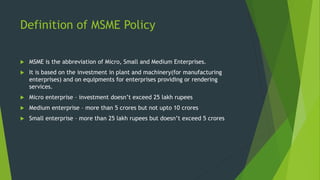

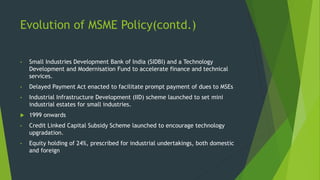

The document discusses India's MSME policy. It defines MSMEs based on investment levels, with micro enterprises having investments under 25 lakh rupees. The evolution of MSME policy since 1948 aimed to promote employment, equitable income distribution, and mobilizing private resources. Key policies include reserving manufacturing for MSMEs, improving access to bank credit, and the 1999 Credit Linked Capital Subsidy Scheme to encourage technology upgrades. MSMEs are important as they account for 9% of GDP, 45% of manufacturing output, 40% of exports, and employ 42 million people across various industries. Current policy measures center around protection, improving credit access, entrepreneurship development, and infrastructure.