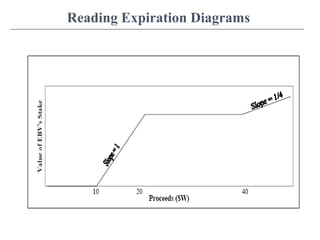

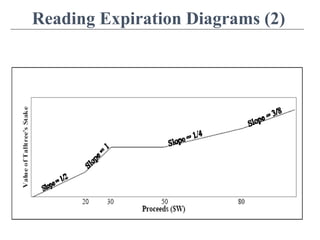

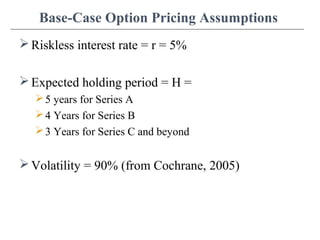

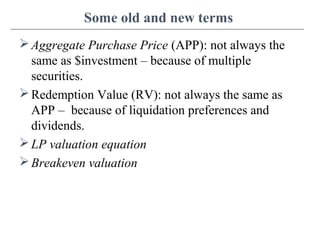

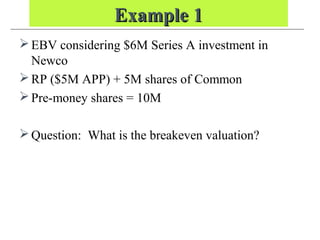

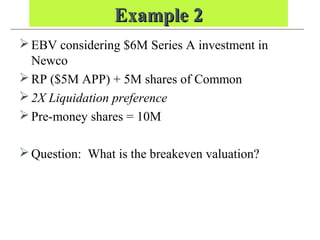

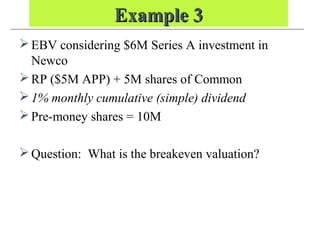

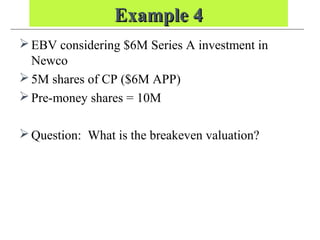

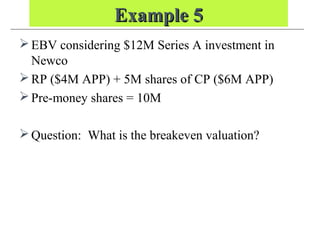

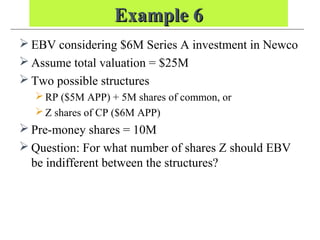

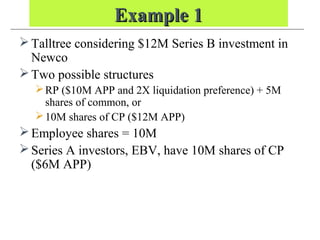

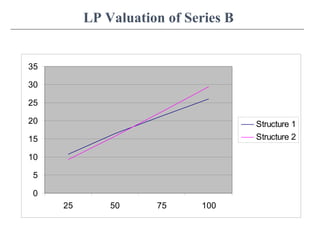

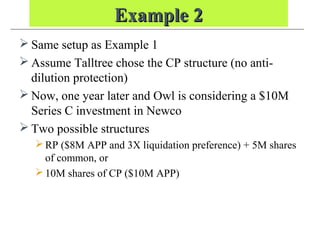

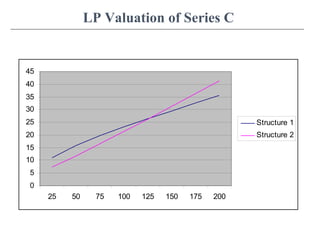

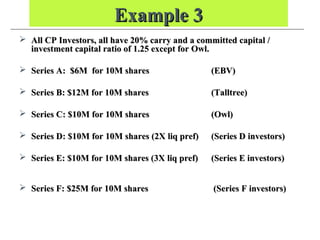

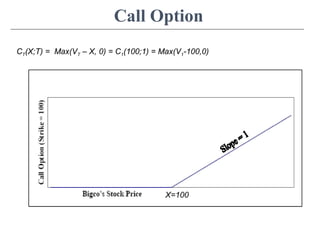

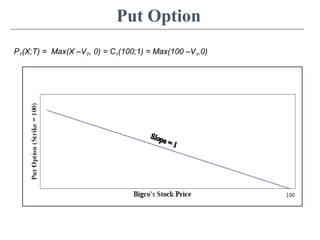

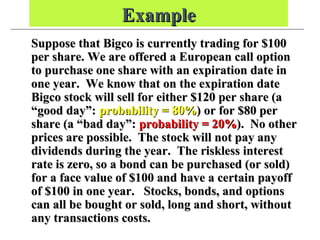

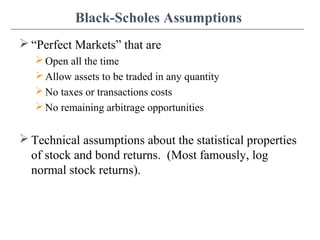

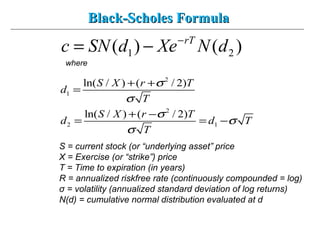

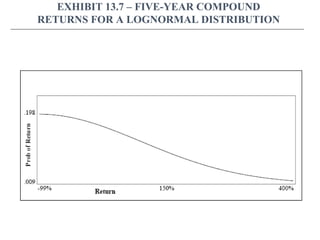

This document discusses partial valuations related to option pricing, preferred stock, and later series investments. It begins by defining options and differentiating between call and put options. It then covers the Black-Scholes option pricing model and its assumptions. Next, it compares the valuation of redeemable and convertible preferred stock, discussing liquidation preferences and breakeven valuations. Finally, it examines later round investments such as Series B, C, and beyond, providing examples of how preferred stock is structured and valued across multiple investment rounds.

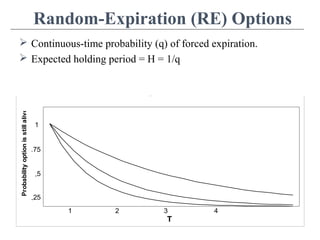

![RE Call Formula

1 2

0

[ ( ) ( )]rT qT

SN d Xe N d qe dT

∞

− −

−∫

You do not need to memorize this!You do not need to memorize this!](https://image.slidesharecdn.com/gs503vcflecture5partialvaluationi140315-150323064421-conversion-gate01/85/Gs503-vcf-lecture-5-partial-valuation-i-140315-14-320.jpg)