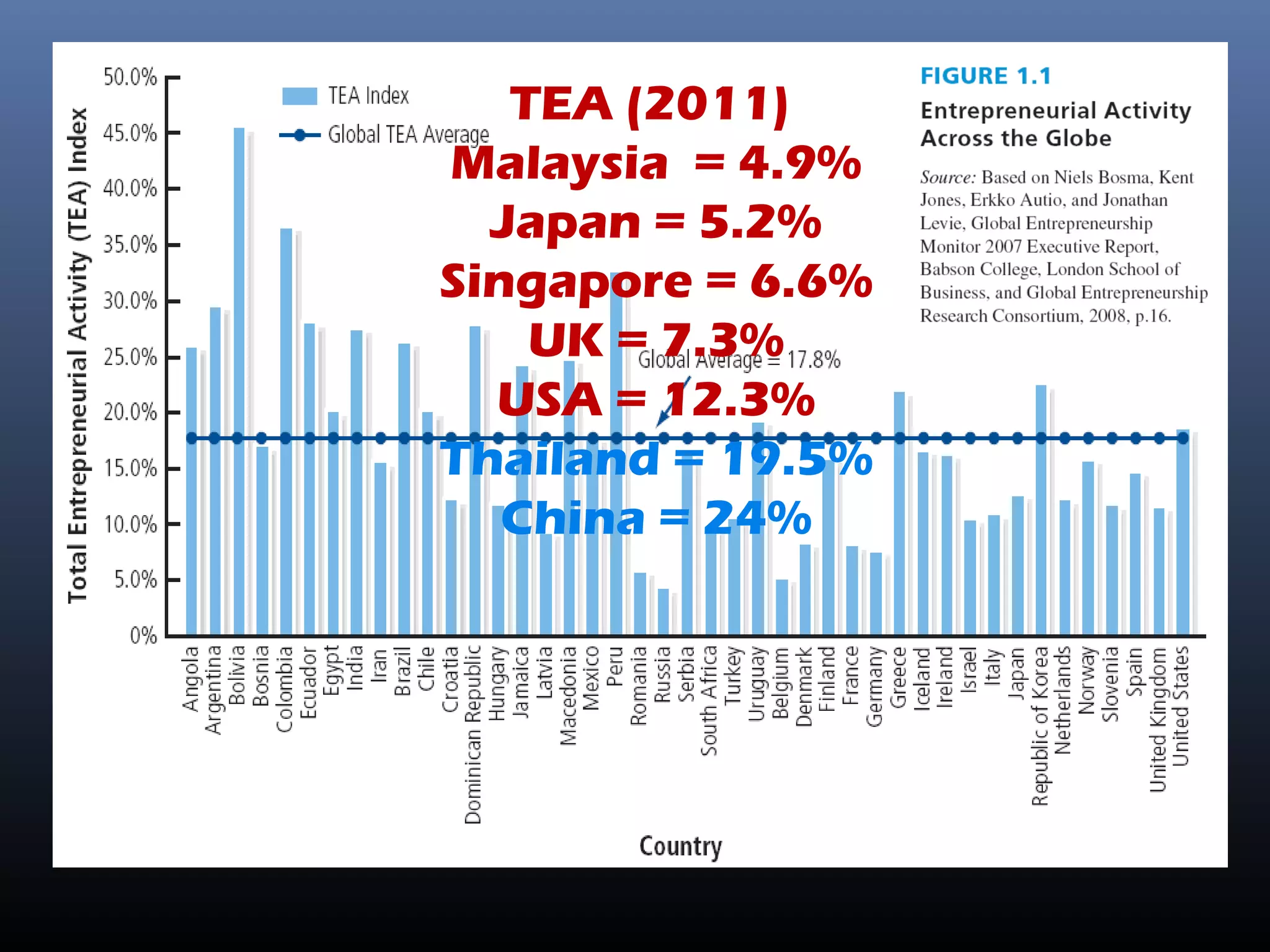

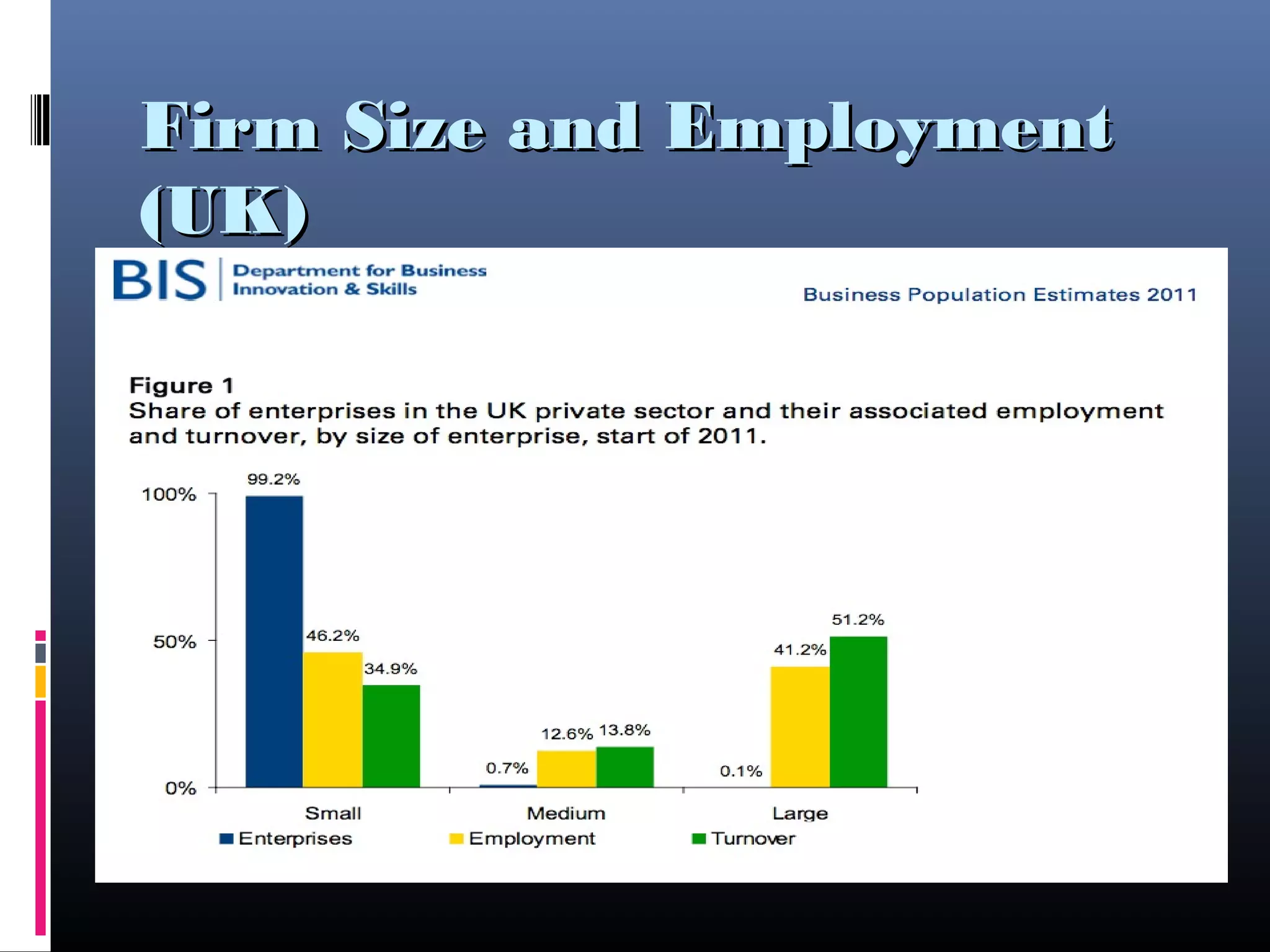

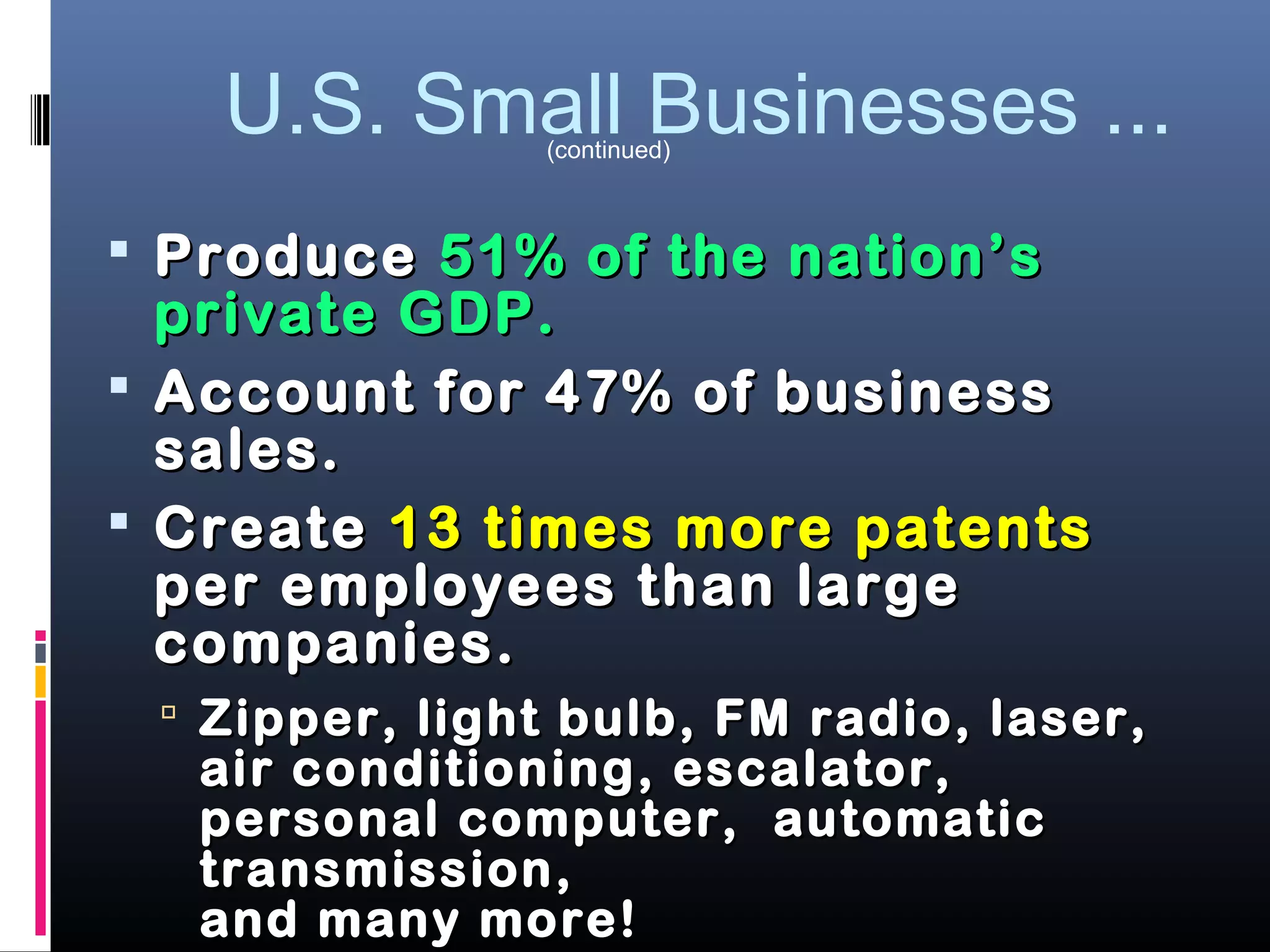

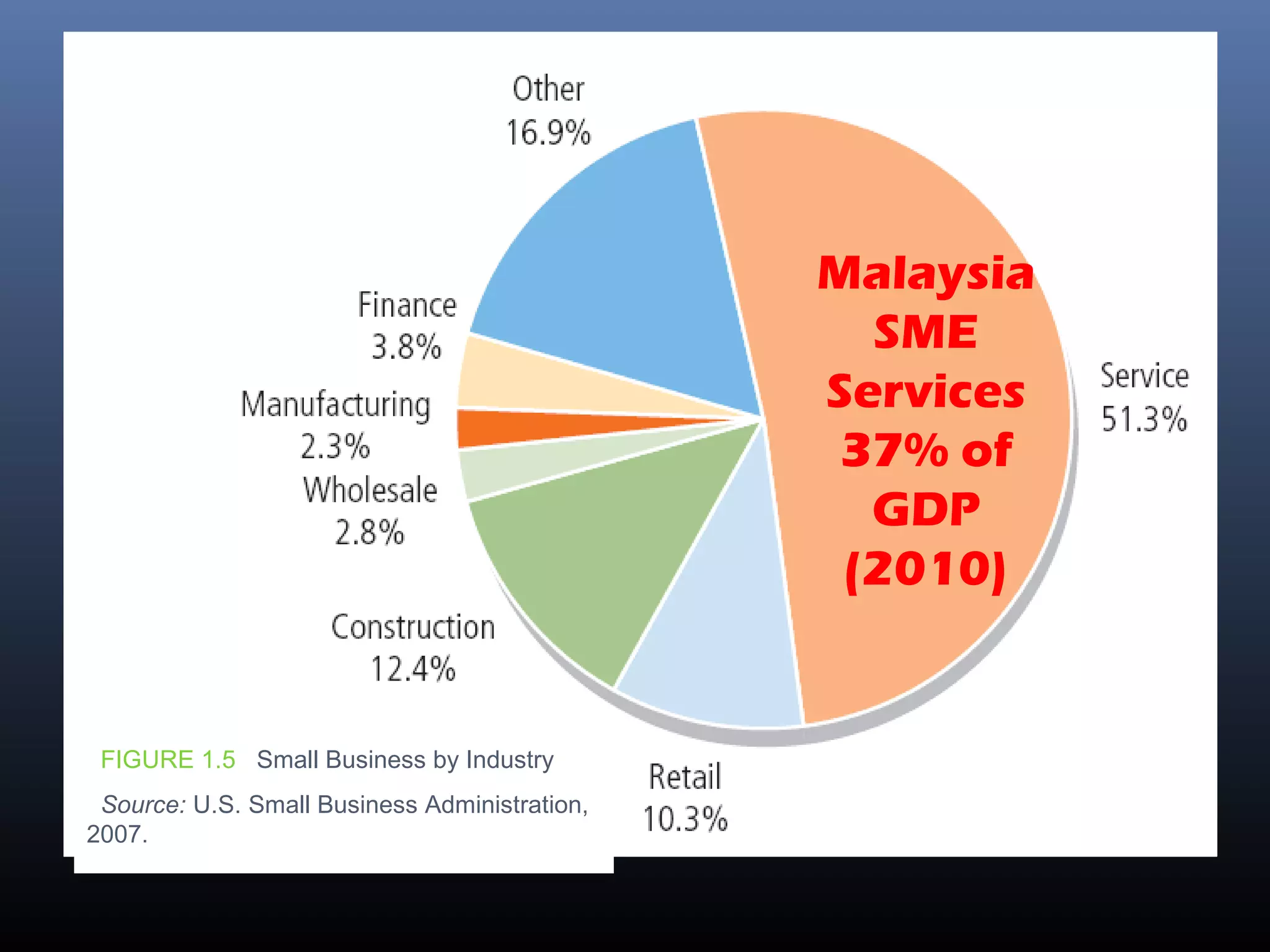

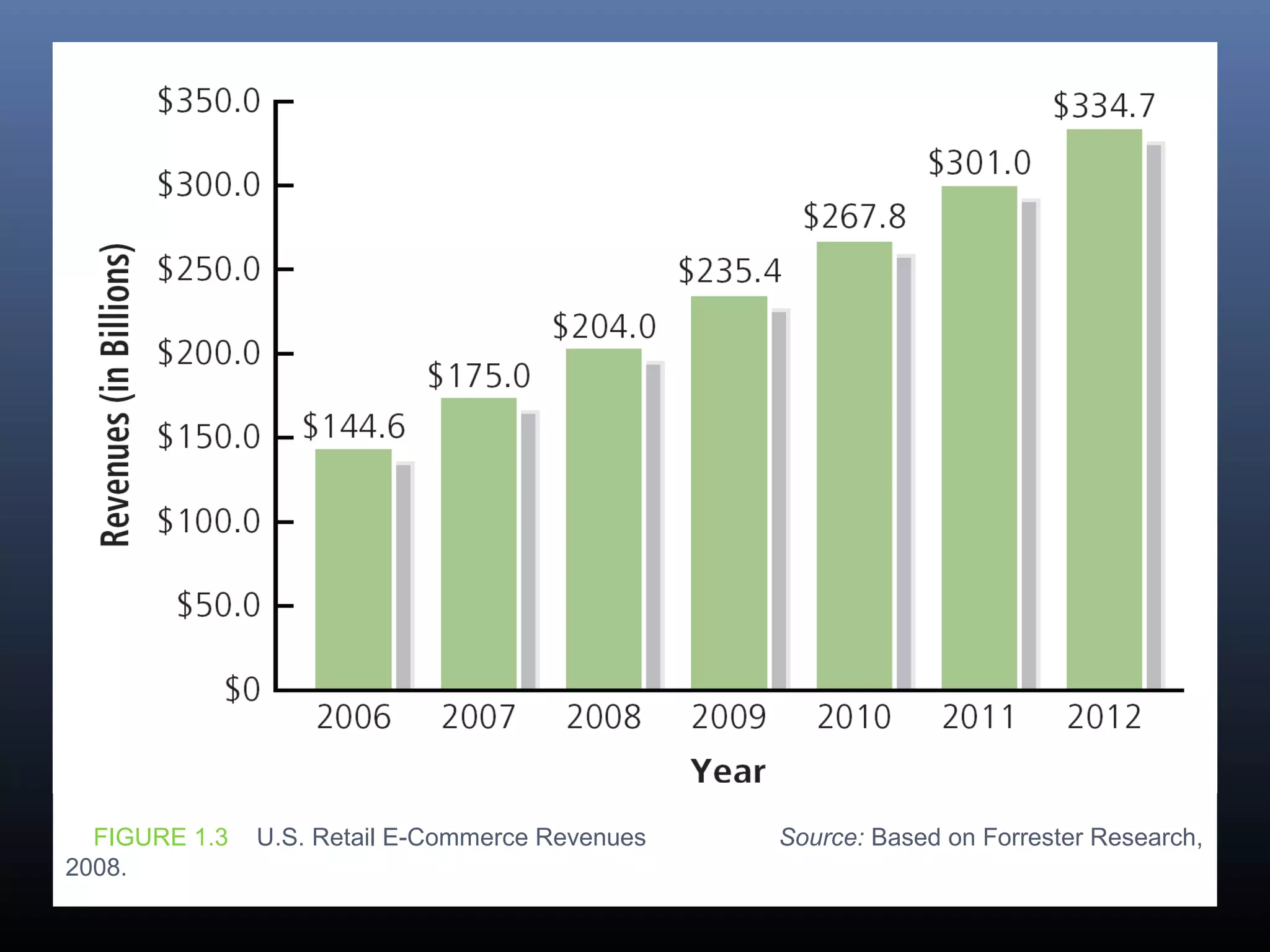

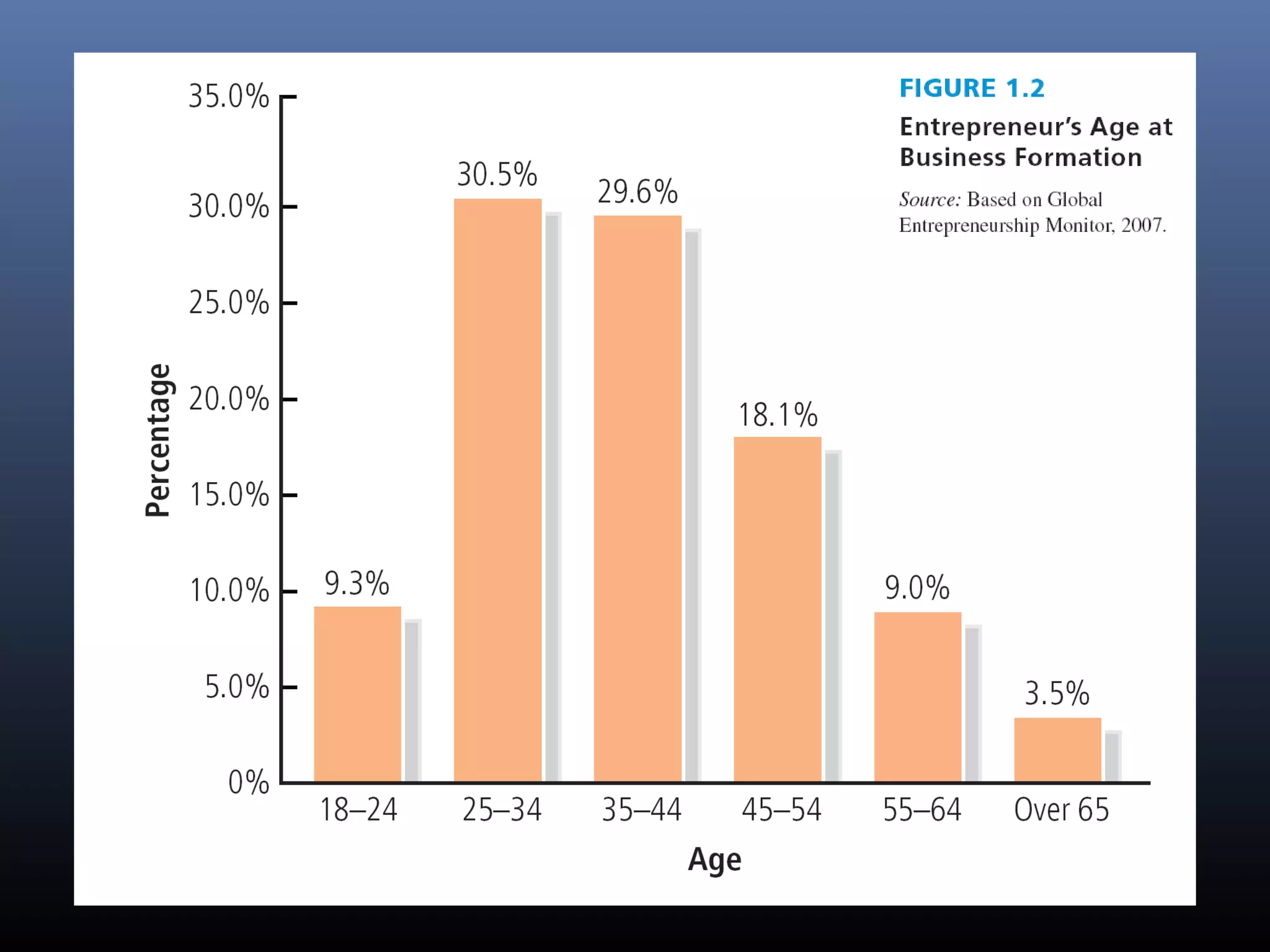

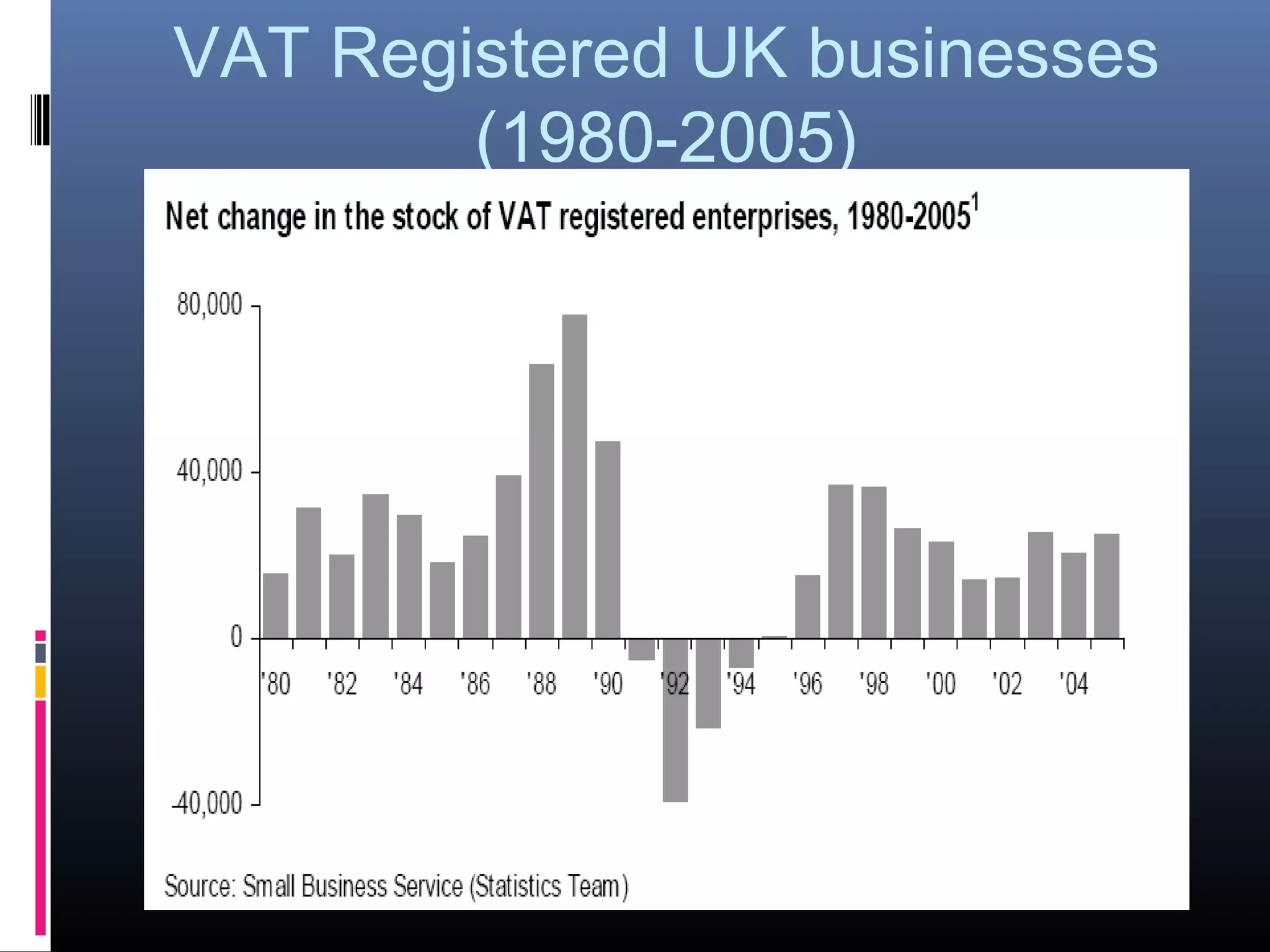

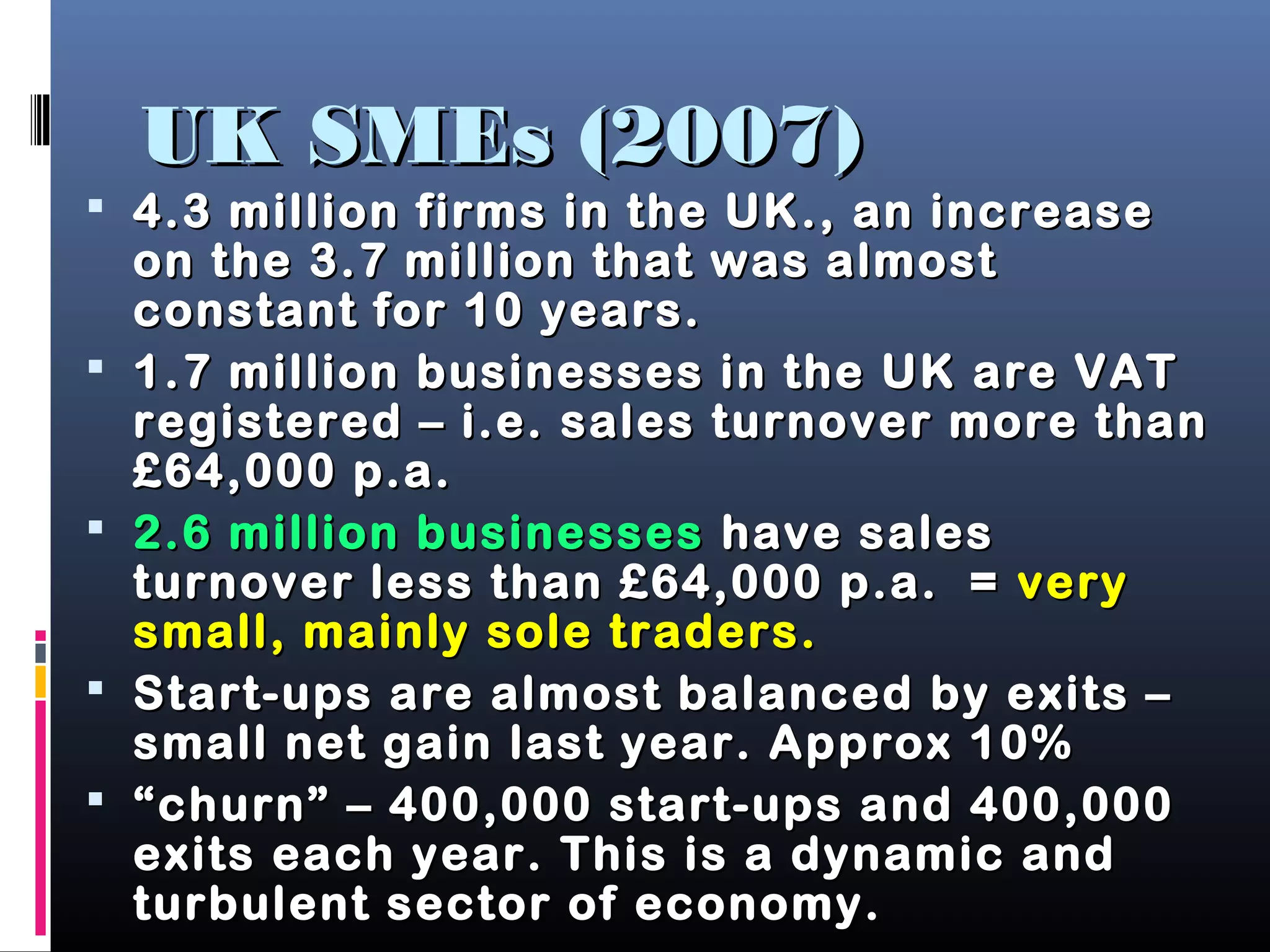

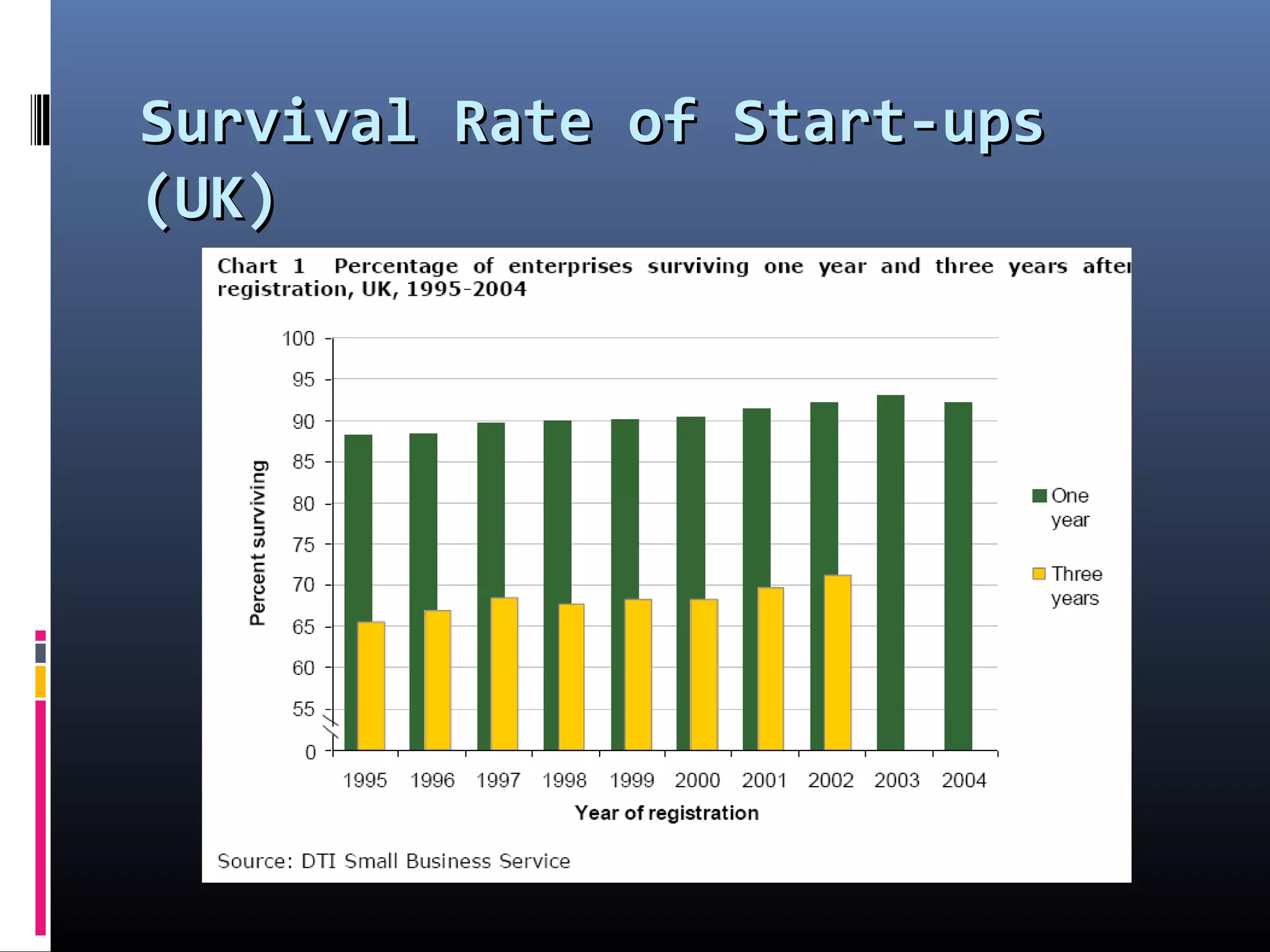

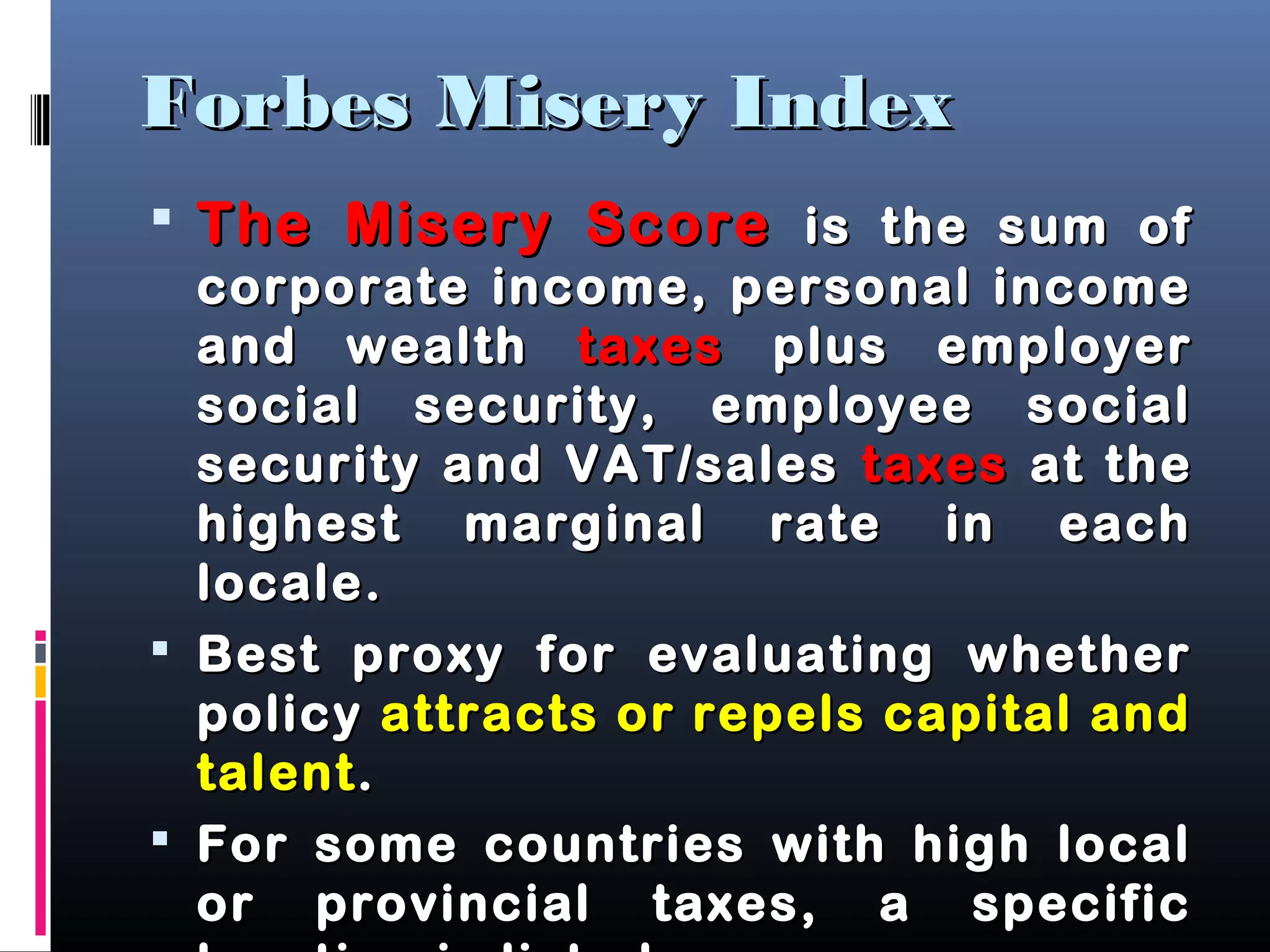

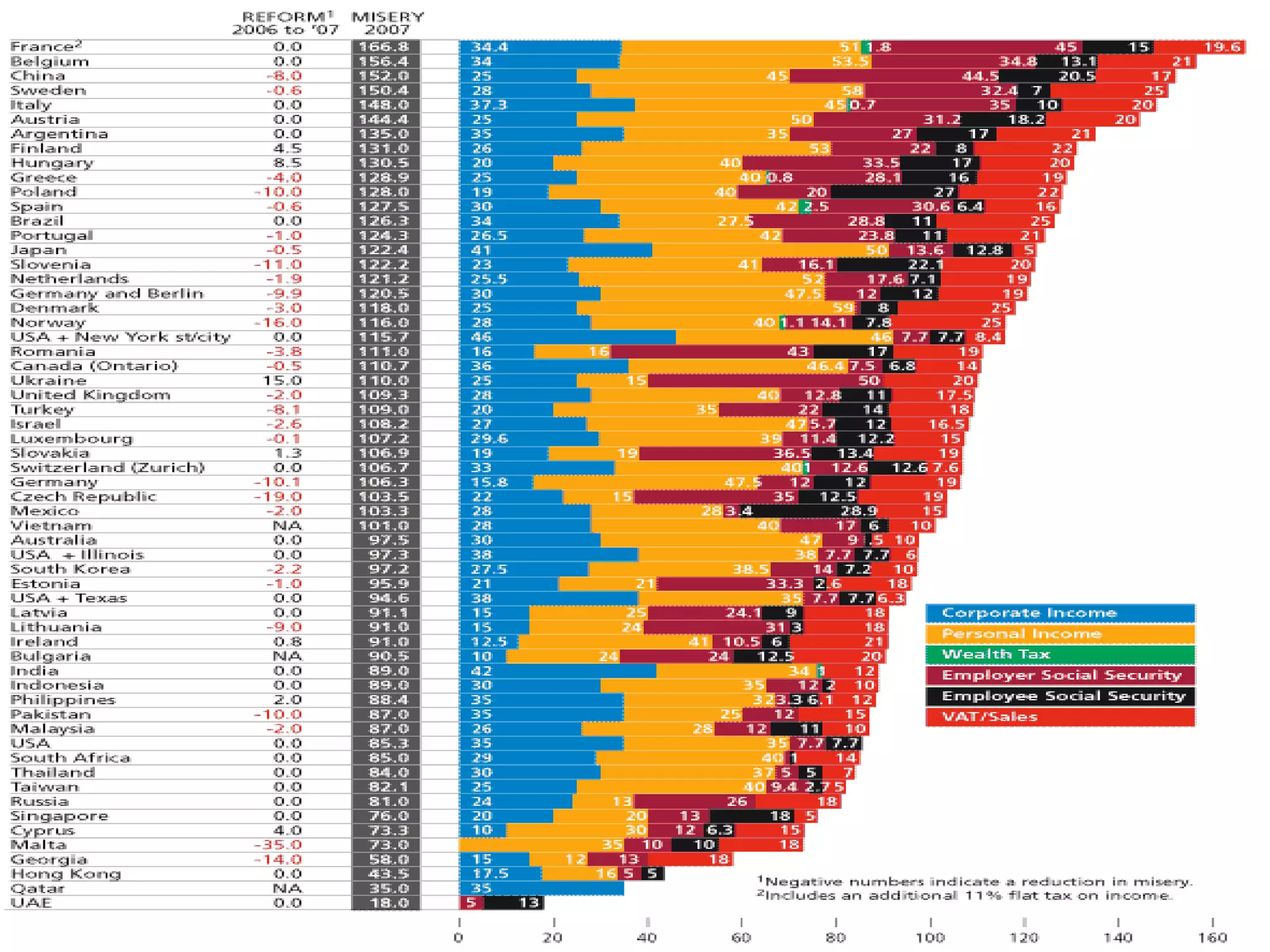

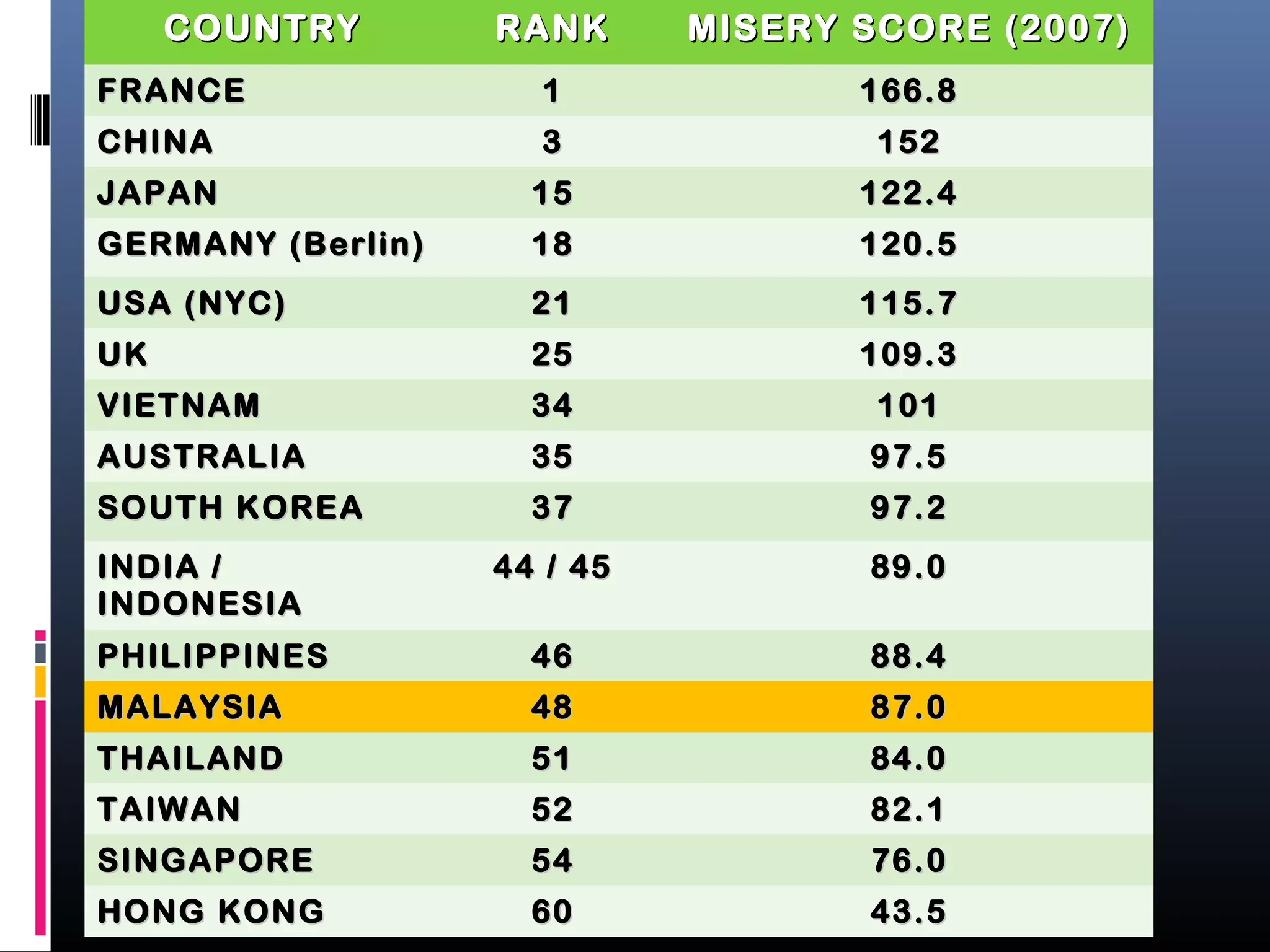

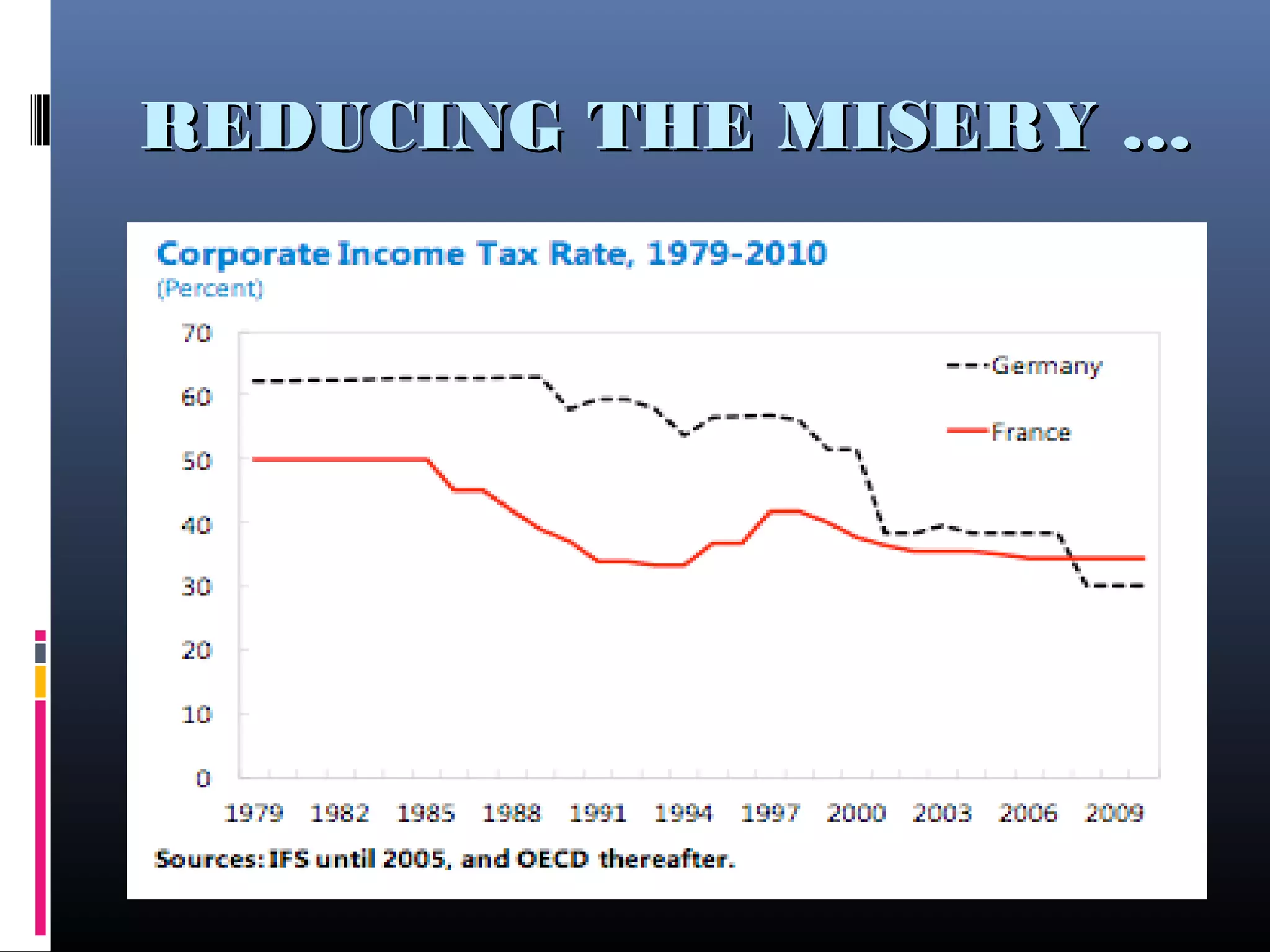

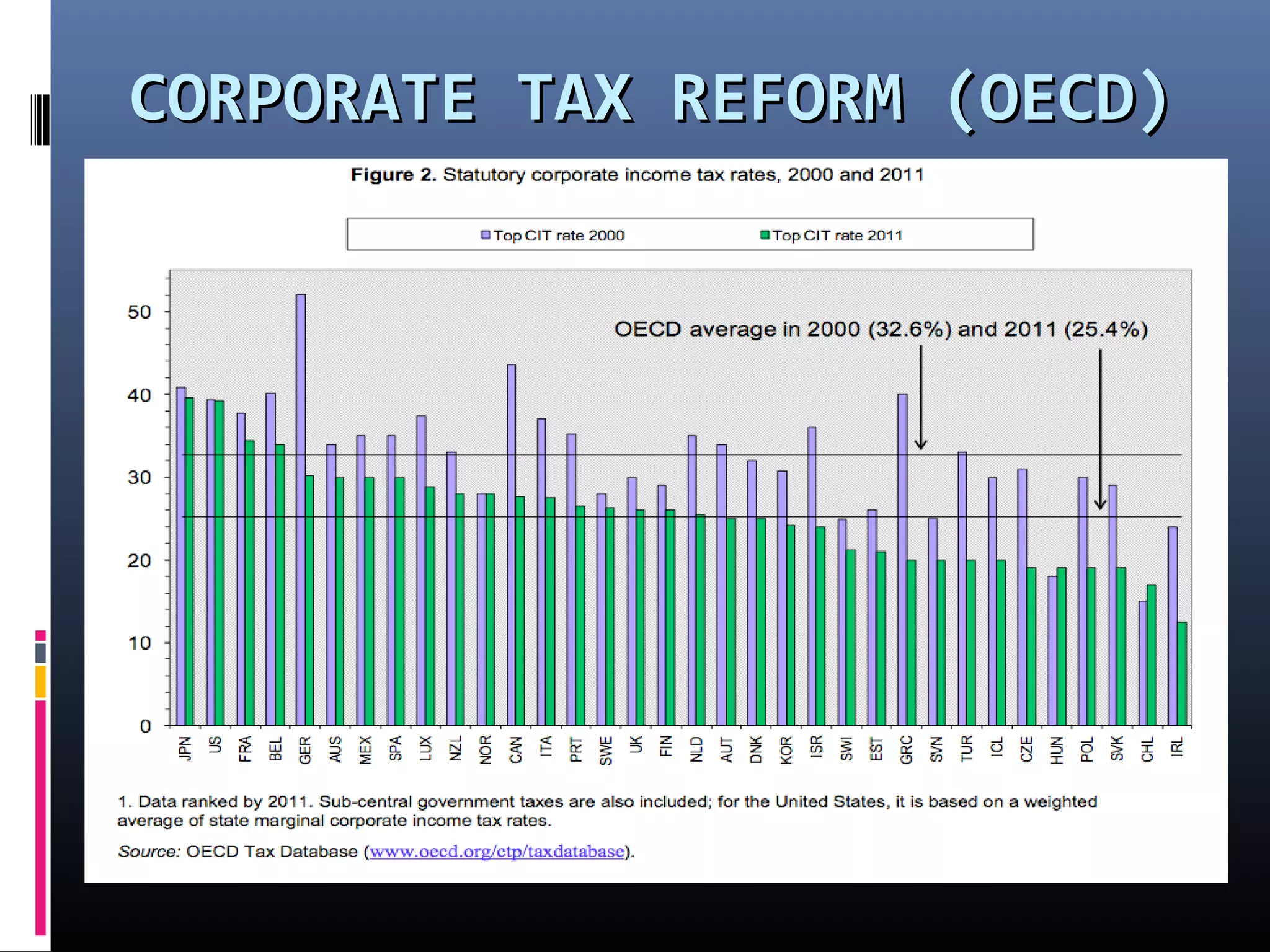

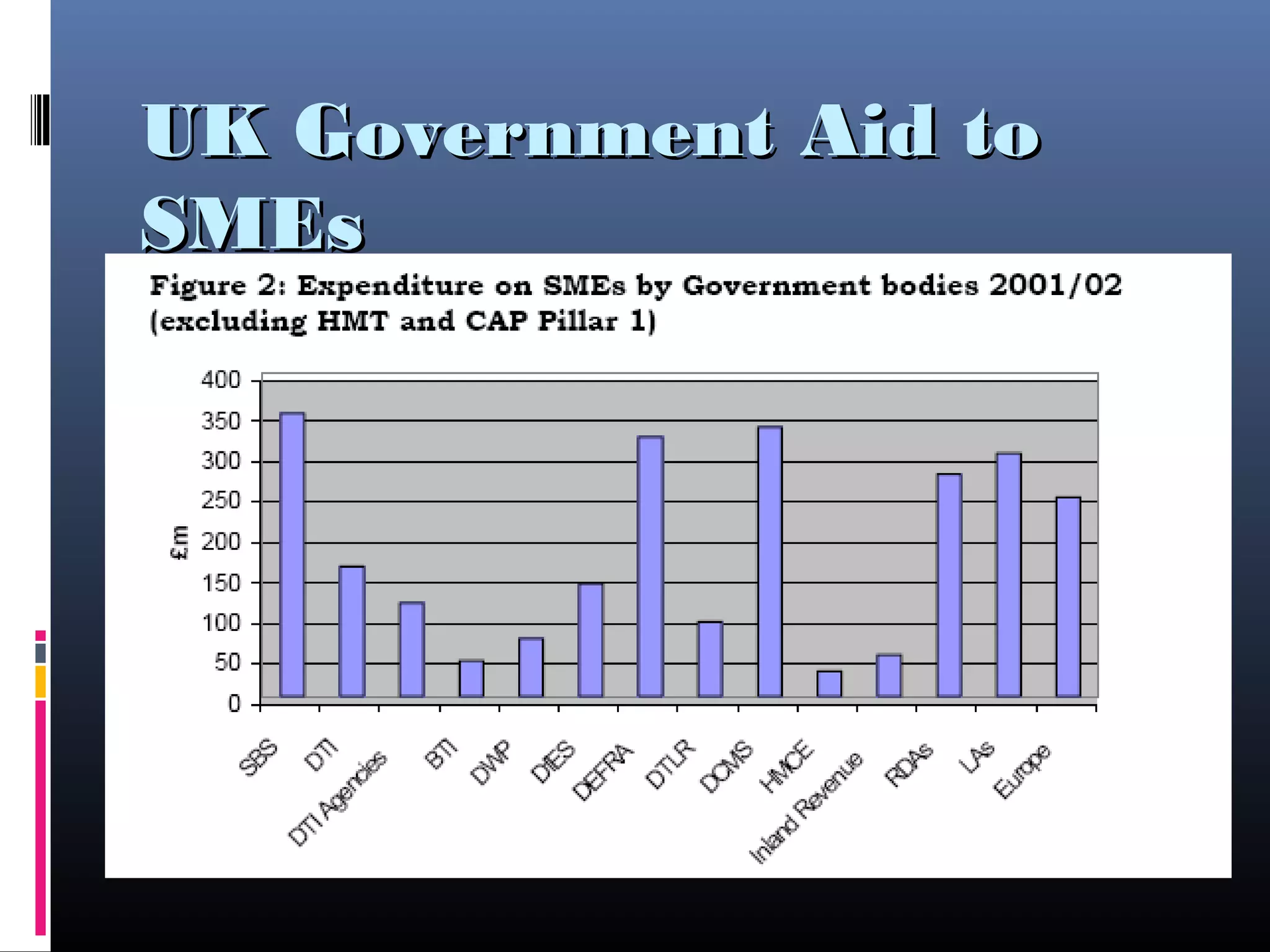

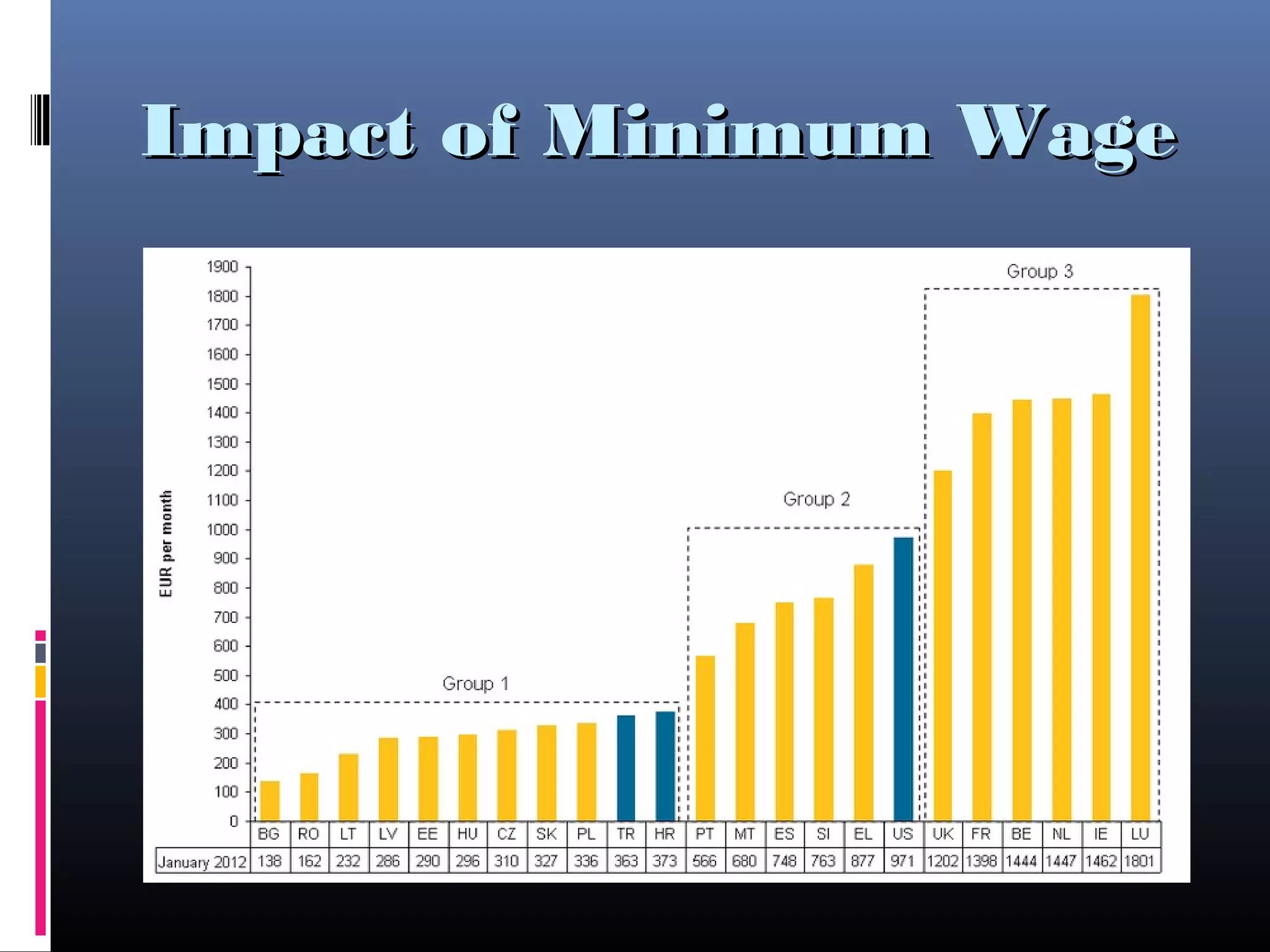

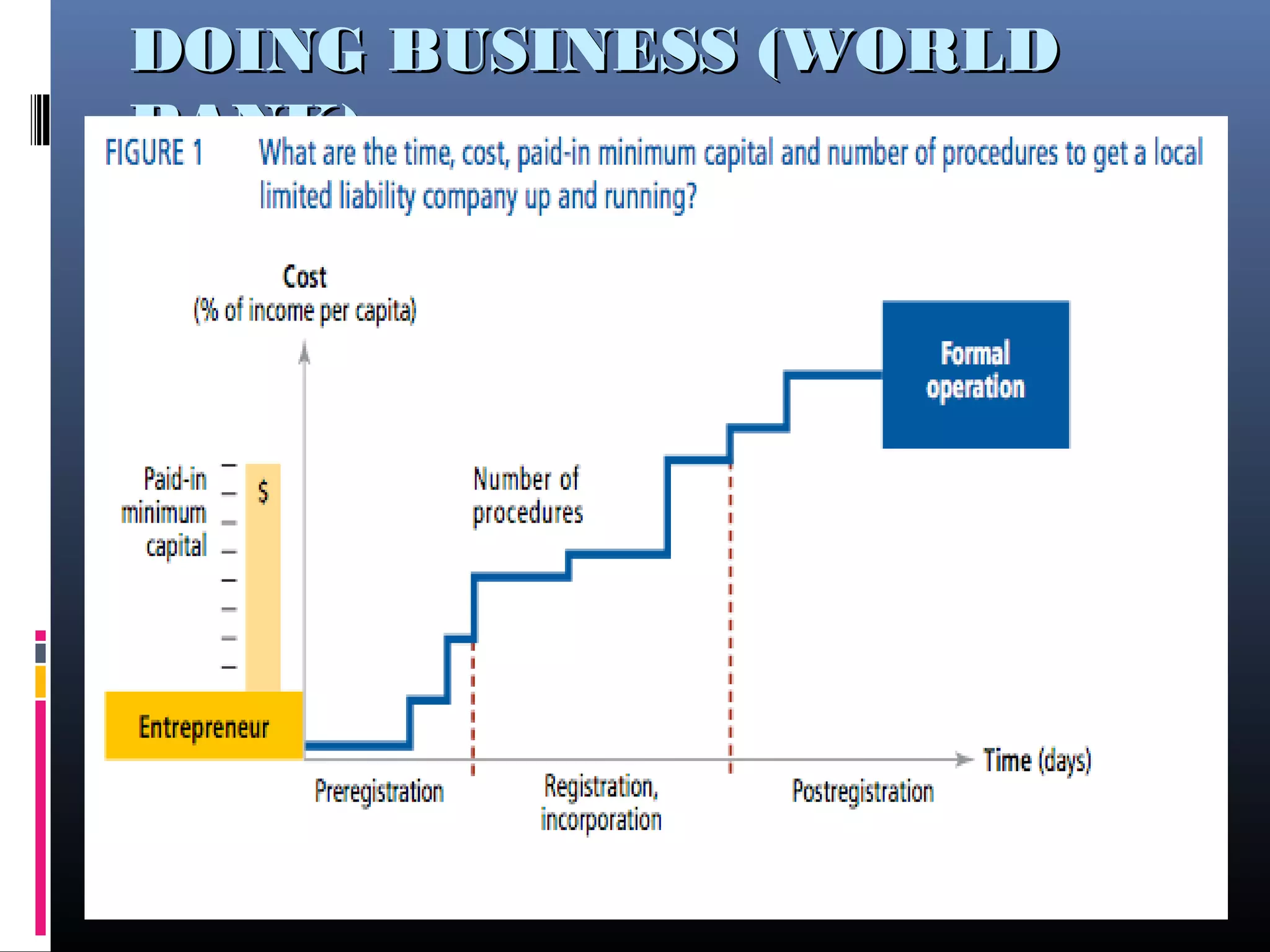

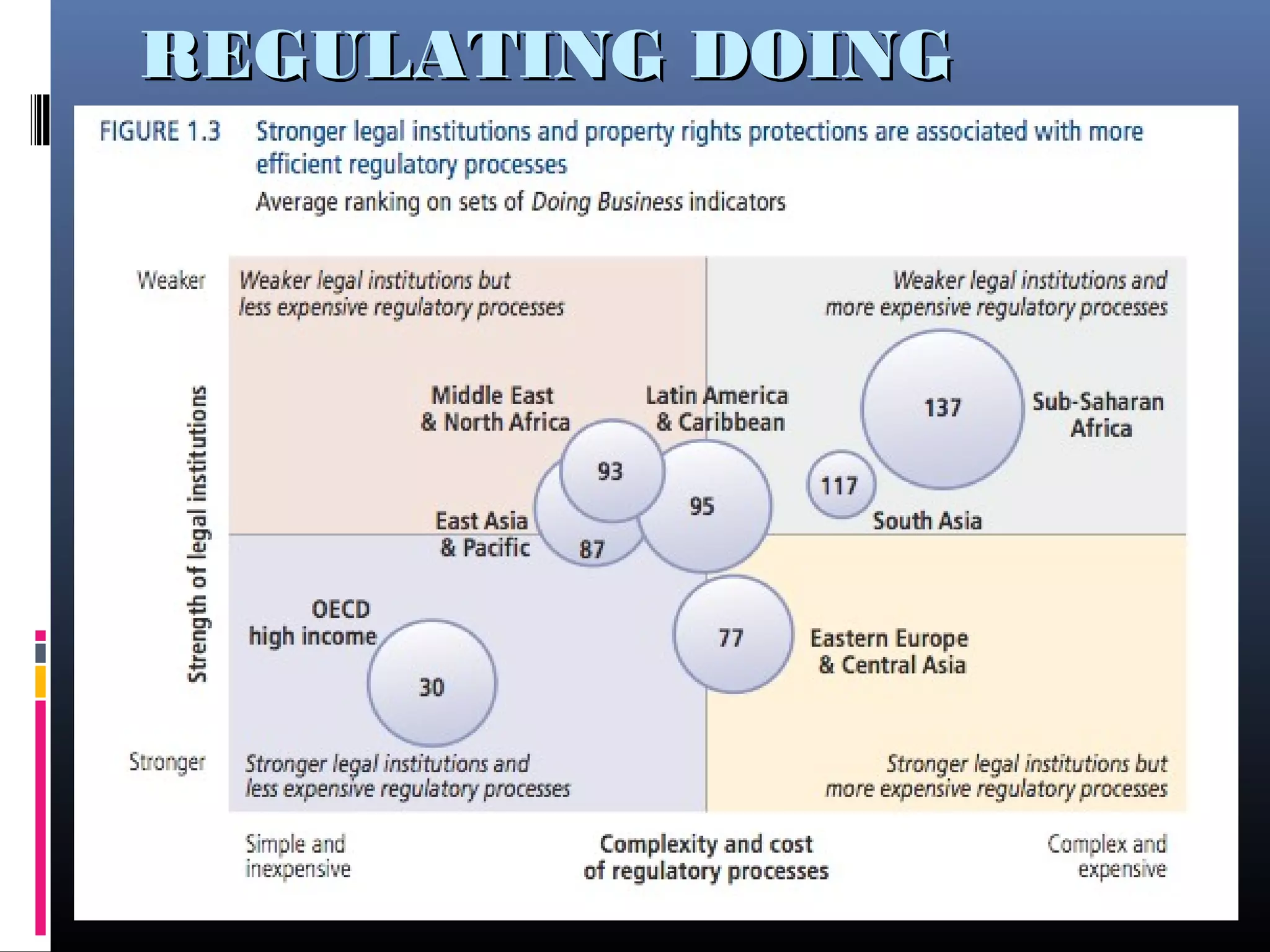

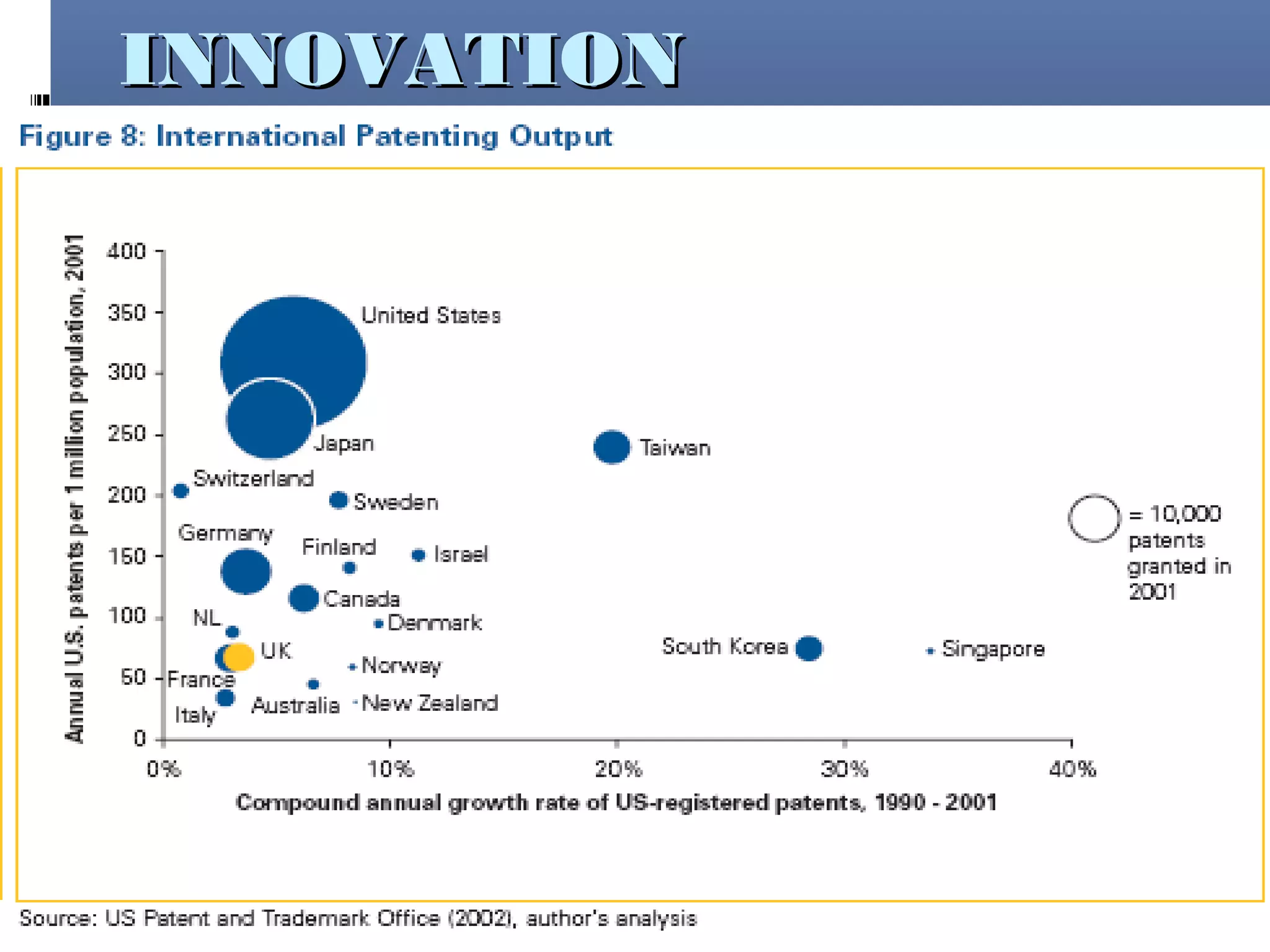

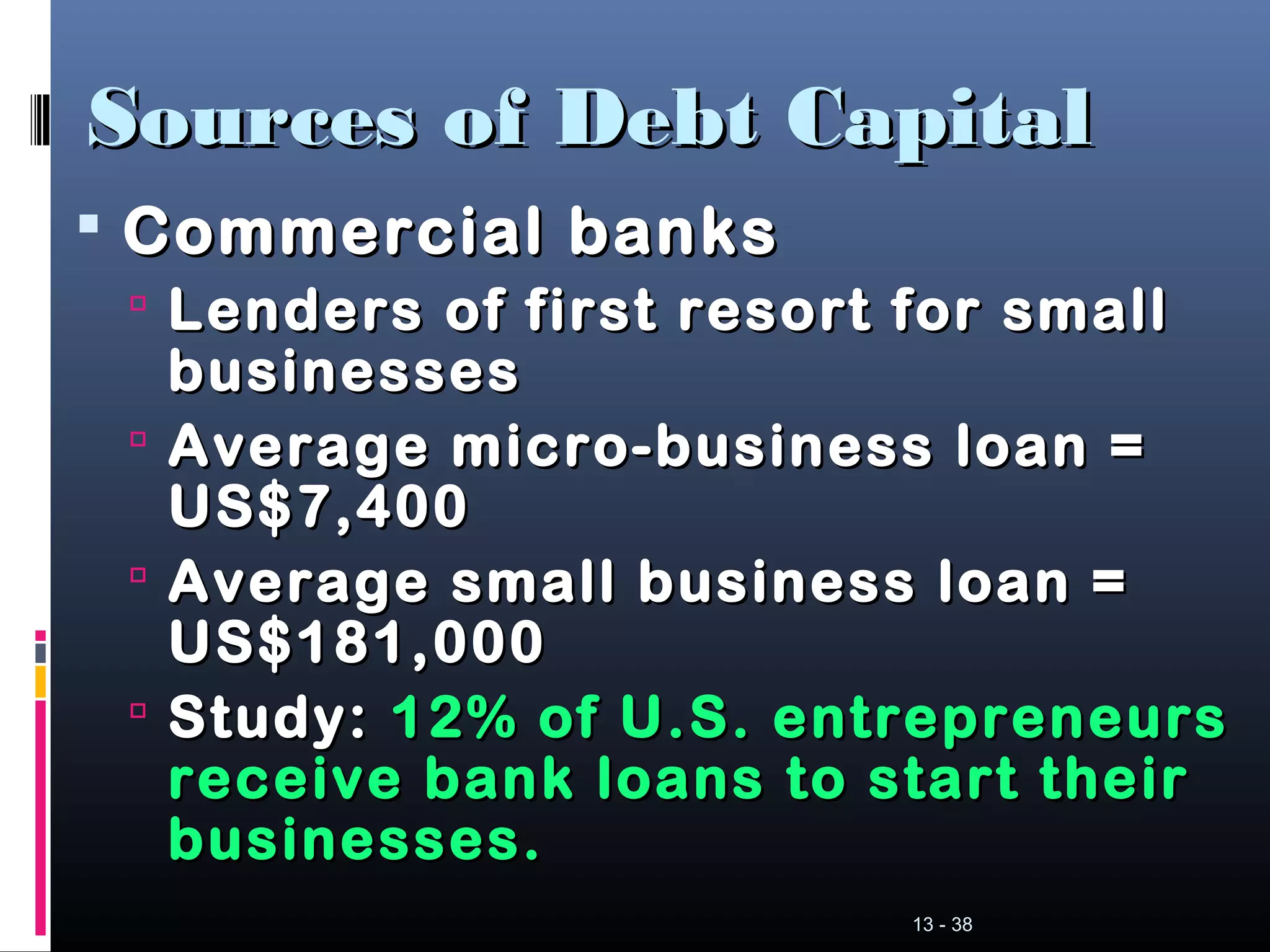

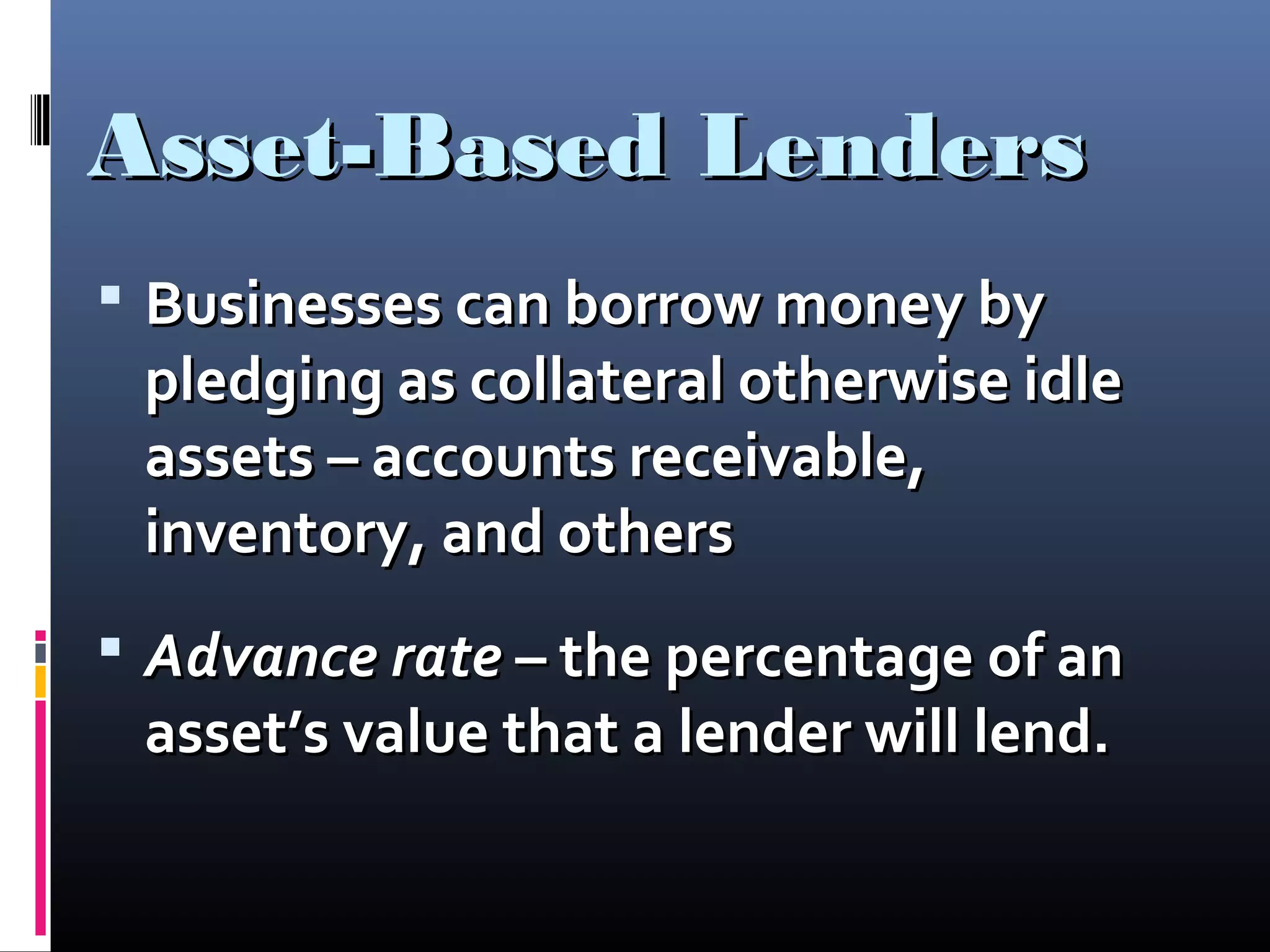

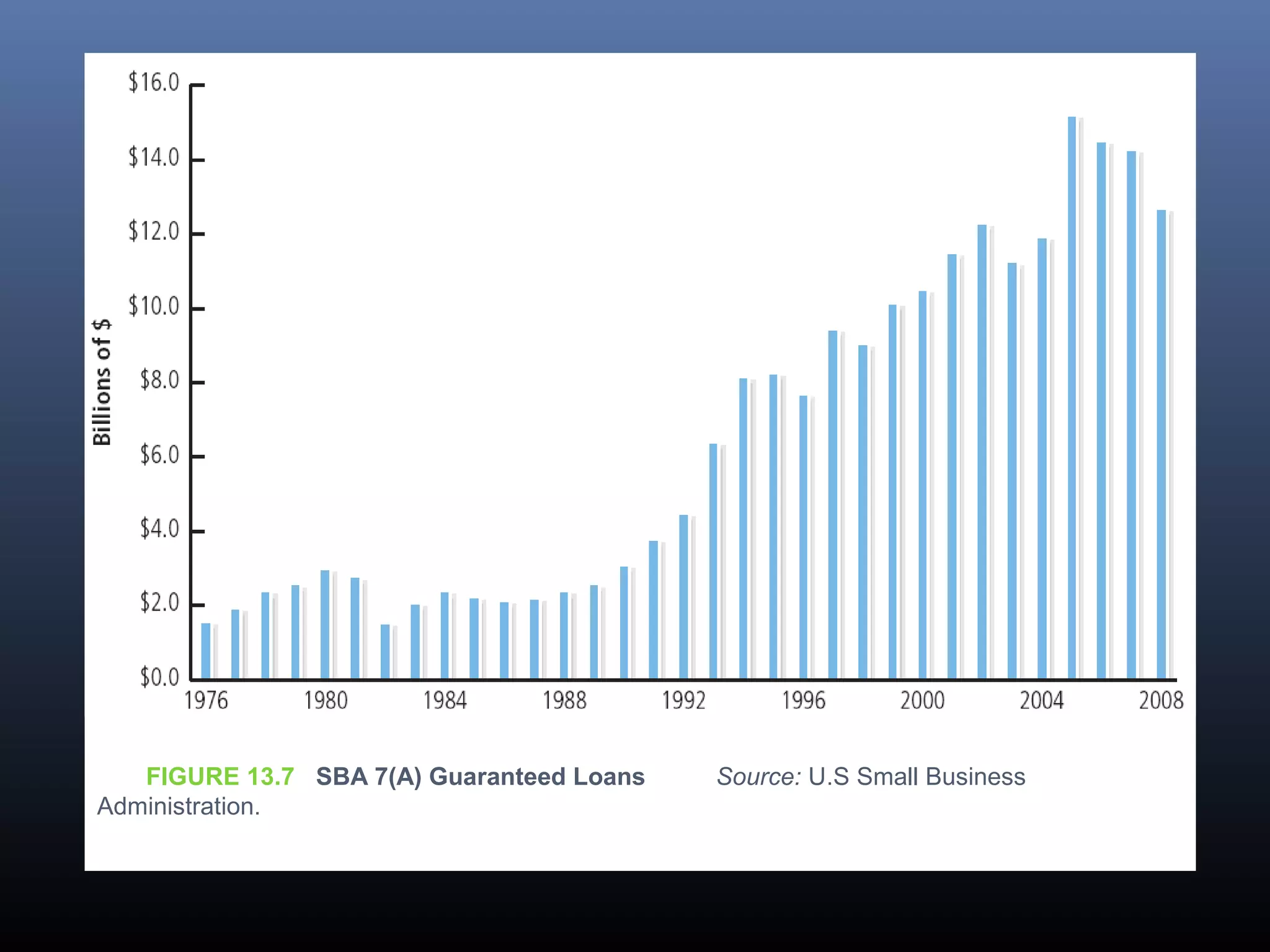

This document provides an overview of entrepreneurship and small and medium enterprises (SMEs) from a national and international perspective. It examines the economic significance of startups and SMEs, comparing their role in employment and GDP across countries. It also reviews common challenges faced by SMEs, such as low survival rates, regulatory burdens, and difficulties obtaining financing for growth. Government policies to support SMEs through reduced taxes, regulations, and aid programs are discussed.