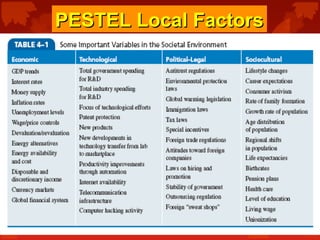

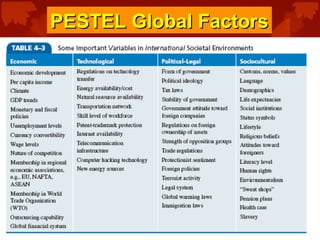

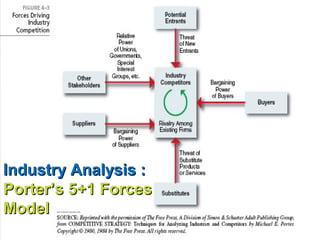

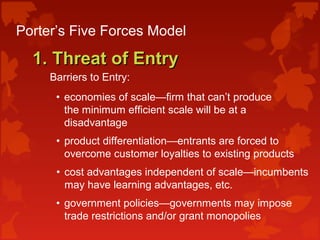

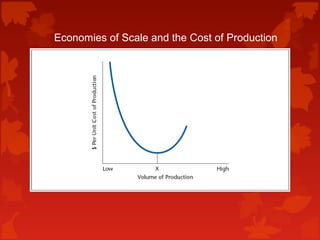

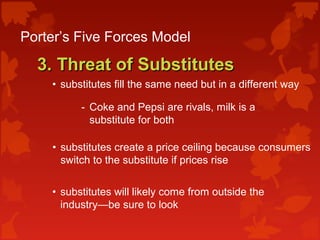

This document provides an overview of methods for assessing the external business environment, including PESTEL analysis and Porter's Five Forces model. It discusses using these tools to discover threats and opportunities, understand industry competition, and make informed strategic choices. Porter's Five Forces model analyzes five competitive forces that shape industry competition: the threat of new entrants, power of suppliers and buyers, threat of substitutes, and industry rivalry. It also discusses a sixth force of complementors. The document provides examples and outlines factors that influence the competitive forces.