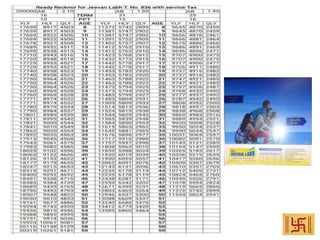

The Jeevan Labh Plan No. 836 by NVM Endowment Plan offers a limited premium paying term, with three policy term options and eligibility from ages 8 to 59. It provides maturity benefits that include the basic sum assured, bonuses, and accidental death benefits, with riders available for additional coverage. The plan also offers various premium payment modes and tax benefits, making it suitable for education and marriage funding, with an emphasis on long-term risk coverage.