Local media7562126652911688540

•

0 likes•11 views

This document contains 8 problems related to break-even analysis. It provides various data points like fixed costs, variable costs per unit, selling price per unit, sales volumes, and profits/losses. The problems ask the reader to calculate break-even points, sales required to earn specific profit amounts, and the impact of increasing price or volume on profits.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Knowledge level-management information-nov-dec-2013

Knowledge level-management information-nov-dec-2013

Cost _management__accounting_9901366442 / 9902787224 / www.mbacasestudyanswe...

Cost _management__accounting_9901366442 / 9902787224 / www.mbacasestudyanswe...

Q 13 Partnership - Fundamentals TSGrewal's Solution with Explanation

Q 13 Partnership - Fundamentals TSGrewal's Solution with Explanation

Taller datos agrupados y no agrupados co1101 franyuri y vilmary

Taller datos agrupados y no agrupados co1101 franyuri y vilmary

Management information may jun 2016 Knowledge Level Question ICAB

Management information may jun 2016 Knowledge Level Question ICAB

20170313 Presentation of richpeace auto sewing machine for automotive interio...

20170313 Presentation of richpeace auto sewing machine for automotive interio...

Auto Sewing Solution for Automotive Interior & Upholstery

Auto Sewing Solution for Automotive Interior & Upholstery

Similar to Local media7562126652911688540

Similar to Local media7562126652911688540 (19)

Week 5 – Term 5 Homework60 PointsDue June 10, 20121.(6 poi.docx

Week 5 – Term 5 Homework60 PointsDue June 10, 20121.(6 poi.docx

. FARMLAND INC. PRODUCES 80,000 UNITS OF PRODUCT A AT A TOTAL COST OF $2.4 MI...

. FARMLAND INC. PRODUCES 80,000 UNITS OF PRODUCT A AT A TOTAL COST OF $2.4 MI...

Recently uploaded

Recently uploaded (20)

Potato Flakes Manufacturing Plant Project Report.pdf

Potato Flakes Manufacturing Plant Project Report.pdf

8 Questions B2B Commercial Teams Can Ask To Help Product Discovery

8 Questions B2B Commercial Teams Can Ask To Help Product Discovery

Did Paul Haggis Ever Win an Oscar for Best Filmmaker

Did Paul Haggis Ever Win an Oscar for Best Filmmaker

Unlock Your TikTok Potential: Free TikTok Likes with InstBlast

Unlock Your TikTok Potential: Free TikTok Likes with InstBlast

Luxury Artificial Plants Dubai | Plants in KSA, UAE | Shajara

Luxury Artificial Plants Dubai | Plants in KSA, UAE | Shajara

chapter 10 - excise tax of transfer and business taxation

chapter 10 - excise tax of transfer and business taxation

Meaningful Technology for Humans: How Strategy Helps to Deliver Real Value fo...

Meaningful Technology for Humans: How Strategy Helps to Deliver Real Value fo...

Unleash Data Power with EnFuse Solutions' Comprehensive Data Management Servi...

Unleash Data Power with EnFuse Solutions' Comprehensive Data Management Servi...

Local media7562126652911688540

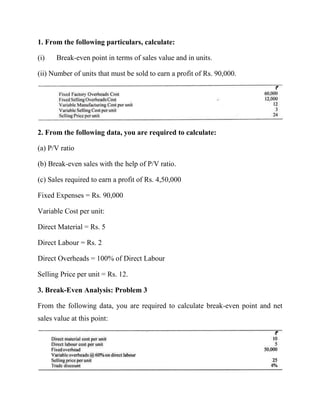

- 1. 1. From the following particulars, calculate: (i) Break-even point in terms of sales value and in units. (ii) Number of units that must be sold to earn a profit of Rs. 90,000. 2. From the following data, you are required to calculate: (a) P/V ratio (b) Break-even sales with the help of P/V ratio. (c) Sales required to earn a profit of Rs. 4,50,000 Fixed Expenses = Rs. 90,000 Variable Cost per unit: Direct Material = Rs. 5 Direct Labour = Rs. 2 Direct Overheads = 100% of Direct Labour Selling Price per unit = Rs. 12. 3. Break-Even Analysis: Problem 3 From the following data, you are required to calculate break-even point and net sales value at this point:

- 2. If sales are 10% and 25% above the break even volume, determine the net profits. 4. Break-Even Analysis: Problem 4 From the following particulars, find out the break-even-point: What should be the selling price per unit, if the break-even point should be brought down to 6,000 units? 5. Break-Even Analysis: Problem 5 The fixed costs amount to Rs. 50,000 and the percentage of variable costs to sales is given to be 66 ⅔%. If 100% capacity sales are Rs. 3,00,000, find out the break-even point and the percentage sales when it occurred. Determine profit at 80% capacity: 6. Break-Even Analysis: Problem 6 From the following information, ascertain by how much the value of sales must be increased by the company to break-even: Break-Even Analysis: Problem 7. Calculate:

- 3. (i) The amount of fixed expenses. (ii) The number of units to break-even. (iii) The number of units to earn a profit of Rs. 40,000. The selling price per unit can be assumed at Rs. 100. The company sold in two successive periods 7,000 units and 9,000 units and has incurred a loss of Rs. 10,000 and earned Rs. 10,000 as profit respectively. 8. Break-Even Analysis: Problem 8 A company is making a loss of Rs. 40,000 and relevant information is as follows: Sales Rs. 1, 20,000; Variable Costs Rs. 60,000; Fixed costs Rs. 1, 00,000. Loss can be made good either by increasing the sales price or by increasing sales volume. What are Break even sales if (a) Present sales level is maintained and the selling price is increased. (b) If present selling price is maintained and the sales volume is increased. What would be sales if a profit of Rs. 1,00,000 is required ?