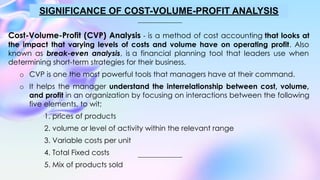

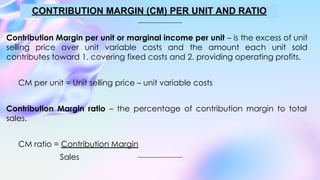

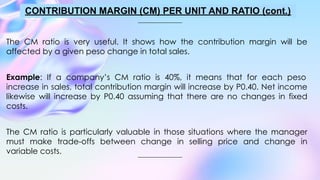

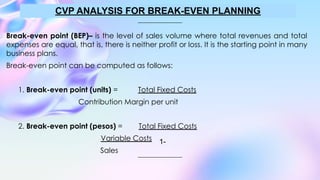

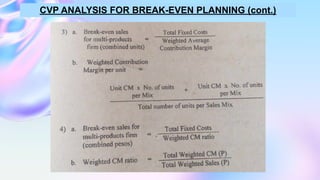

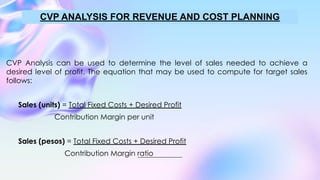

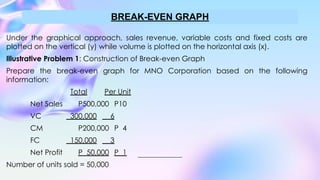

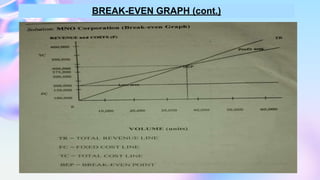

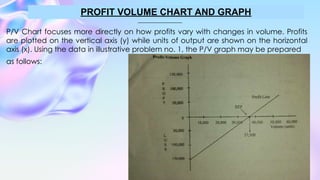

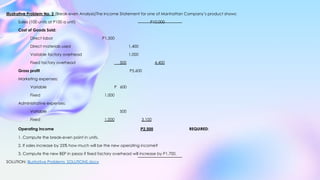

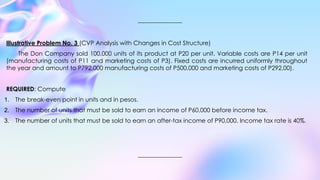

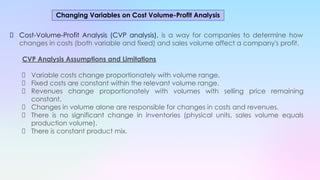

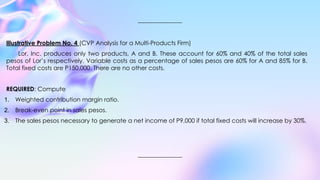

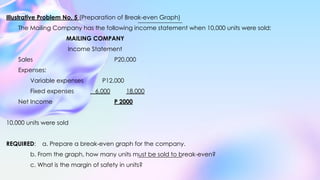

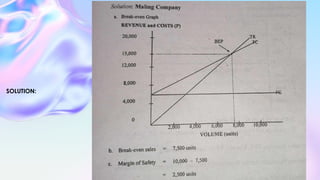

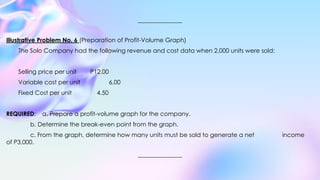

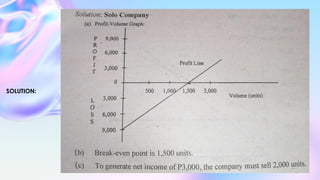

Chapter III focuses on cost-volume-profit (CVP) analysis, which helps determine the number of units to be sold to break even or achieve a target profit. It covers key concepts such as contribution margin, break-even point, and the significance of CVP in decision-making, while also exploring the impact of risk and changes in cost structures. The chapter includes illustrative problems and graphical approaches for applying CVP analysis in multiple product settings.