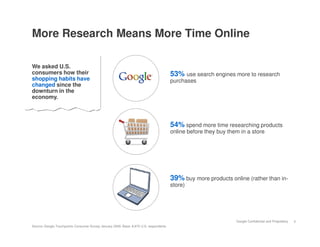

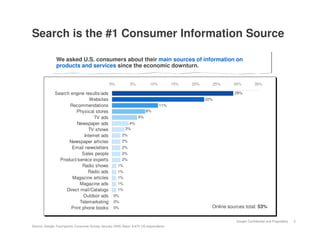

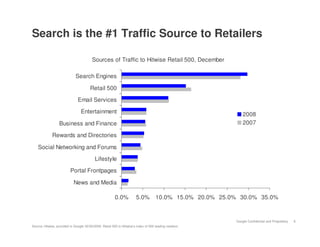

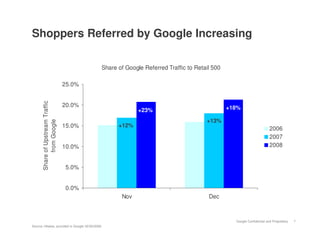

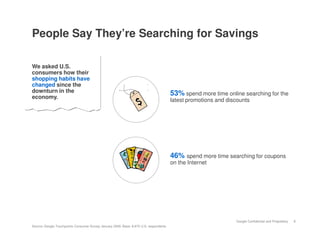

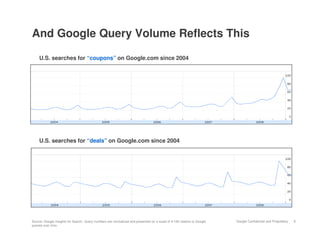

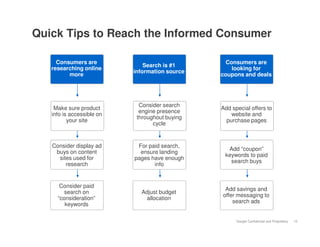

Consumers are spending more time researching purchases online before buying. A Google survey found that 53% of consumers use search engines more for research and 54% spend more time researching products online. Search engines are also the top information source for consumers. Retailers should consider search engine marketing and optimizing their websites to provide product information to these informed consumers.