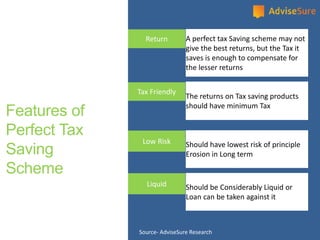

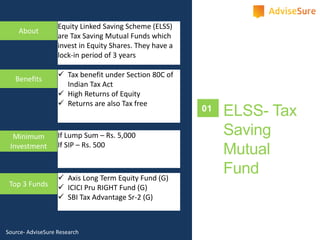

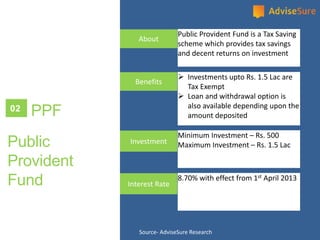

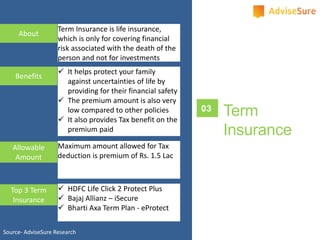

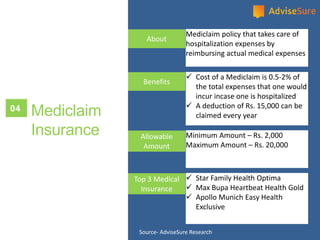

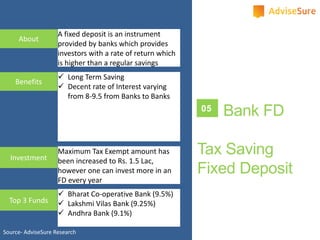

The document outlines five tax-saving instruments suitable for Indian investors: Equity Linked Savings Scheme (ELSS), Public Provident Fund (PPF), Term Insurance, Mediclaim Policy, and Tax Saving Fixed Deposits, each offering tax benefits and varying investment characteristics. It also emphasizes the importance of choosing tax-saving options that provide liquidity, low risk, and minimal erosion of principal. Additional information includes examples of top funds and policies under each category and a disclaimer regarding the investment advice provided.