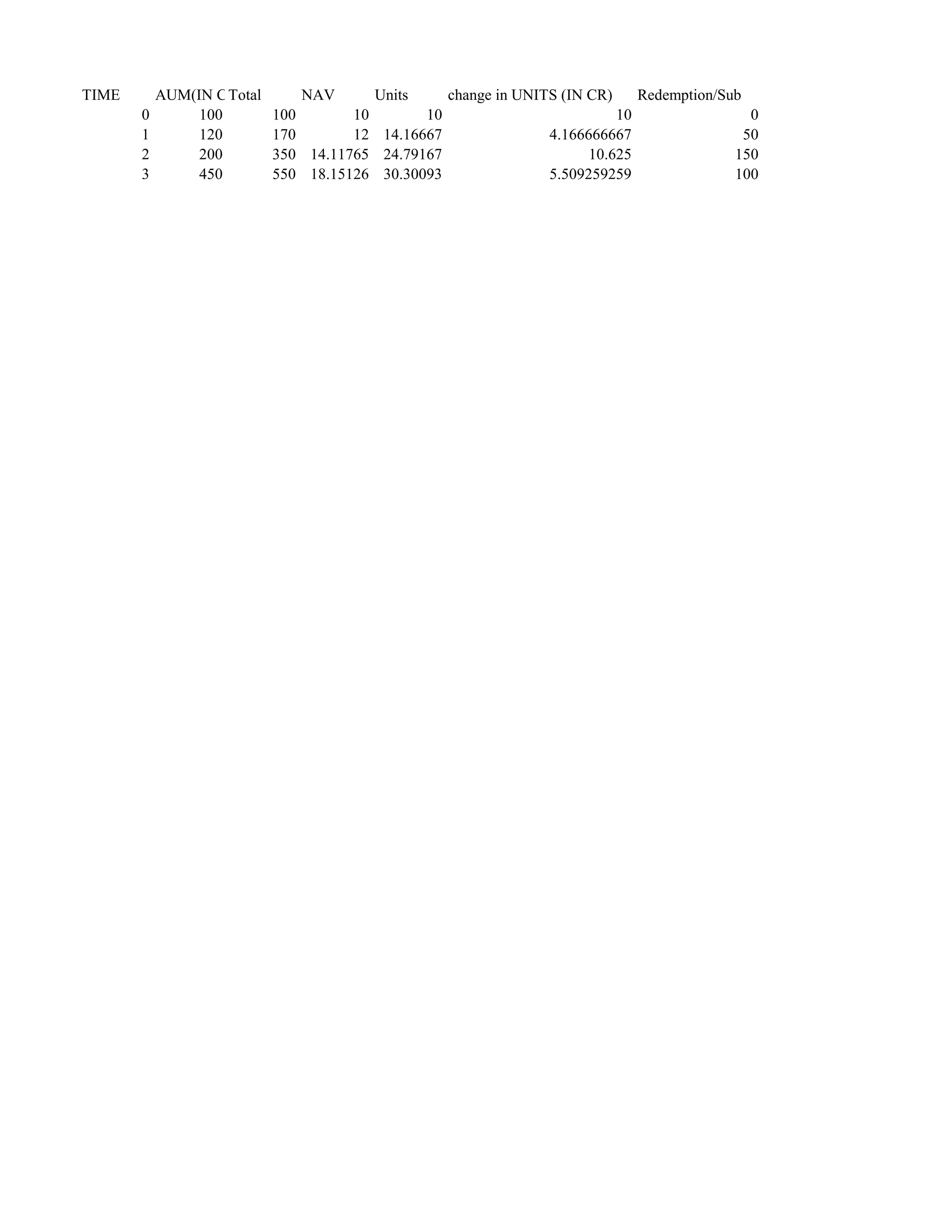

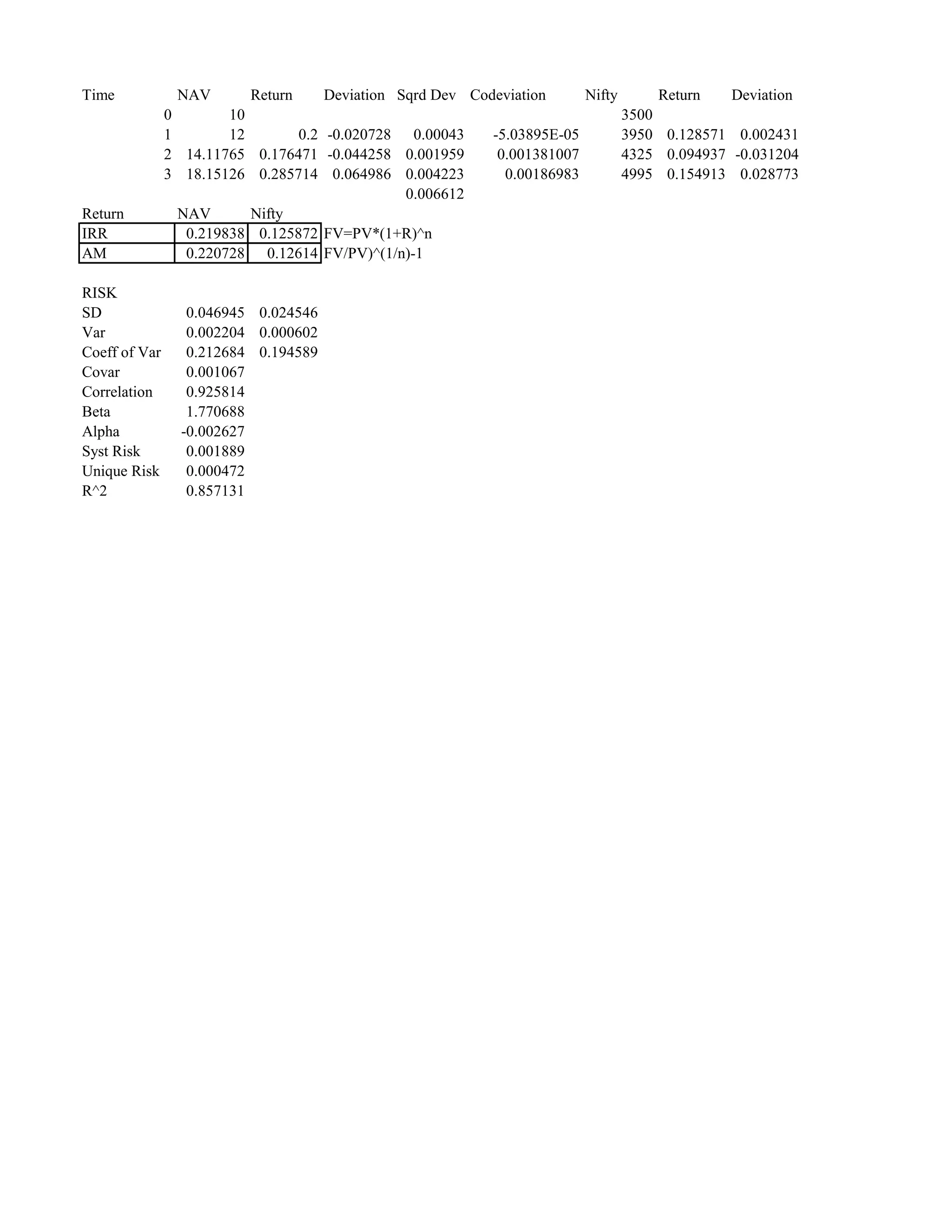

The document contains information about the net asset value (NAV), units, and returns of a fund over 3 time periods. It also contains the corresponding information for a stock market index as well as calculations of various risk metrics for the fund and index returns. In summary:

1) The fund's NAV increased from Rs. 10 to Rs. 18.15 over 3 time periods while its units outstanding rose from 10 to 30.3.

2) Risk metrics like standard deviation, variance, and coefficient of variation were calculated for both the fund and index returns.

3) The correlation between the fund and index returns was found to be 0.9258, indicating a high positive correlation. The fund's