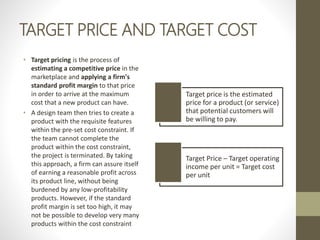

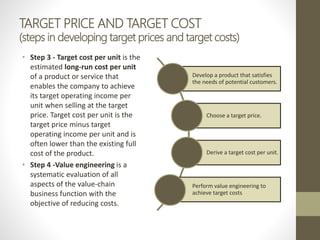

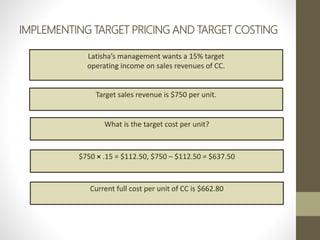

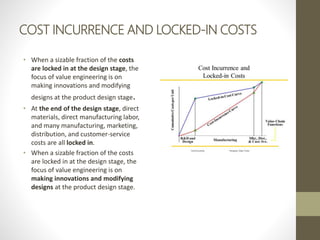

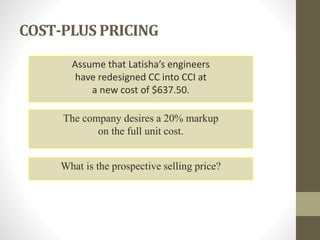

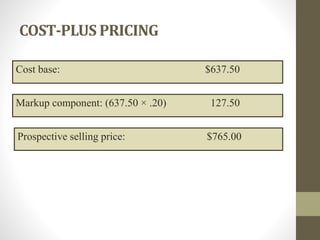

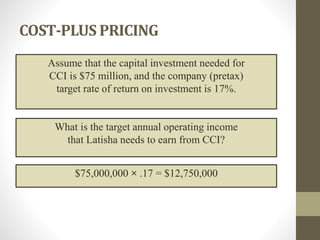

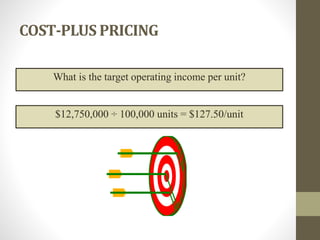

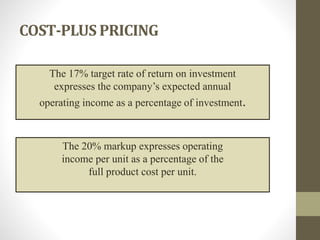

There are three major influences on pricing decisions: customers, competitors, and costs. Short-run pricing decisions have a time horizon of less than one year and consider relevant variable costs, while long-run decisions consider fixed costs and aim to earn a reasonable return on investment. Target costing sets a target price and derives the maximum allowable cost, while cost-plus pricing adds a markup to total costs to determine price.