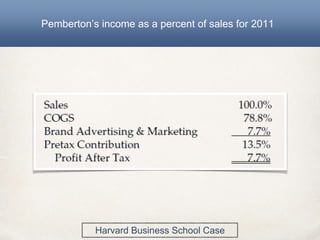

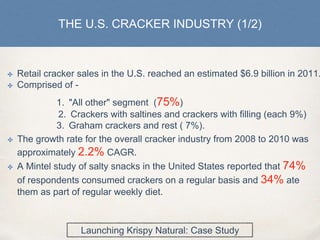

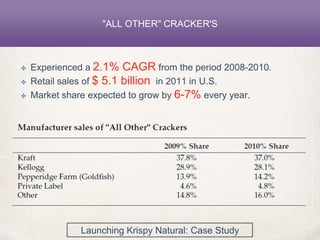

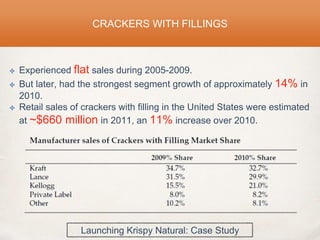

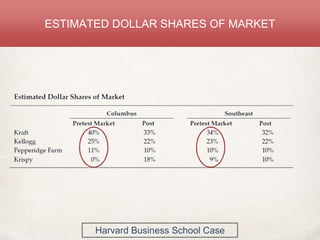

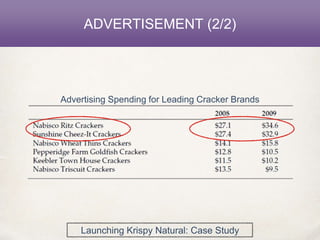

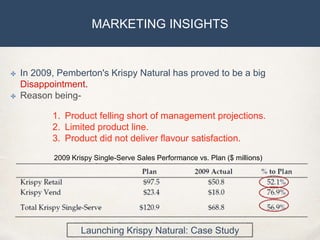

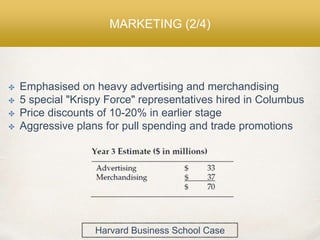

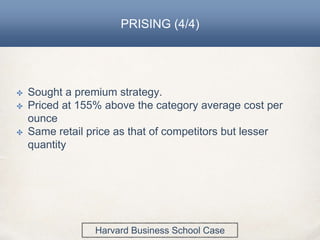

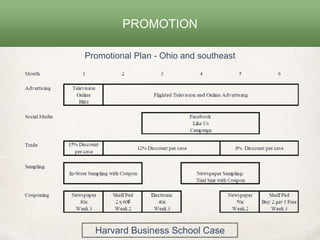

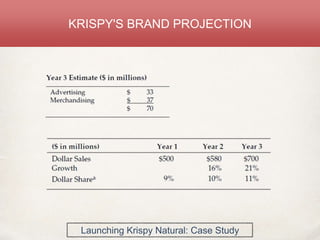

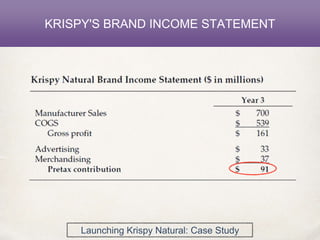

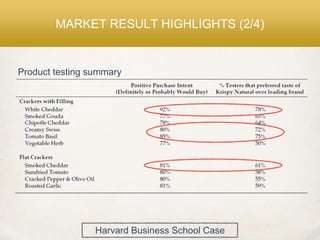

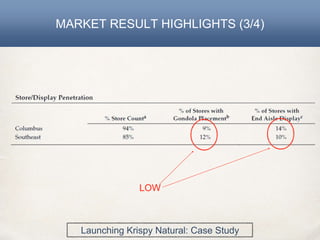

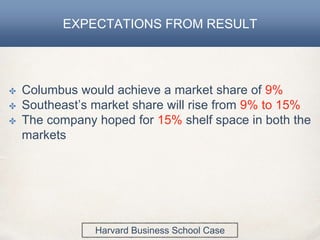

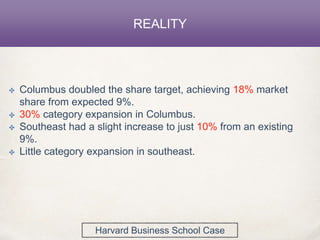

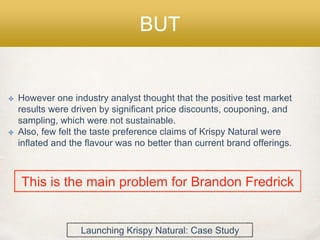

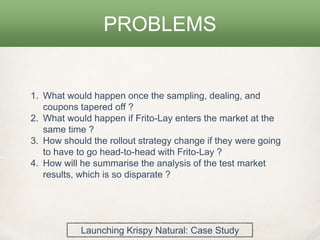

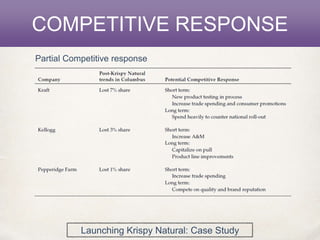

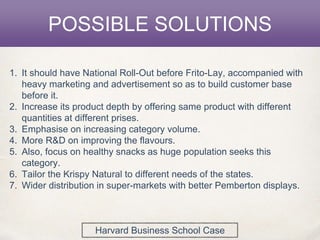

Krispy Natural is a new salty snack launched by Pemberton in 2009. Market tests in Columbus, Ohio showed double the expected market share gains, but results in the Southeast fell below targets. The U.S. cracker market is large and growing, led by Kraft, Kellogg and Pepperfridge Farm. Pemberton plans to expand distribution and emphasize improved flavors, health attributes, and aggressive promotional activities for the national rollout. However, analysts question whether initial positive results relied too heavily on promotions and sampling. The marketing director faces challenges in explaining varying test market outcomes and competing nationally against expected new entries like Frito-Lay crackers.