Embed presentation

Download to read offline

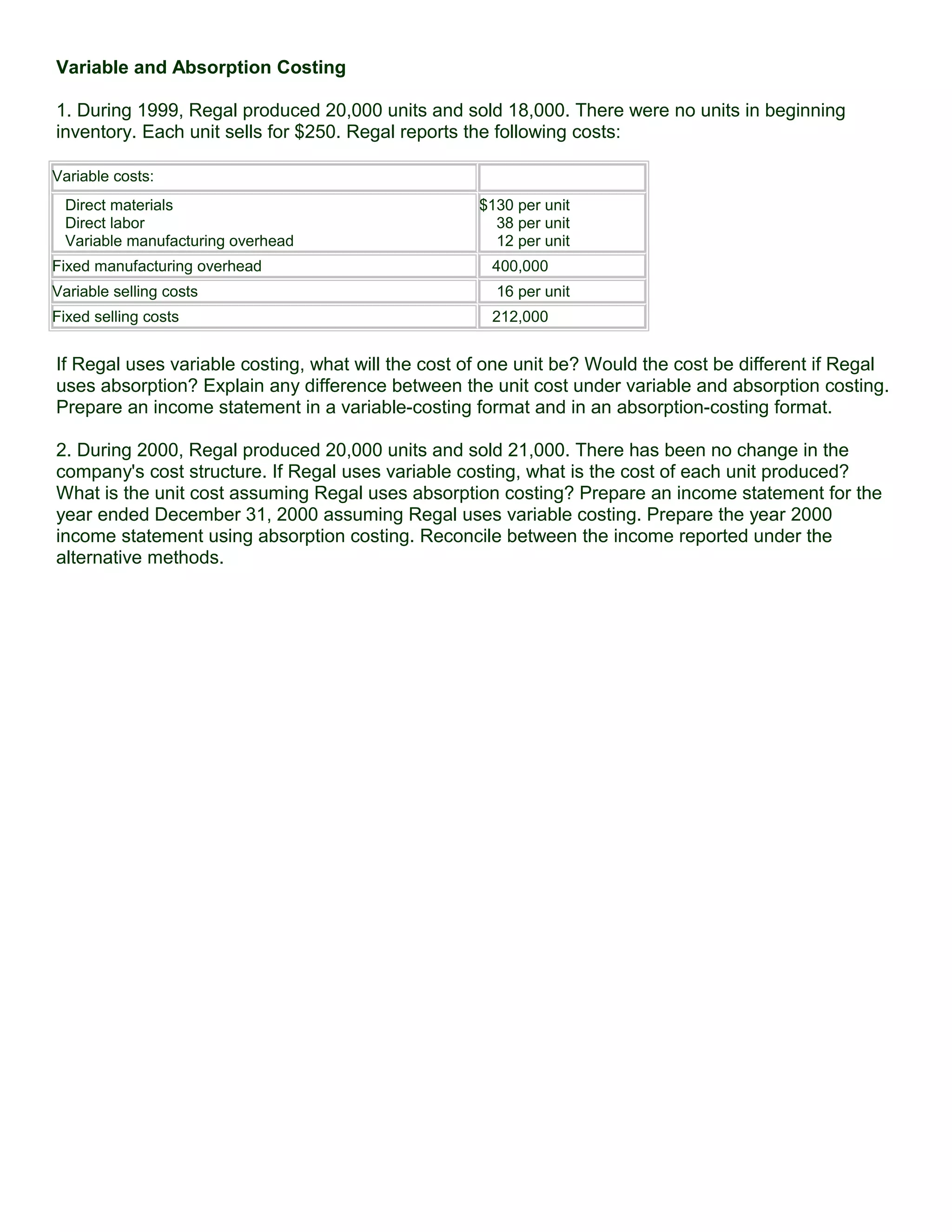

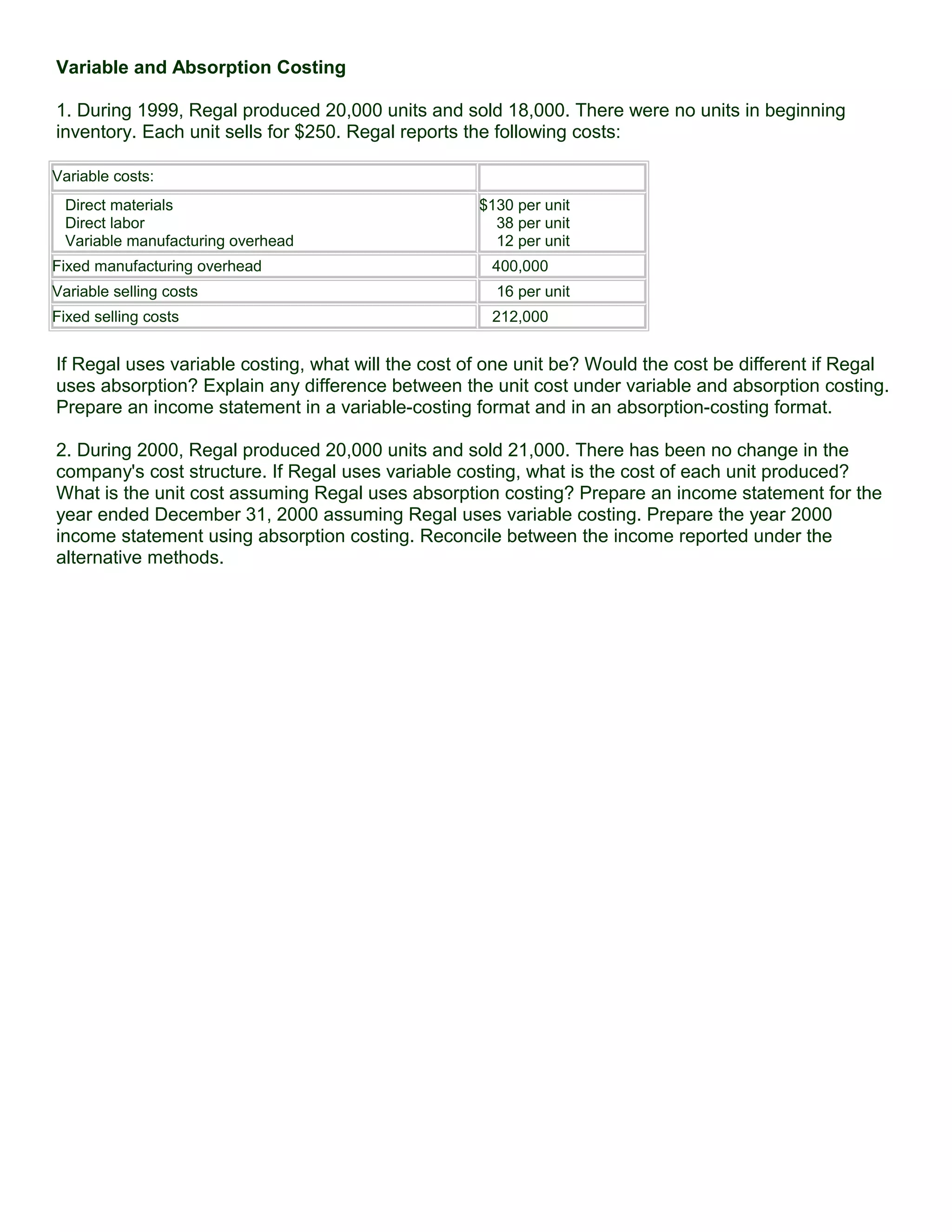

The document discusses the differences between variable and absorption costing methods. It provides cost information for Regal, which produced 20,000 units in 1999 and sold 18,000 units. The variable costs per unit are $130 for direct materials, $38 for direct labor, and $12 for variable overhead. Fixed costs include $400,000 for manufacturing overhead and $212,000 for selling costs. Income statements are to be prepared for 1999 under both variable and absorption costing. In 2000, Regal produced and sold 20,000 and 21,000 units respectively, with no change in costs. Income statements for 2000 must also be prepared under both costing methods.