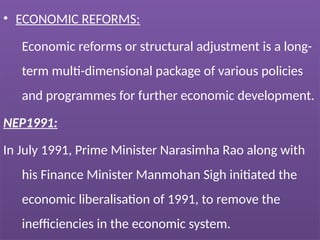

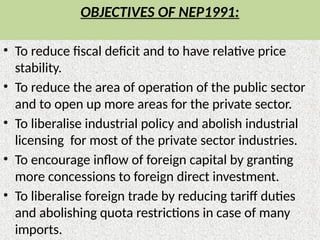

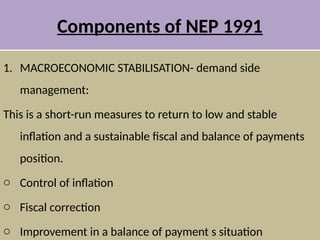

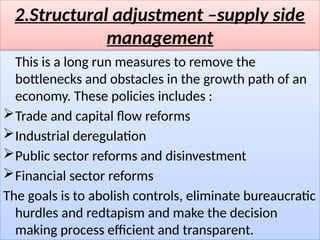

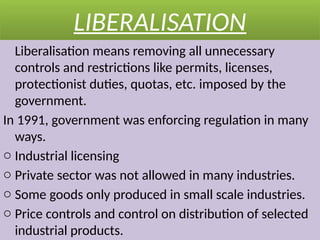

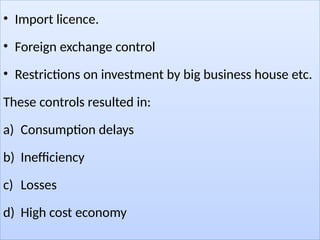

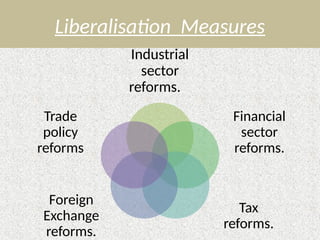

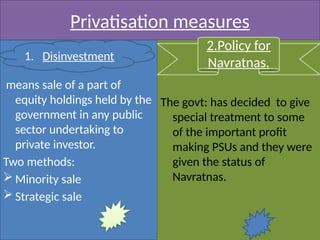

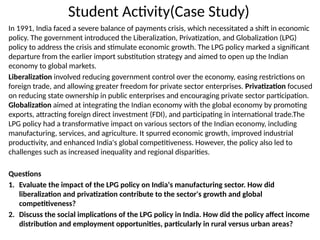

The document outlines the evolution of India's economic policy from 1947 to 1990, emphasizing the shift from a protectionist, socialist model to the liberalization, privatization, and globalization (LPG) framework initiated in 1991 due to a balance of payments crisis. The New Economic Policy aimed to reduce government control, encourage private sector involvement, and integrate India into the global economy, leading to substantial economic growth and improved competitiveness, albeit with associated challenges such as inequality. Key components of the reforms included macroeconomic stabilization, structural adjustments, and reforms in industrial, financial, and trade sectors.