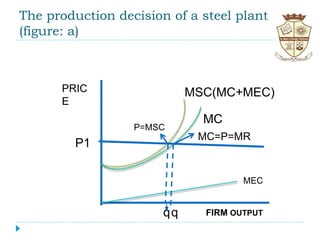

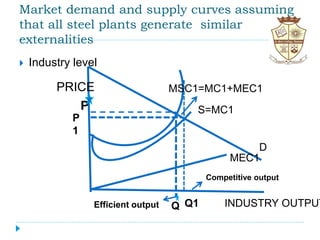

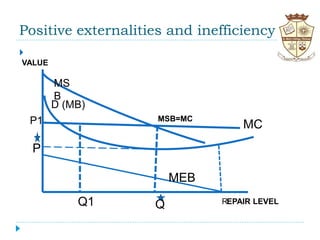

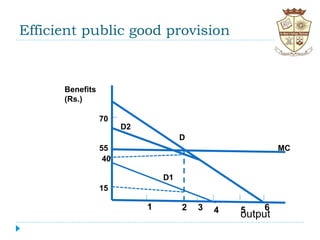

The document discusses market failure, focusing on the inefficiencies caused by market power, incomplete information, externalities, and public goods. It highlights the consequences of negative and positive externalities, explaining how they lead to excess production or underinvestment and how public goods can result in free-rider problems. Solutions to correct market failure include emission standards, fees, and tradable emission permits.