modules covering topics such as debt management, credit understanding, and goal setting. The toolkit emphasizes connecting financial empowerment with client outcomes, assessing financial conditions, and providing appropriate referrals. The training, presented by local non-profits in collaboration with the Consumer Financial Protection Bureau, aims to enhance the confidence and knowledge of case managers in offering financial guidance to diverse populations.