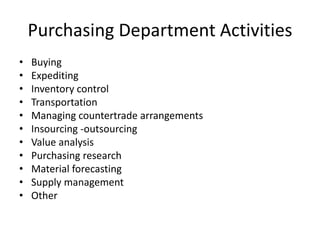

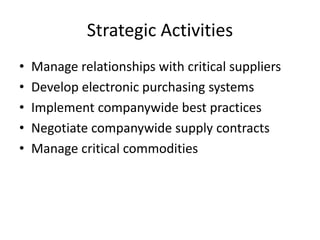

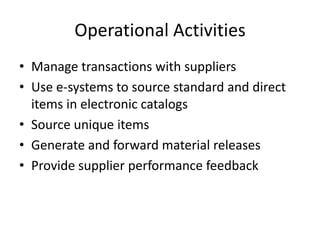

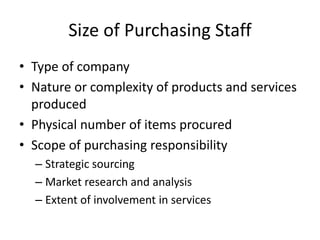

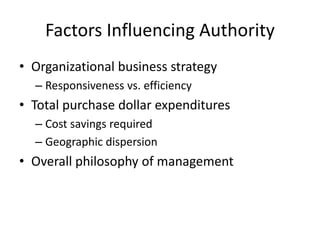

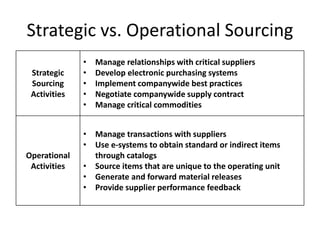

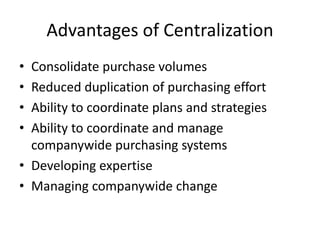

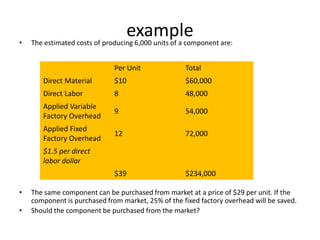

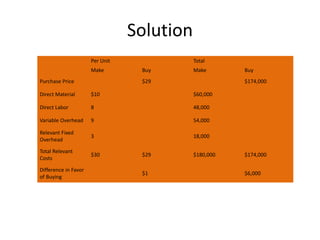

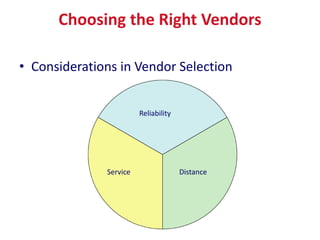

This document discusses key concepts in purchase management. It covers factors to consider when organizing the purchasing function such as specialization within roles. Strategic sourcing activities include managing critical suppliers while operational activities focus on transactions. The advantages of centralized and decentralized purchasing models are outlined. Make-or-buy and insourcing-outsourcing decisions require analyzing both qualitative and quantitative factors to minimize costs. Getting the best price involves contacting multiple vendors and leveraging discounts.