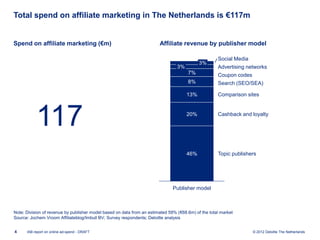

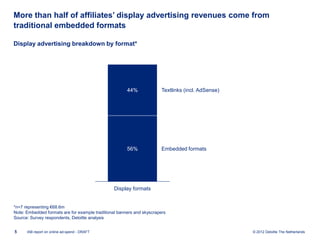

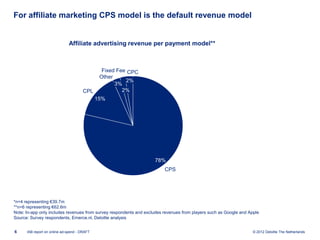

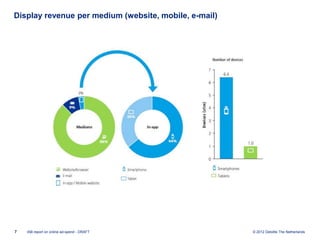

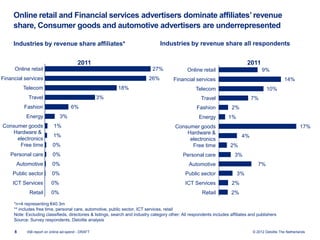

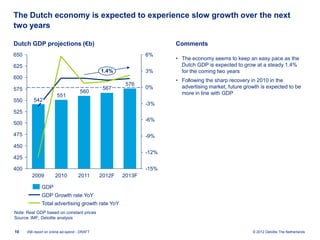

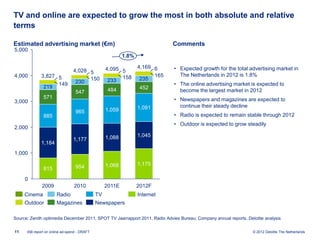

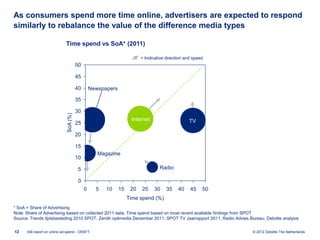

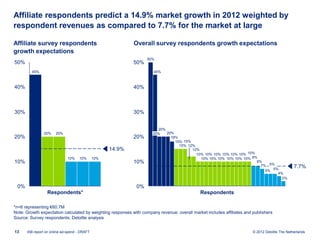

The 2011 IAB report on online ad spending in the Netherlands reveals a total affiliate marketing spend of €117 million, with significant revenue contributions from cashback and loyalty (46%) and search models (13%). The report highlights that online retail and financial services dominate revenue shares, while growth expectations for the market are projected at 14.9% for affiliates versus 7.7% for the overall market. Display advertising shows a preference for embedded formats, with contributors predicting a stable but slow growth in advertising driven by a shift towards online spending.