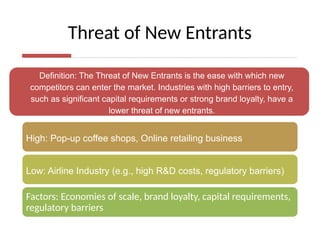

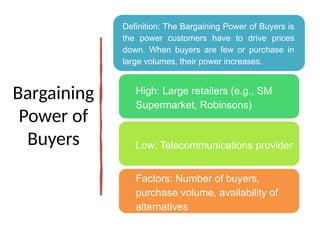

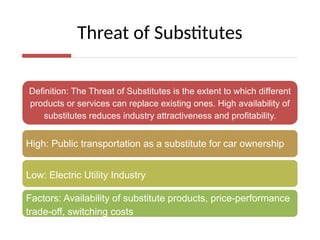

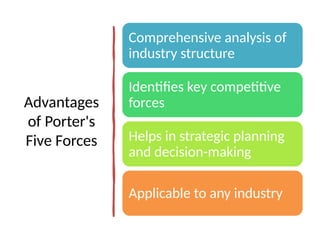

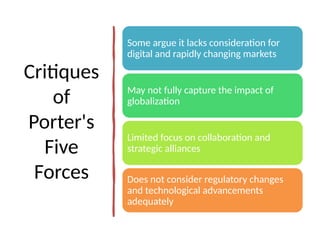

Porter's Five Forces is a framework developed by Michael E. Porter that analyzes the competitive forces within an industry to determine its attractiveness and inform strategic decisions. The model identifies five key forces: competitive rivalry, threat of new entrants, bargaining power of suppliers, bargaining power of buyers, and threat of substitutes, each affecting industry profitability and dynamics. While it provides valuable insights for strategic planning, it has limitations, such as oversimplification of complex industries and lack of consideration for rapid market changes.