- India's foreign trade can be traced back to the Indus Valley civilization. The 1991 reforms aimed to liberalize trade and attract foreign investment.

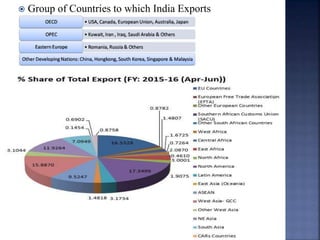

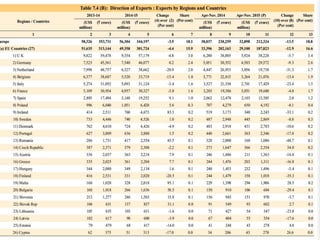

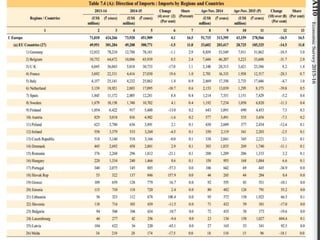

- The direction of India's trade refers to its major export and import partners. Exports have diversified to many countries. Major import sources are European countries.

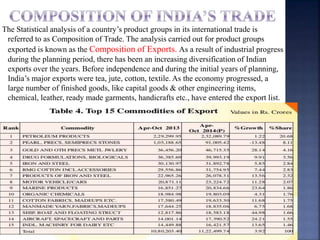

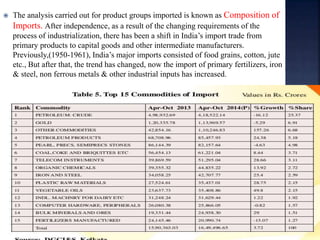

- The composition of trade analyzes product groups. Exports have diversified from primary goods to manufactured goods. Imports now include more capital goods and industrial inputs.

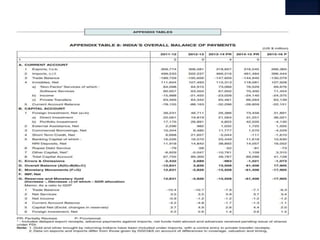

- The balance of trade is favorable if exports exceed imports, and unfavorable if imports exceed exports. The balance of payments includes current accounts like trade plus capital and financial flows. India has recently experienced a lower trade deficit and falling exports and imports