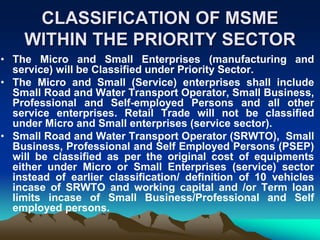

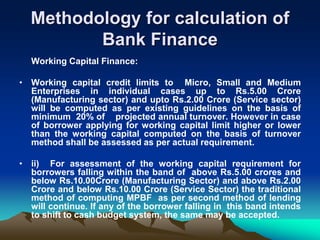

The document summarizes the key aspects of the Micro, Small and Medium Enterprises Development Act passed by the Government of India in 2006. Some highlights include expanded definitions and limits for micro, small and medium enterprises based on plant and machinery investment, classification of micro and small enterprises under priority sector lending, guidelines around loan applications, security aspects, and methodologies for calculating working capital and term loan financing.