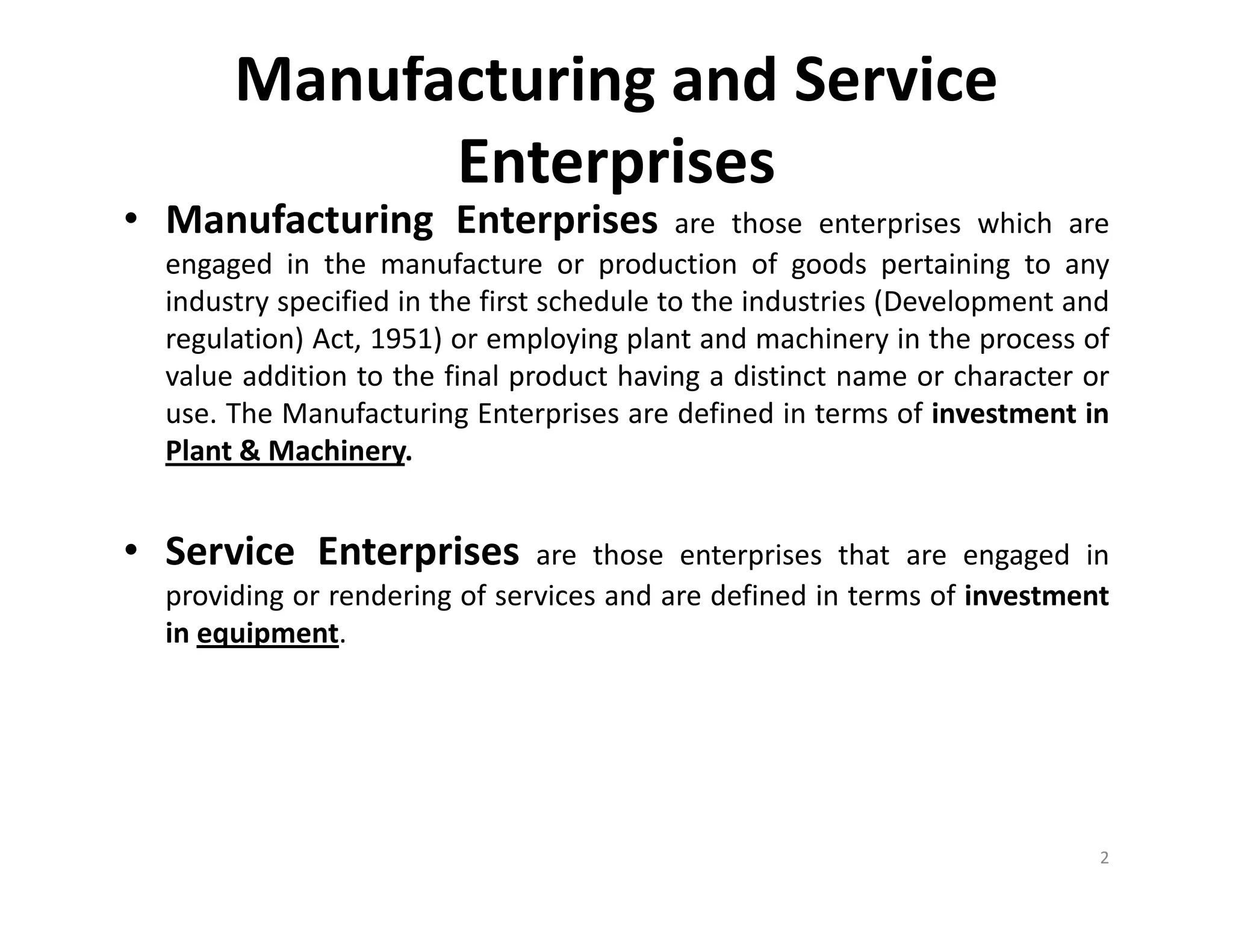

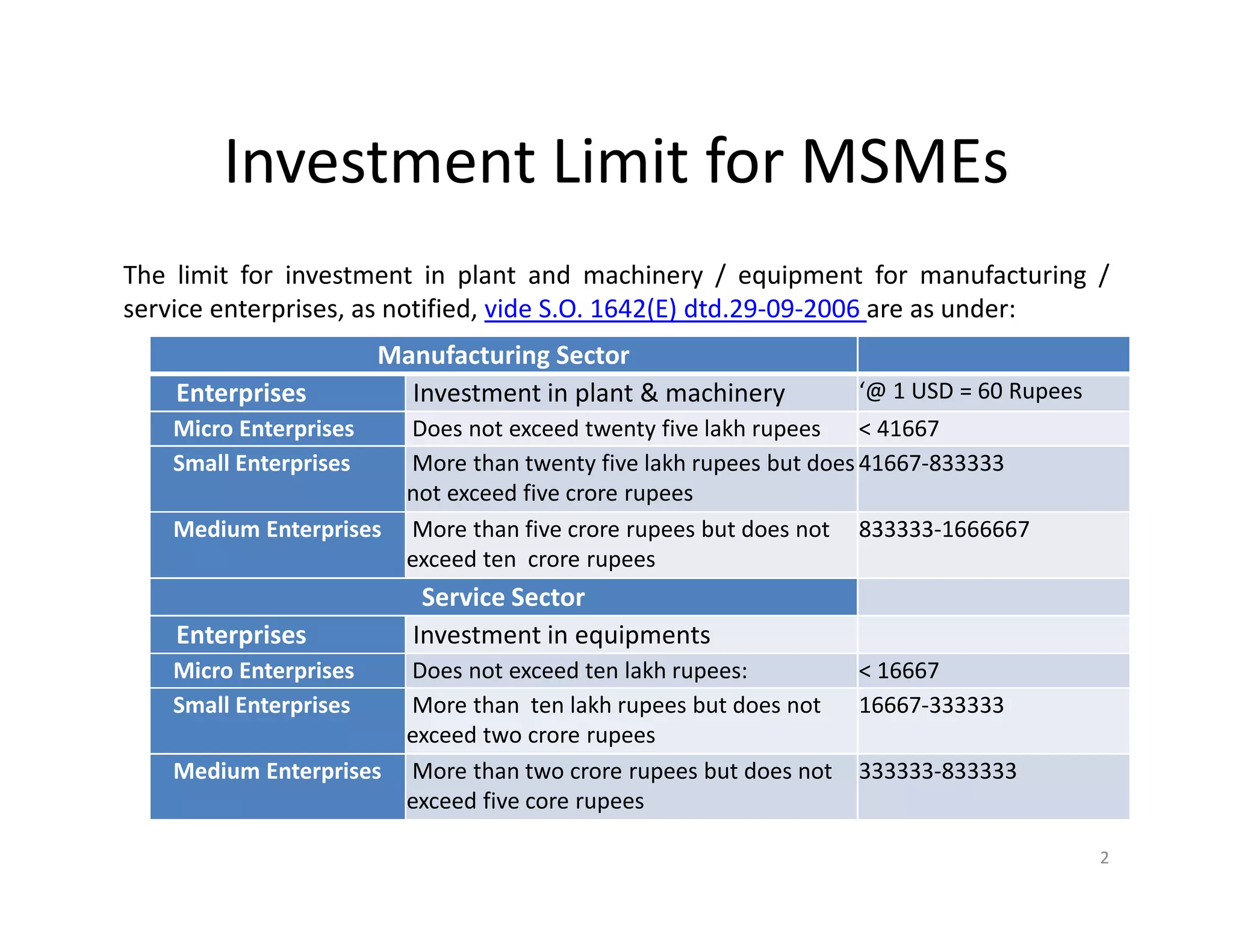

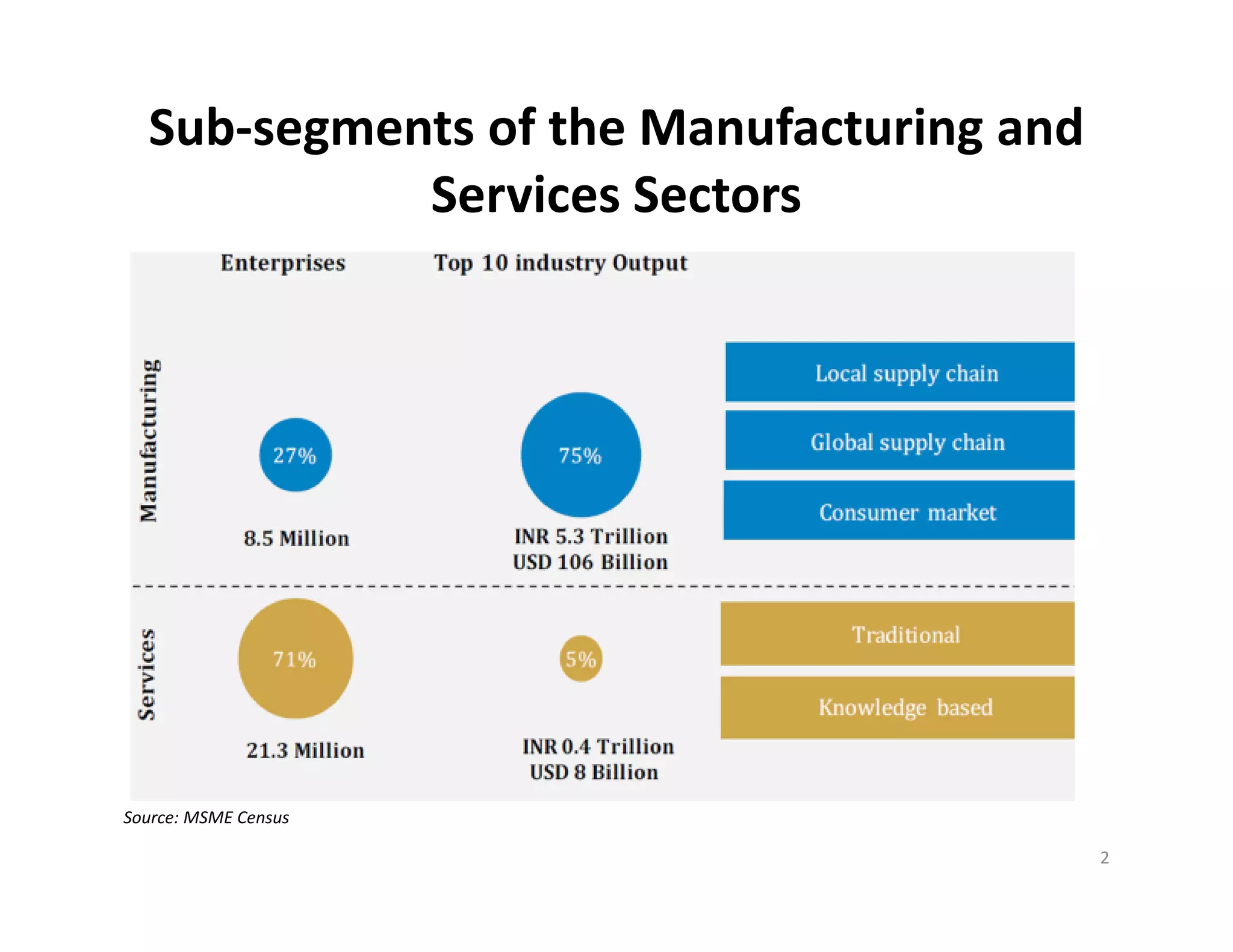

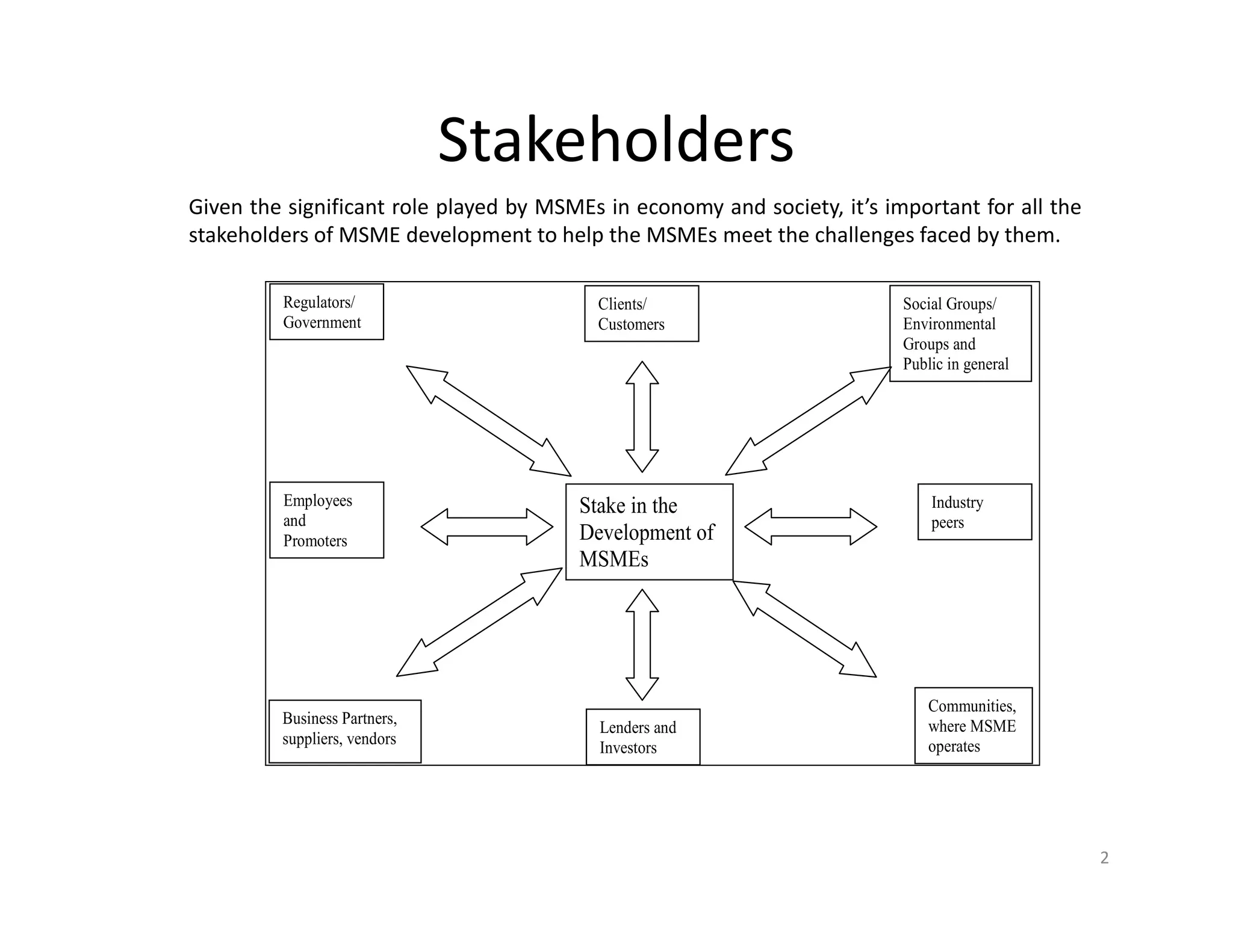

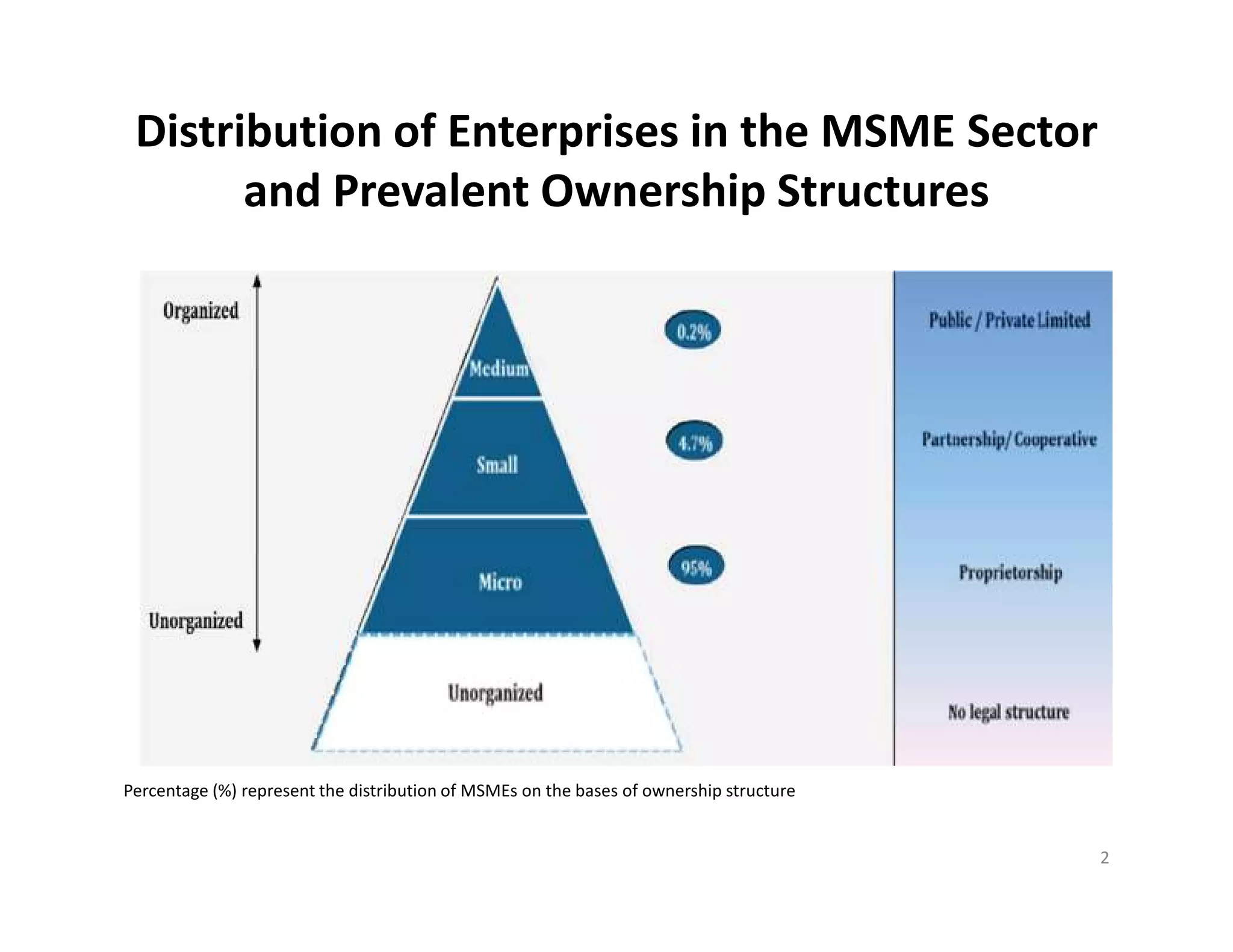

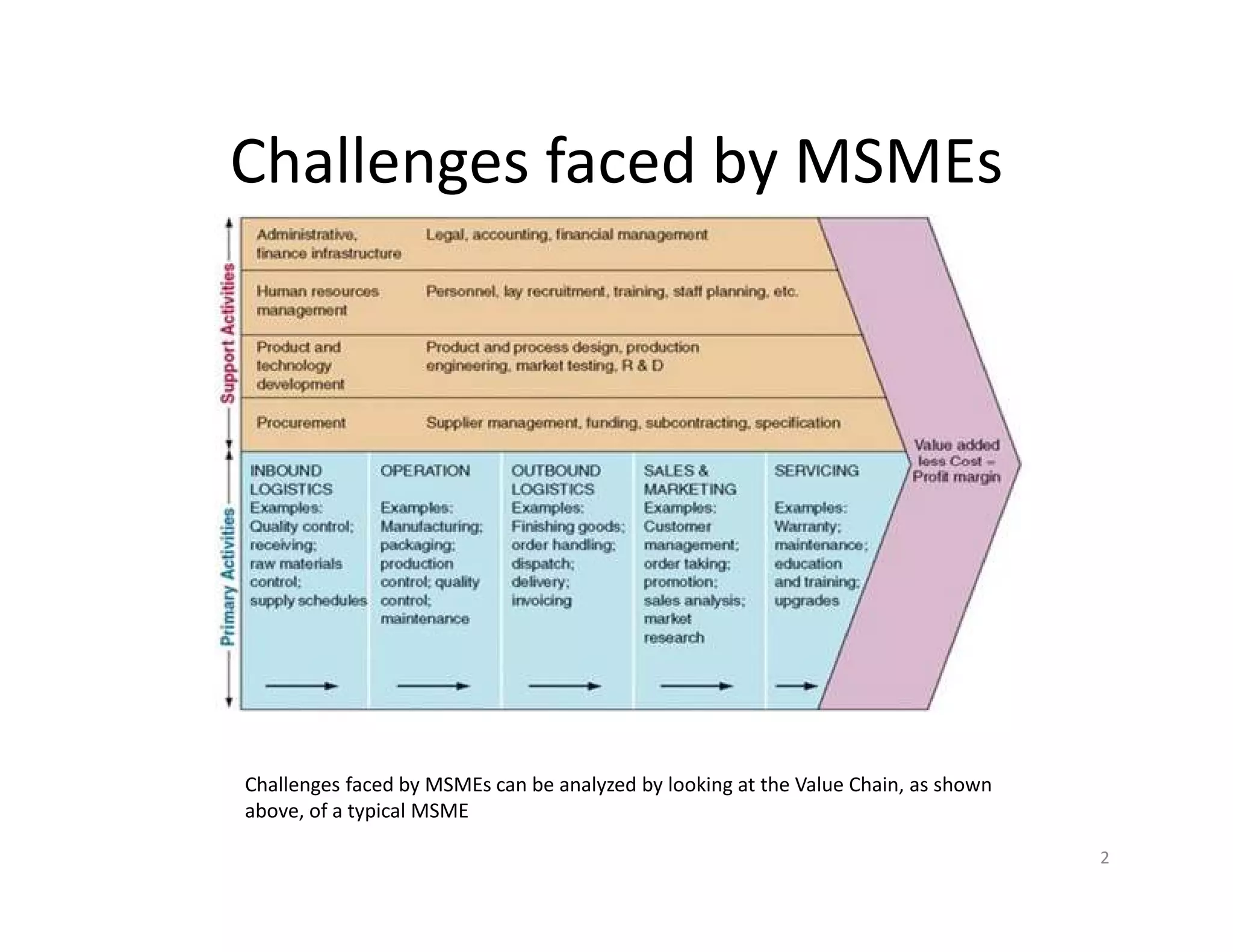

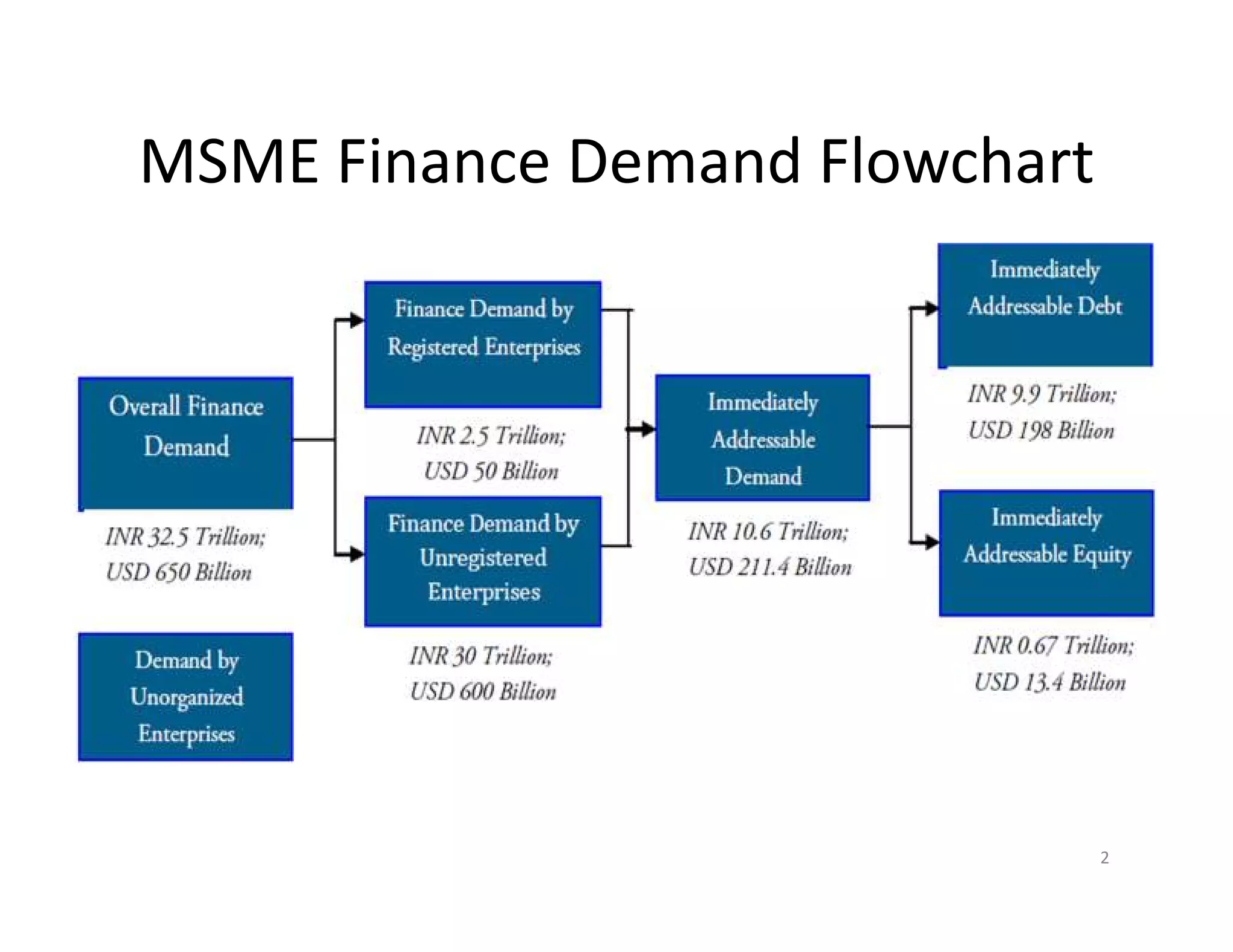

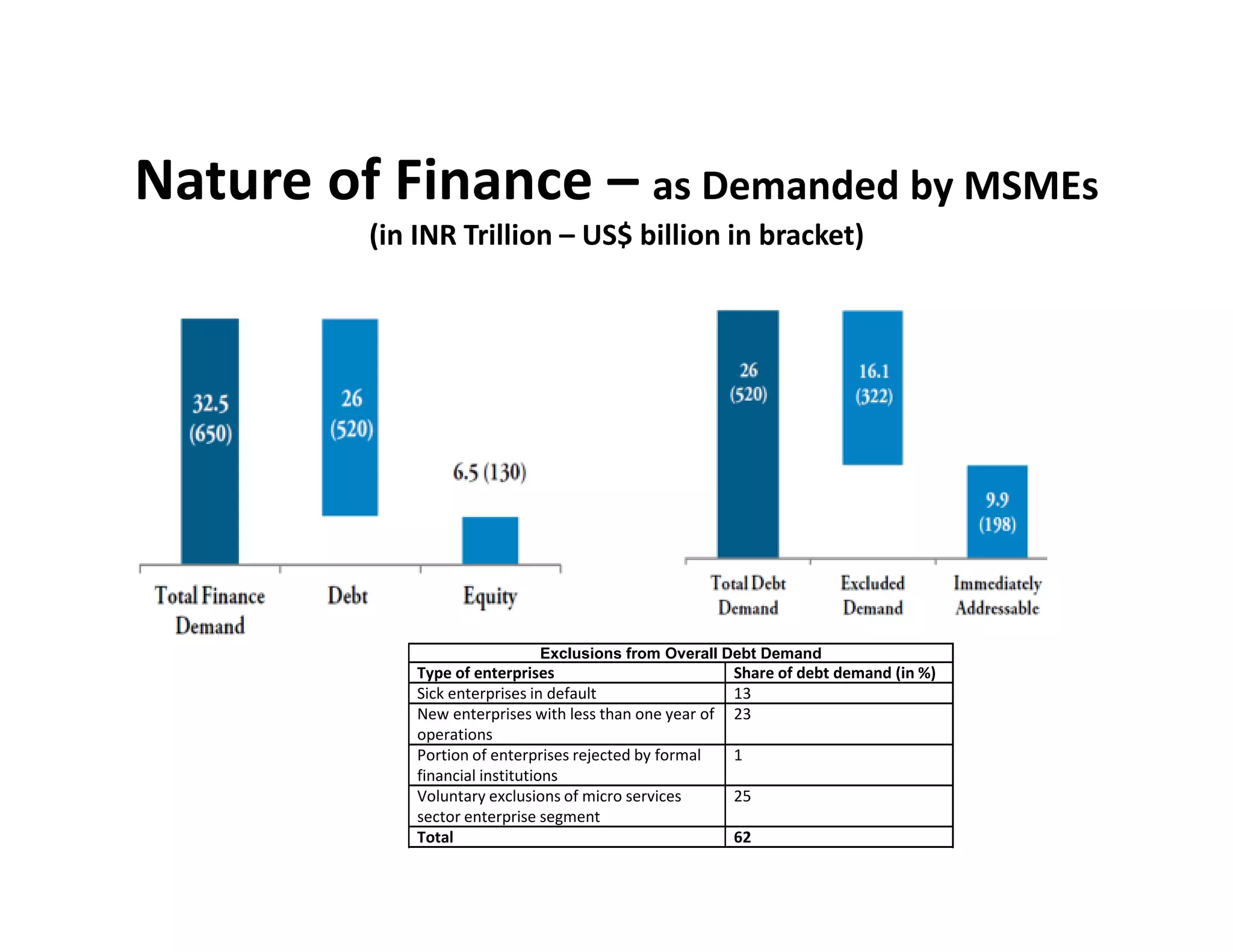

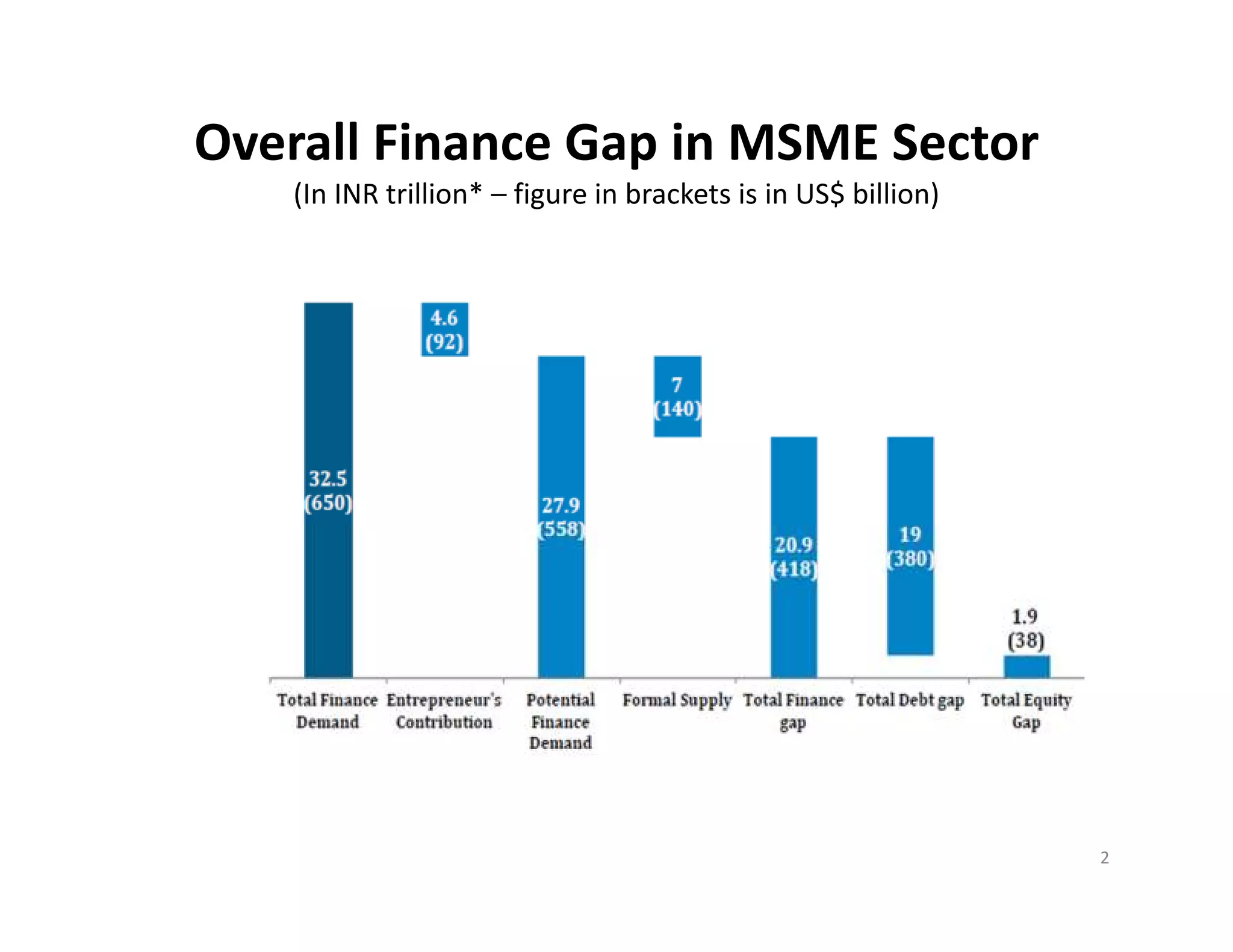

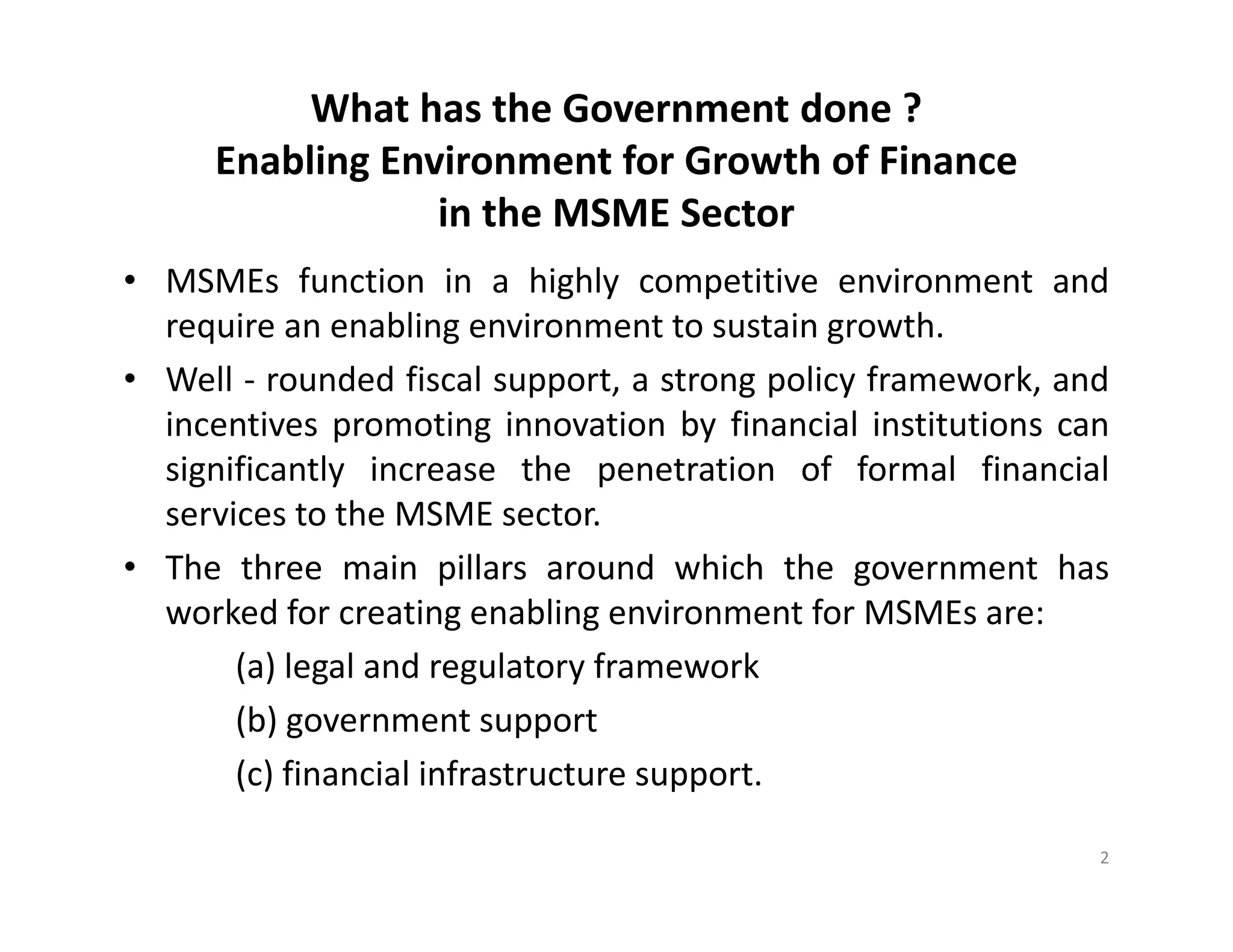

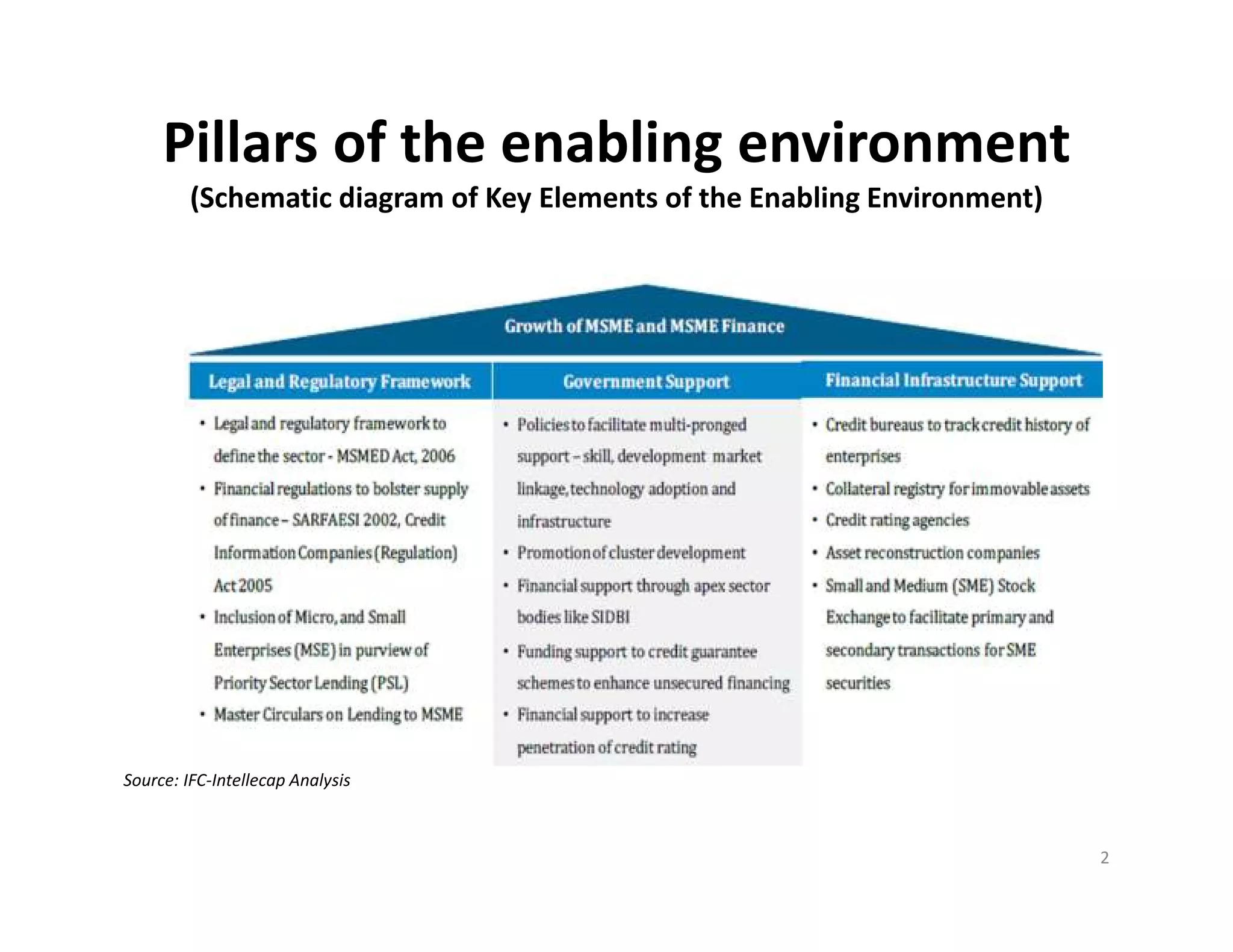

The document discusses MSME financing in India. It defines MSMEs and outlines their important role in the Indian economy. MSMEs face challenges obtaining financing due to perceptions of high risk. Formal sources meet only 22% of estimated MSME financing needs. The government has taken steps to improve the enabling environment for MSMEs through legal frameworks, support programs, and financial infrastructure schemes. However, more can be done regarding enabling infrastructure, liquidity management, and risk management to increase MSMEs' access to financing.