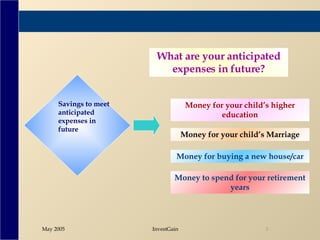

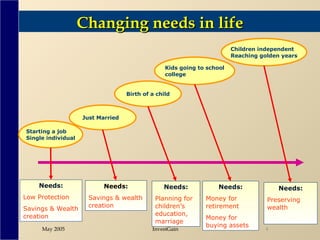

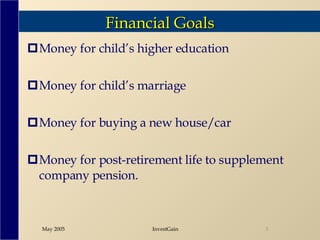

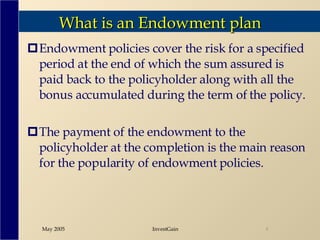

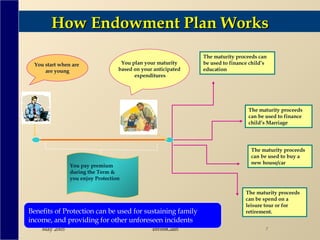

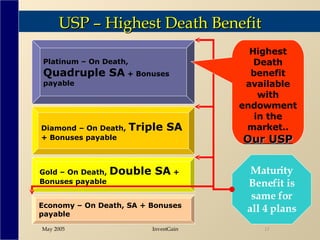

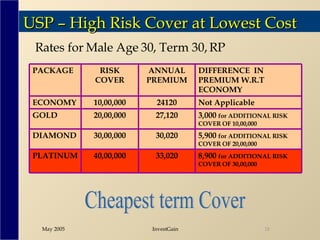

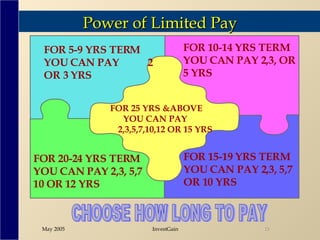

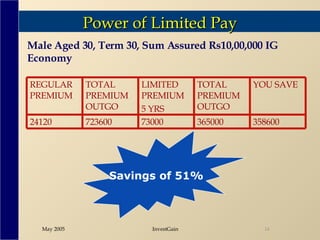

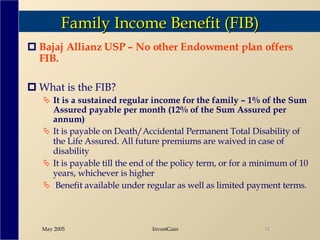

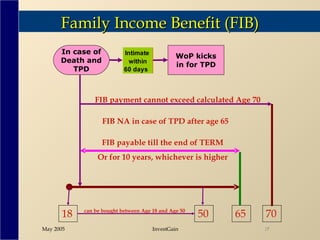

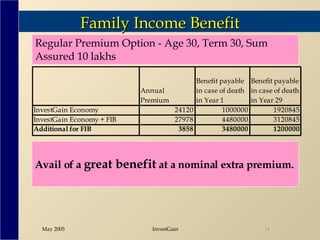

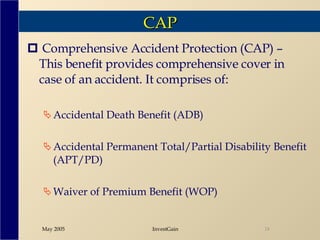

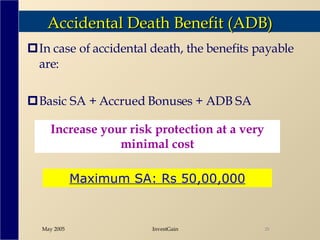

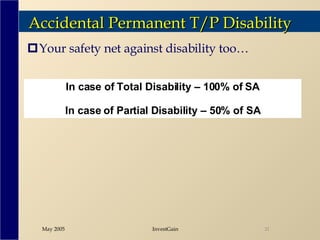

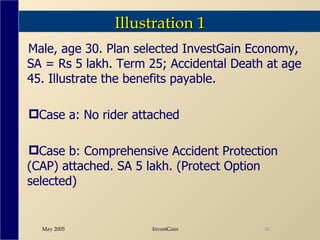

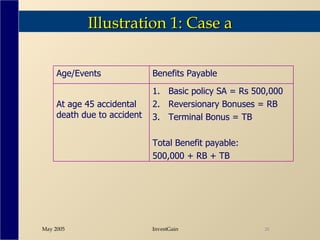

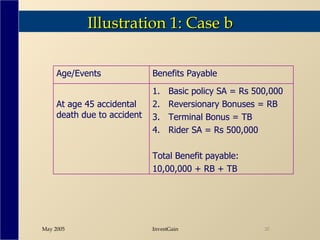

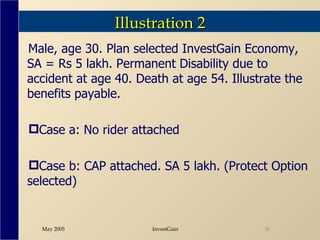

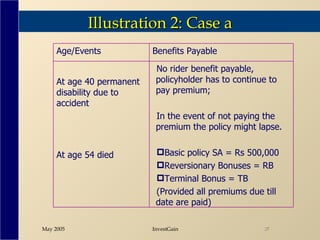

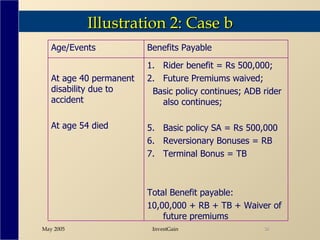

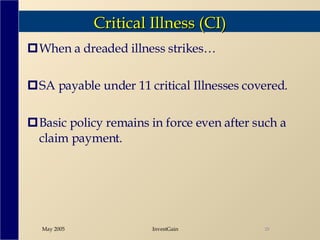

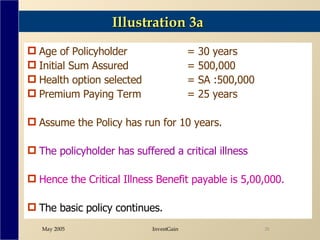

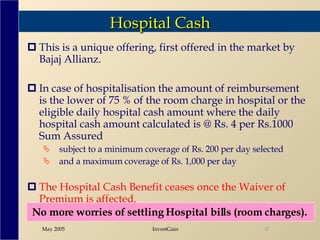

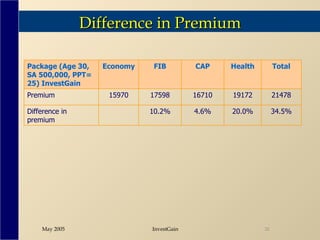

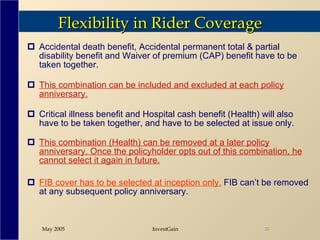

The document discusses an endowment plan called InvestGain that provides life insurance protection and savings for various future financial goals. It has 4 plan options with increasing death benefits and offers low cost riders for additional accident and critical illness coverage. The plan allows paying premiums for a limited period and provides benefits like family income in case of death or disability. Examples illustrate how the riders enhance the basic policy's coverage.