Life cycle costing and customer life cycle costing.

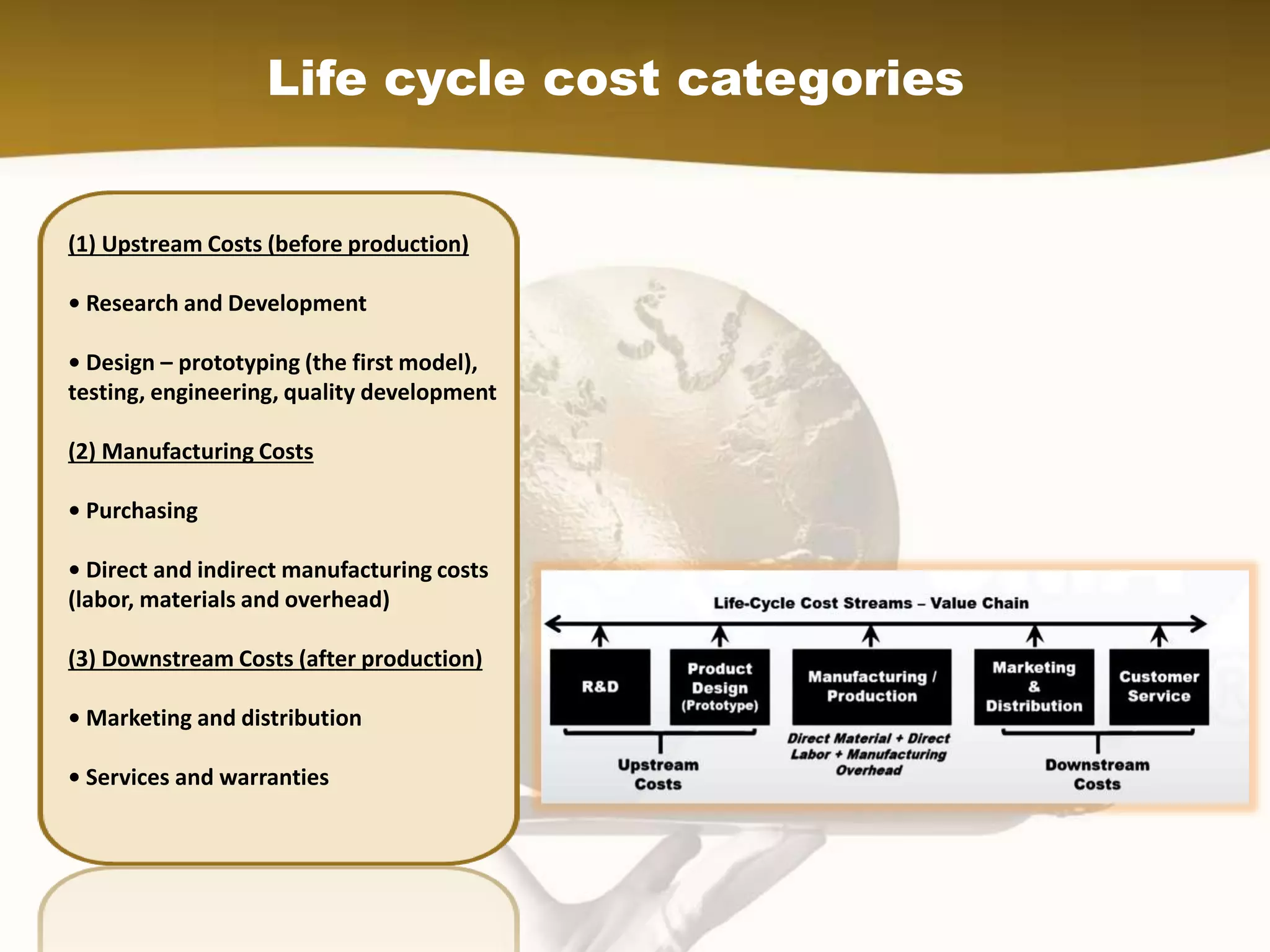

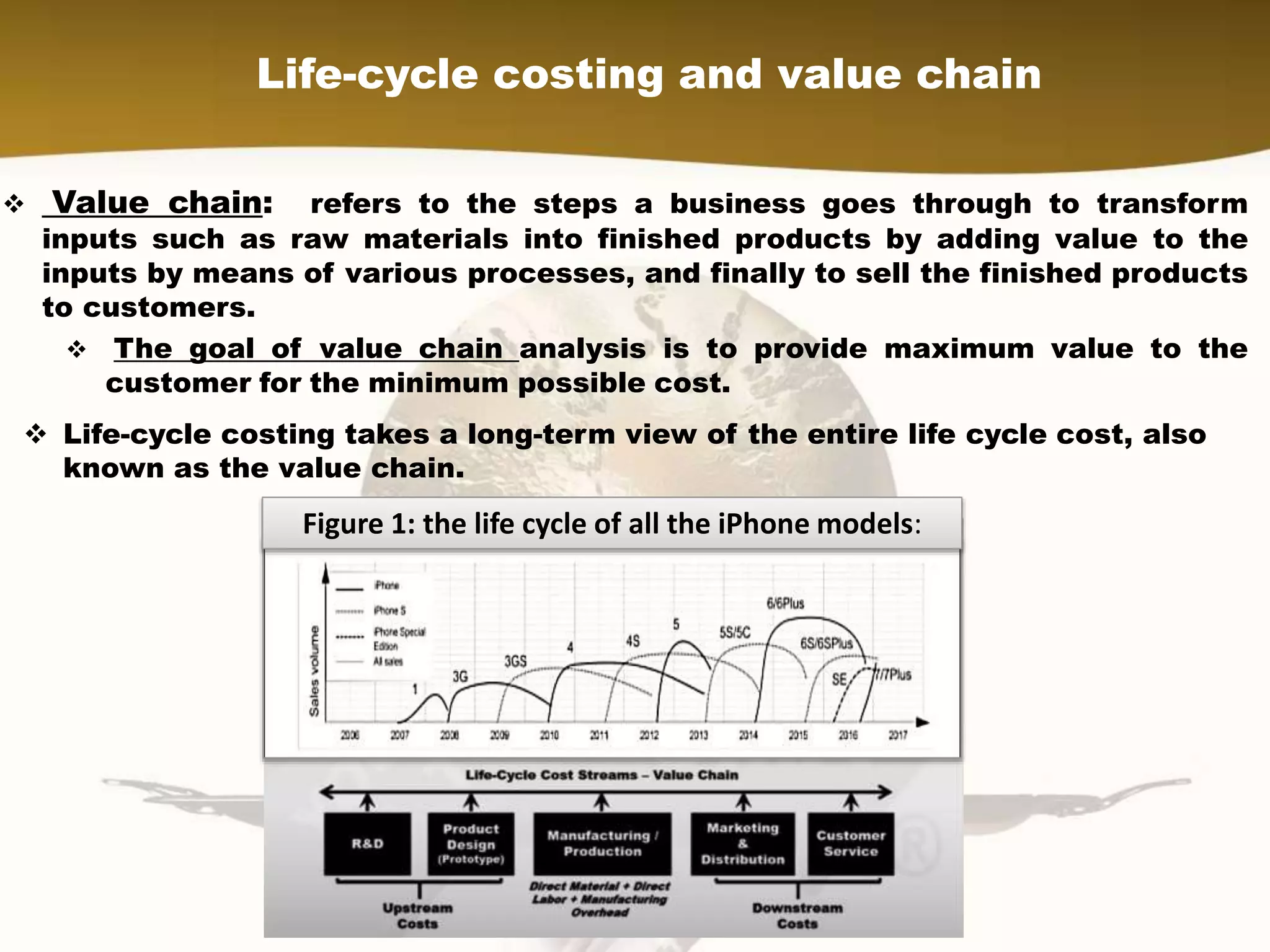

1) Life cycle costing takes a long-term view of all costs associated with a product over its entire lifecycle, including pre-production, production, and post-production costs. This allows companies to better understand total costs and make optimal strategic decisions.

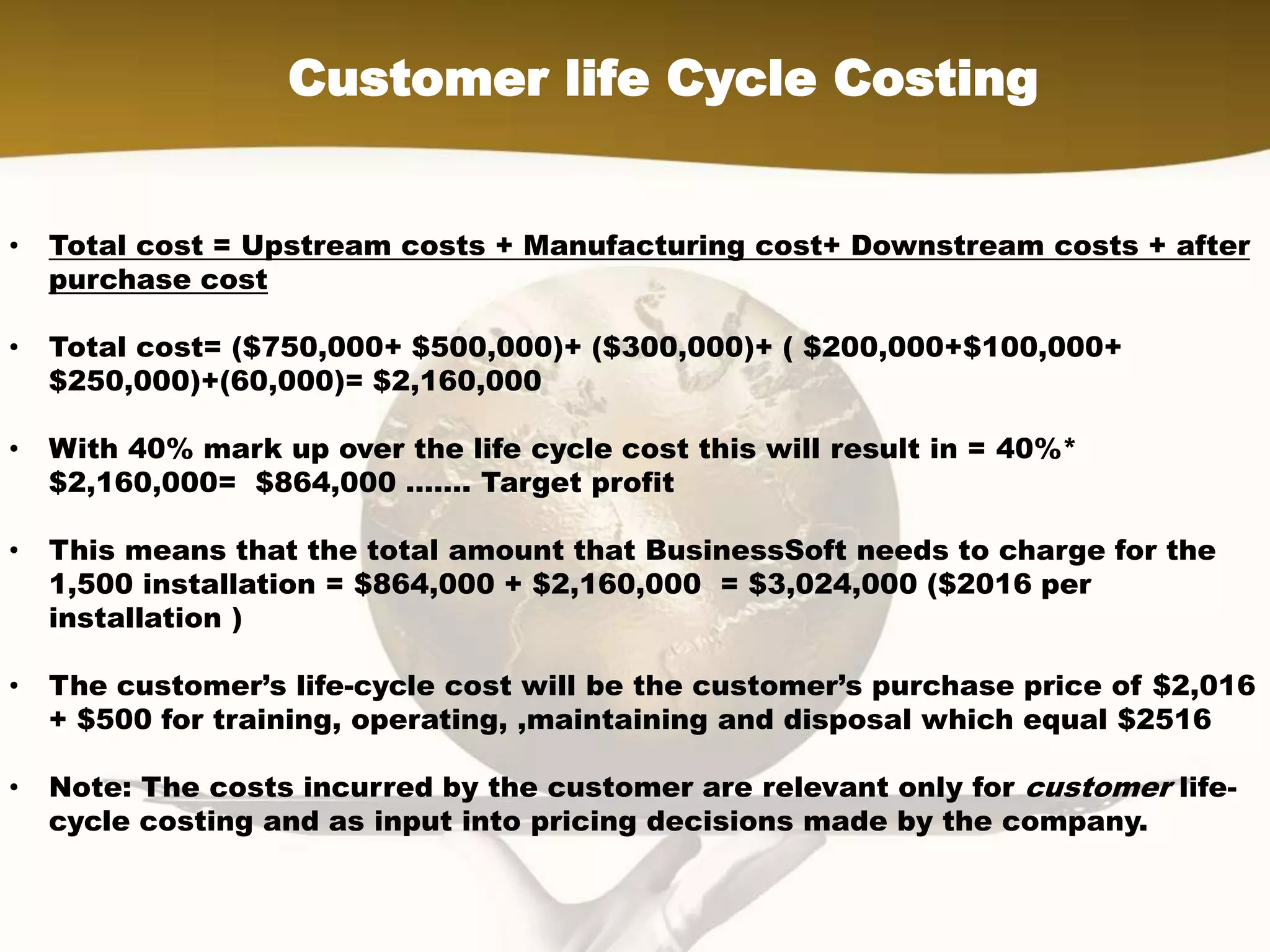

2) Customer life cycle costing analyzes costs from the customer's perspective, including purchase costs as well as after-purchase costs like maintenance and disposal. This information helps companies determine appropriate pricing.

3) Calculating life cycle costs can reveal less expensive options that may be missed when only considering initial purchase prices. Considering all costs over a product's lifetime leads to more informed decision making.